ASX rally gathers steam, Qantas profit jumps, coal, energy rallies

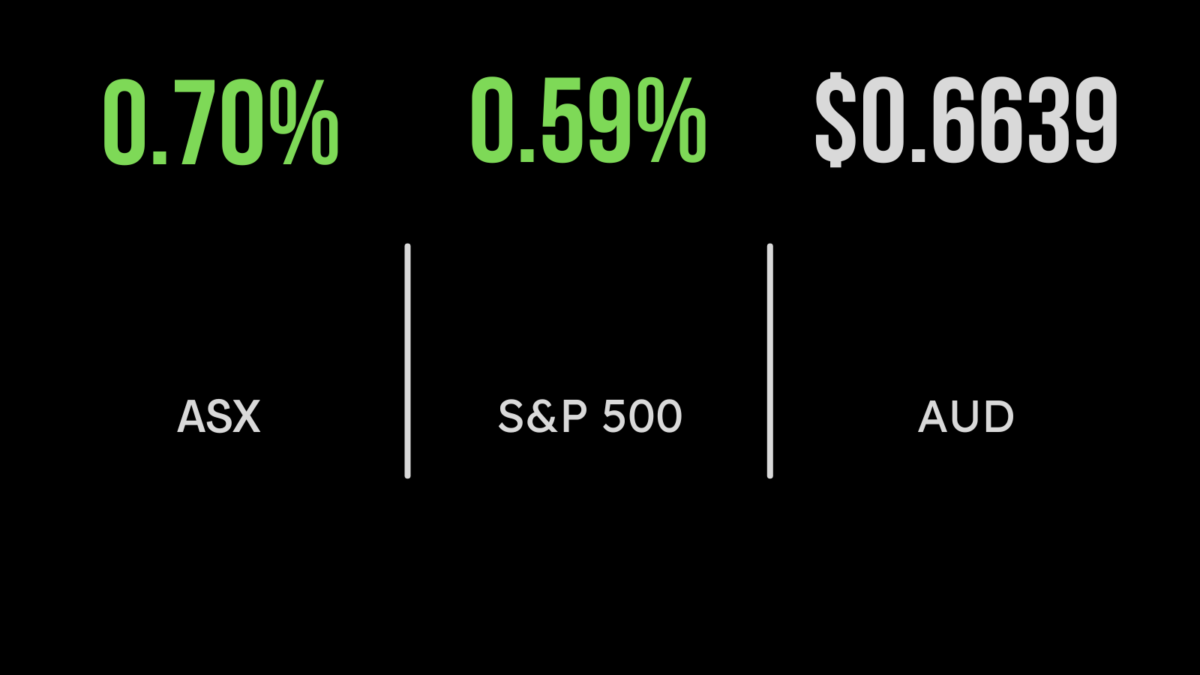

The local market continues to gather steam ahead of a number of major economic announcements, with the S&P/ASX200 finishing 0.7 per cent higher.

The rally was driven by a surge in the energy and utilities sectors both up 1.6 and 1.3 per cent as coal and oil prices rallied on another production cut.

Whitehaven Coal (ASX:WHC) remans a standout, gaining 5.6 per cent on the back of another OPEC+ supply cut.

Yet the majority of the focus was on major airline Qantas (ASX:QAN) which announced a $150 million improvement to it’s bottom line amid reports of significant increases in fares and growing levels of cancellation.

Shares gained 5.3 per cent after the company increased first half profit forecast to $1.45 billion as consumers pivot to travel ahead of other retail spending.

The challenge remains increasing fuel costs, up 30 per cent, but thus far higher fares are offsetting this and resulted in a $900 million improvement to the company’s debt position.

Mesoblast loss narrows, rates hit SCA

Experimental medical group Mesoblast (ASX:MSB) fell by another 1 per cent despite the company reporting a narrowing of its quarterly loss to US$16 million, which came despite a near halving in revenue for the period.

Retail landlord Shopping Centres Australia (ASX:SCP) confirmed recent guidance for the property trust, but also noted it had no intentions to make further acquisitions in the coming months.

Rather, the focus has turned to dealing with the impact of higher interest rates which are flowing through to higher interest payments and potentially lower income for investors.

BHP (ASX:BHP) was able to offset concerns around the falling iron ore price and Chinese economy gaining 1 per cent despite another surge in COVID-19 cases.

Shares in garbage collection group Cleanaway (ASX:CWY) were unchanged despite the company announcing intentions to partner with plastic maker Qenos to consider a significant increasing recycling and related capabilities.

Fed rate hikes set to slow, recession risk grows, S&P500 rallies

The release of the Federal Reserve’s minutes from its November meeting evidenced the fact that they continue to do one thing and say another.

The board flagged a potential slowing of rate hikes due to the growing recession threat, which sent the Nasdaq 1 per cent higher and the S&P500 0.6.

The Dow Jones continues to underperform on up days, gaining 0.3 per cent, due to the higher exposure to more old-fashioned businesses.

Economic data continues to weaken with jobless benefits increasing and PMI benchmarks for both goods and services falling below the all-important 50 point level which signals and economic contraction.

Shares in agricultural equipment maker Deere (NYSE:DE) gained more than 5 per cent after the group reported a 37 per cent increase in sales, smashing expectations, as farmers seek to increase efficiencies and the company passes on higher costs.

Global shortages and price spikes are encouraging farming operations to invest more in equipment and seek additional growth opportunities.