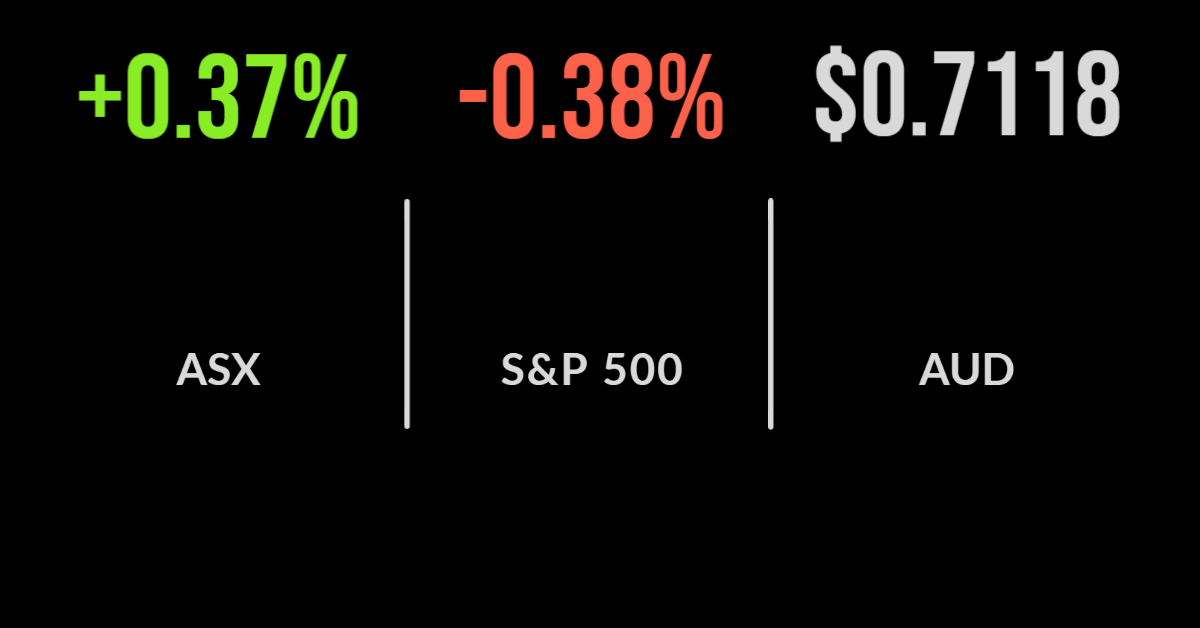

Aussie market pushes higher, against trend

The Australian sharemarket pushed higher on Monday, led by the resources stocks, as petroleum producers gained on fears of an imminent Russian invasion of Ukraine and gold miners rose on the back of gold’s traditional role as a safe-haven asset in times of geo-political stress.

The S&P/ASX 200 Index rose 26.6 points, or 0.4%, to 7243.9 points, while the broader S&P/ASX All Ordinaries index added 19.3 points, or 0.3%, to 7,535.1.

But the tone of the session was mixed, with only six of 11 sectors showing a gain.

Oil prices surged to seven-year highs on Monday on fears that a possible Russian attack could lead to sanctions from Europe and the US.

Brent crude futures touched $US96.16, the highest price since October 2014. Investors are concerned that sanctions on Russia could worsen energy supply issues – and rising oil prices tend to feed-in to other commodities.

However, it is an ill wind that blows nobody any good, and the energy stocks stirred at the prospect of higher petroleum prices.

Oil, gold bankroll the market

Woodside Petroleum gained 3.6% to $27.43, and Santos added 4% to $7.72, but these were put in the shade by Beach Energy, which was also reporting half-year results.

Beach’s 9.8% previously reported 11 million barrels of oil equivalent (MMboe) of production led to a revenue rise of 9.8%, to $797.4 million, and a net profit rise of 66%, to $212.9 million.

The company’s realised oil price jumped from $US47 per barrel to $US84, while higher gas and ethane prices increased revenue by $16 million with realised prices of $7.54 a gigajoule.

In response, Beach shares gained 9.4% on the day, to $1.62, after hitting a ten-month high, at $1.64.

Gold miners also enjoyed the day, led by Evolution Mining, up 7% to $3.96, and Northern Star, which ended 5% higher at $9.00.

In the industrial sector, a deal was struck between gaming heavyweight Crown Resorts and private equity group Blackstone, under which Blackstone will buy all listed shares for $13.10 cash each, valuing the Melbourne-based company at $8.9 billion.

Counter-intuitively, Crown shares ended just 25 cents, or 2%, higher at $12.64.

JB Hi-Fi reported first-half results that saw total sales fall by 1.6%, to $4.9 billion, but with online sales surging by 62.6% to $1.1 billion, to represent 22.7% of total sales. In the first half of 2020, online sales were just 6.5% of total sales.

First-half profit fell by 9.4%, to $420.5 million, but was up almost 69% over a two-year period – a strong performance in lockdown – and JB Hi-Fi wowed investors with a $250 million share buyback. The shares gained 5%, to $51.71.

US market stressed on conflicting Ukraine news

In the US overnight, markets slipped on the general geo-political worries and inflation concerns, with the S&P 500 index losing 17 points, or 0.4%, to 4,401.7, and the 30-stock Dow Jones Industrial Average shedding 171.9 points, or 0.5%, to 34,566.2.

The tech-heavy Nasdaq Composite Index lost a mere 0.2 points, to be virtually unchanged at 13,790.9.

Markets did not like the developments in Ukraine, where the US announced it was relocating its Embassy from Kiev to the country’s west, which went against earlier reports that a diplomatic resolution between Russia and Ukraine could be reached before an armed conflict begins.

Again, energy stocks were mostly positive, with Occidental Petroleum up 5.6% and Marathon Oil up 3.2%.

Crude oil was up $1.77 to US$94.87, a 1.9% rise, while gold gained $31.80, or 1.7%, to US$1,873.90.

While Ukraine grabs the headlines, investors aren’t forgetting inflation concerns, and are still worried that the Fed could lift rates higher and faster than expected.

St. Louis Federal Reserve President James Bullard (who is a member of the Fed’s rate-setting committee) said overnight that the Fed may have to do just that, saying there is “a lot of inflation in the US economy” and that “our credibility is on the line here. We have to react to data. However, I think we can do it in a way that is organized and not disruptive to markets.”

Reflecting market concerns, the VIX Volatility index – the so-called “Fear Index” – jumped a further 4.6% overnight.