Why investors should embrace change in the Year of the Snake

On 29 January, we will exit the Year of the Dragon and enter the Year of the Snake. In the Chinese zodiac, people born in the Year of the Dragon are said to be powerful and optimistic. In contrast, those of a serpentine year are wise masters of reinvention, able to shed their skin amidst change.

Past years of the snake have indeed been transformative: 1929, 1941, 1953, 1965, 1977, 1989, 2001 all saw war, economic pain, or political and financial instability. So perhaps we should consider how investors might need to adapt for the year ahead.

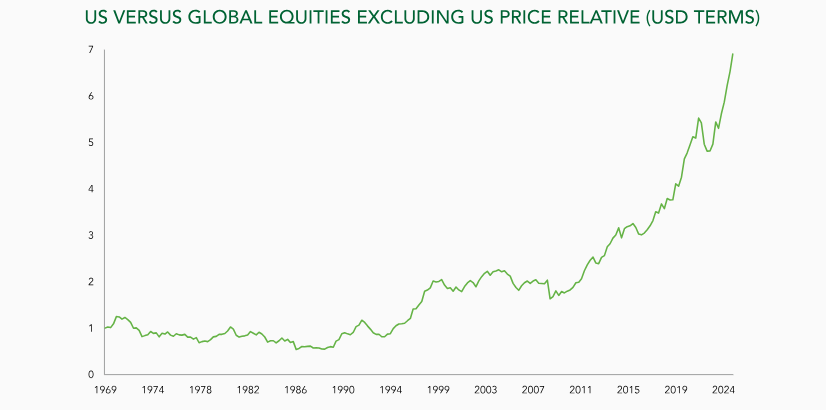

This month’s chart states the obvious: US equity markets, relative to the rest of the world, are extremely expensive on almost any measure. Price/book, EV/EBITDA, forward PE and cyclically adjusted PE are all now in the 96th percentile or higher compared with their history since 1976. The US equity risk premium – the additional amount investors are rewarded for owning stocks over bonds – is currently less than 0.5 per cent. The historic average since the mid-1980s has been comfortably more than 2 per cent, and closer to 7 per cent if you take the data back another 100 years.

These lofty expectations are also reflected in investor positioning. Relative to history, global fund managers are more overweight the US today than ever before. Of course, you would expect Ruffer to avoid the expensive stuff. So how do we expect to make our investors money?

Out of favour equity markets is one way. The UK, Europe and China look to be in dire straits on the face of it. But, with equity risk premia as high as 7 per cent and cyclically adjusted PE less than half the US level, arguably much of that is now reflected in the price. The US has often been better at growth and innovation, but it’s not always been twice as expensive. The Ruffer portfolio’s current equity weight is around 30 per cent, more than two thirds of which is outside the US.

Another winner in a rotational year could be the yen. The yen remains extremely cheap on a trade-weighted basis, domestic inflation pressures persist, and the carry trade – where investors borrow yen to buy foreign currency and harvest the higher interest rates elsewhere – remains at large. An unwinding of the carry trade would make the yen an excellent protection should equity markets correct.

But what about in a more benign market? Scott Bessent, the US Treasury Secretary in waiting, has a deep understanding of Japan, having cut his teeth there under the watchful eye of George Soros. He has said he is focused on bringing down the US trade deficit and the easiest way to do this is to weaken the dollar.

Japan is one of the few countries which could give the PayPal mafia in Trump’s inner circle what they want. This makes the Japanese currency potentially one of the greatest beneficiaries of the new administration’s attempts to increase competitiveness. We continue to own a core position in the yen, with 15 per cent across cash and Japanese government bonds, and an additional 10 per cent exposure via call options against sterling, the Swiss franc and the US dollar.

The stock market is a speculative beast and, for now, animal spirits remain high. The risk of a correction this year remains elevated, and our sense is the opportunity in 2025 will come from beyond the US. That’s why the portfolio is well positioned to benefit from either a benign or a malign rotation in markets. It might be time for investors to shed old skin, ready for another transformative year.