‘What do I want to leave as my legacy?’: Behind Alexis George’s decision to lead AMP

Perhaps it’s too early to be talking about legacy. But Alexis George’s decision to take the reins at AMP rested squarely on just that.

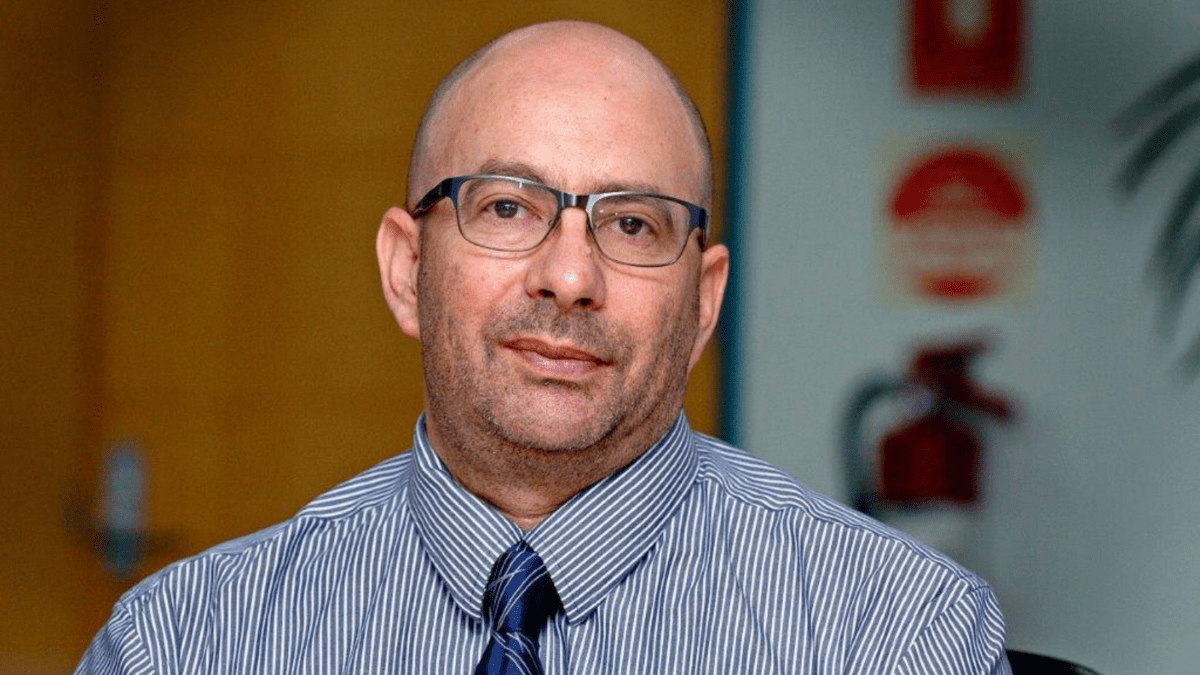

Most other executives of Alexis George’s calibre might be happy to rest on their laurels after a career as distinguished as hers. But speaking at the Women in Super (WIS) Sydney chapter’s end-of-year lunch last Wednesday (December 15), George revealed that she believed her role as CEO of AMP would likely be her last executive job. The legacy she would leave behind was at the heart of her decision to take it on.

“AMP is an iconic brand in Australia and it gets far more attention than it probably deserves in today’s world. I’m also at the latter end of my career, and this is probably going to be my last executive gig,” George told a sell-out audience.

“What do I want to leave as my legacy? That was really important to me… This is an industry I really love; watching that company from the outside-in was sad, and I wanted to make a difference.”

In that sense, perhaps nobody has more to gain – or more to lose – from the turnaround than George. Legacy is a much more potent concept than whatever the next job might be. She has effectively strapped herself to the mast and must know that no matter how distinguished her career before, whatever happens with AMP could ultimately set the tone for what comes after – at least, in the press. Which George gets a fair amount of, though she says that she tries not to read it.

No other leadership role in corporate Australia has been the focus of as much press attention as hers due to the litany of crises that have beset AMP since the Royal Commission, and she has had to deal with the press since her very first day.

Going into AMP’s office in the middle of Sydney’s most recent lockdown to pick up a laptop and the various effects one needs to start a new job, George held a virtual townhall with James Georgeson, AMP’s CFO. George “literally, for about a second” removed her mask – and the moment wound up in the Australian Financial Review’s notorious ‘Rear Window’ column.

“I thought I looked pretty good in it,” George joked.

From the mouth of a different executive – say, former CEO Francesco De Ferrari – all of this might sound like the usual bluster we’re used to hearing from corporate Australia. But George has already set a different tone to that of her predecessor, due in a large part to her self-effacing appearances at events for the AFR and WIS. She’s not aiming to return AMP to the lofty heights it once occupied. She’s aiming to right the ship.

“I want to simply leave the place better than when I found it. That doesn’t sound very visionary, but I mean that in every way. I want there to be an obvious successor; I want us to be respected in the industry, as a leader in what we do; I want the shareholders to love us – or at least like us,” George said.

“But I really want the place to be somewhere people want to work, want to be our customers, and want to be our shareholders. And if I can just make it a little bit better, that is good for me. That’s what will be important to me.”

Failing to turn AMP around would not exactly be a black mark. The job seems so vast and difficult that anybody who takes it on probably deserves sympathy, if not respect. De Ferrari, who had the most recent go, is now right back at Credit Suisse, where he has been installed as head of its newly created global wealth division – proof that there is life after death. Executive roles aside, George will likely sit on more than a few boards once she’s finished running the show.

And as another member of the audience noted, George will leave a second, perhaps more powerful legacy behind – her role as the female CEO of a company that has earned the bad reputation of being a boys’ club. George’s daughter warned her about “the glass cliff”; the fact that it is often a woman who is handed the reins in a crisis, and that the failings from then on are seen as theirs alone, rather than as a cumulation of every stuff-up prior to their appointment.

“AMP is a bit male dominated… but I found this woman who I think is really talented and capable,” George said. “We had coffee today, and I said to her ‘I’m sure you’re wondering why I invited you to coffee’. She was looking a bit scared. And I said, ‘Whether you like it or not, I’ve chosen you and I’m going to be your mentor’.”

“I say that because I think it’s really important. I’ve worked for great bosses who have given me amazing opportunities, let me fail, make mistakes, picked me up and supported me. That, I want to make sure that I have women I have helped to feel confident enough to have a go.”