ASX manages gain, Zip cans Sezzle deal, Eagers upgrade, Lake hit by short seller

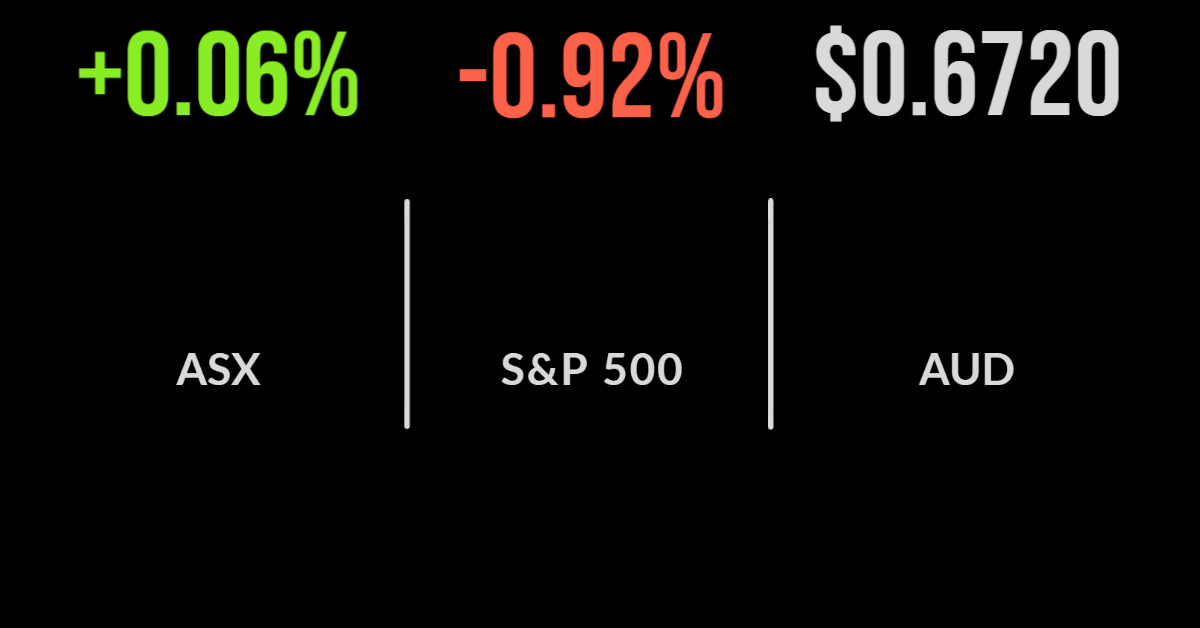

The local market managed to overcome increasingly negative global sentiment ahead of an important US earning season that begins later this week, finishing 0.1 per cent higher.

The stalwart blue chips were the standout with financials, consumer staples and healthcare increasing 0.7, 1.2 and 1.1 per cent respectively.

The Commonwealth Bank (ASX: CBA) gained 1.2 per cent, CSL (ASX: CSL) 1.6 and Woolworths (ASX: WOW) 2 per cent as investors continue to divert funds out of the energy and materials sectors. Five of the 11 sectors finished lower, led by materials down 1.2 per cent.

Lake Resources (ASX: LKE) entered a trading halt after receiving a short report by J Capital that flagged questionable practices by management for the lithium miner.

On the positive side, beleaguered BNPL player Zip Co (ASX: Z1P) topped the market, gaining 6 per cent after confirming they would not be proceeding with the ill-timed takeover of Sezzle (ASX: SZL).

Zip will pay some $16 million in break costs with both management teams reiterating a focus on shifting towards profitability in the current environment.

Viva tops estimates, SparkNZ sells towers, Magellan exits retirement market

Oil refinery Viva Energy (ASX: VEA) gained 2.6 per cent after reporting a strong finish to the first half of 2022, with revenue up 5.2 per cent.

A recovery in diesel sales has been central to this with news that earnings will be 140 per cent higher than 2021 levels, confirming that this part of the oil supply chain is among the most profitable by far.

In a similar vein, AP Eagers (ASX: APE) now expects profit to exceed previous guidance following a bumper six months for the car sales network.

Shares gained more than 3 per cent after management confirmed profit is likely to be $246 million, exceeding even the top of the previous guidance provided in May.

The infrastructure sector remains incredibly popular, with Spark New Zealand announcing the sale of 70 per cent of its telecommunication tower assets to the Ontario Teachers’ Pension Plan for $817 million.

The multiple of 33 times earnings exceeds the price achieved by Telstra last year and highlights a lack of any concern about bond yields from the pension fund sector.

The simplification of Magellan (ASX: MFG) has taken another step forward, with the company announcing the closure of their FuturePay business with all investments to be returned to unitholders.

US markets fall ahead of inflation data, PepsiCo surprises, builders slashing prices All three US benchmarks finished lower, albeit at a slower pace, led by the Nasdaq which fell 1 per cent.

The S&P500 and Dow Jones were down 0.9 and 0.6 per cent respectively despite the likes of Apple (NYSE: AAPL) holding ground.

The company is expected to report lower than expected iPhone sales according to ‘First Look’ spending data from bank accounts.

Earnings growth expectations have been cut from around 6 per cent to just 4 with traders increasingly worried about the impact of the booming USD when translating global earnings.

While some commodity prices, particularly food, are reversing these will be unlikely to reverse another massive jump today which could trigger further interest rate hikes.

The impacts are widely evident with reports that home builders are struggling to complete construction and are now being forced to cut prices significantly to sell remaining homes.

PepsiCo (NYSE: PEP) shares were flat after the company reported a 30 per cent fall in profit despite growing revenue by more than 5 per cent.

The company is one of those defensive groups that is generating strong cash flow in a difficult environment, albeit at a slower pace than in recent years.