Aussie market rises across the board

Local stocks enjoyed a positive lead-in from Wall Street, after the US consumer inflation figure rose 7.1 per cent in the year to November, less than economists had expected and down from a 7.7 per cent annual rise in October.

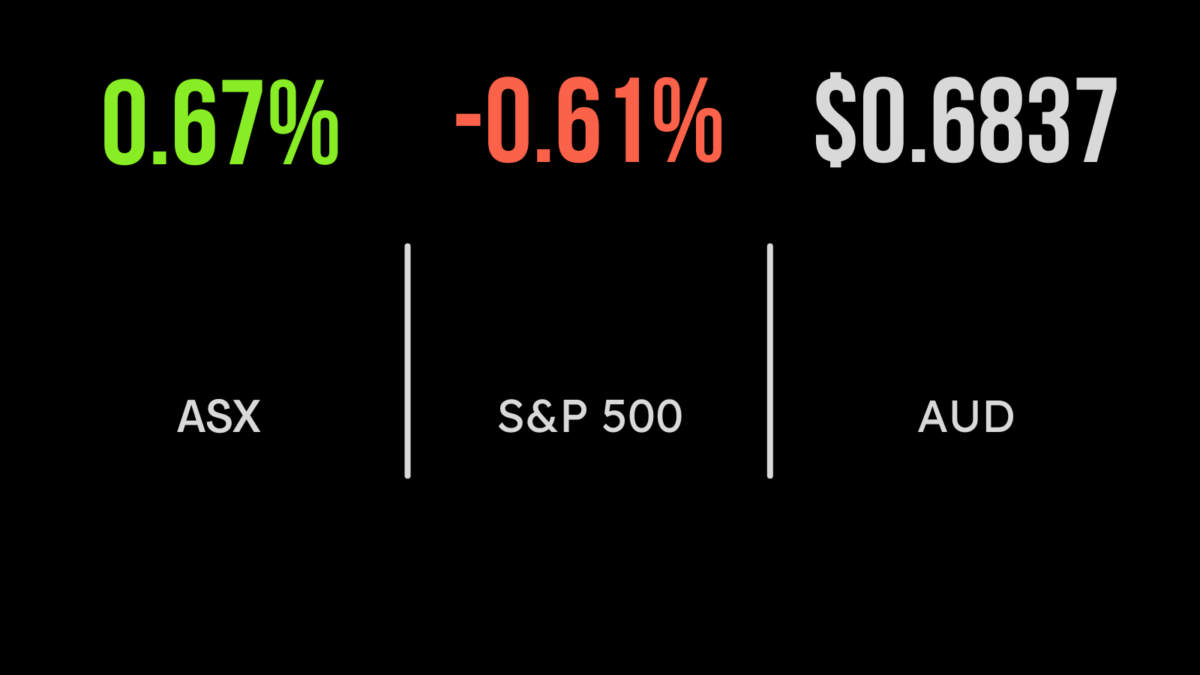

The S&P/ASX200 index gained 48 points, or 0.7 per cent, on Wednesday, to 7251.3, while the broader All Ordinaries gained 49.5 points, also 0.7 per cent, to 7438.7.

Every ASX sub-index finished in the green, with utilities the biggest riser, adding 2.1 per cent as Origin Energy regained 21 cents, or 2.9 per cent, to $7.49, clawing back more of Monday’s losses. The big “gentailer” is still down 4.8 per cent over the last week. AGL Energy rose 3 cents to $7.92.

In the big banks, CBA gained 48 cents, or 0.5 per cent, to $106.92 but the other big three banks were lower. Westpac eased 9 cents, or 0.4 per cent, to $23.57 after chairman John McFarlane told shareholders at its annual general meeting that he would retire in a year’s time. ANZ shed 9 cents, also down 0.4 per cent, to $24.01, while National Australia Bank retreated 8 cents, or 0.3 per cent, to $30.71.

Miners have a strong day

In the big miners, Fortescue Metals Group lifted 23 cents, or 1.1 per cent, to $20.46, BHP gained 23 cents, or 0.5 per cent, to $46.31, and Rio Tinto added 57 cents, or 0.5 per cent, to $114.67.

In coal, Whitehaven Coal was up 23 cents, or 2.4 per cent, to $9.82, New Hope Corporation added 6 cents, or 1 per cent, to $5.80, Coronado Global Resources was up 3 cents, or 1.6 per cent, to $1.95; and Yancoal Australia gained 6 cents, also 1 per cent, to $5.97; while in lithium, producer Pilbara Minerals advanced 3 cents, or 0.7 per cent, to $4.55, and fellow producer Allkem added 8 cents, or 0.6 per cent, to $13.11.

Among the lithium project developers, Core Lithium gained 3 cents, or 2.6 per cent, to $1.16, Lake Resources weakened 2 cents, or 2.2 per cent, to 88 cents, and Liontown Resources moved 1.5 cents, or 0.9 per cent, higher to $1.72, but Piedmont Lithium, which has agreements to supply Tesla, slipped 1.5 cents, or 1.8 per cent, to 83 cents.

Mineral Resources, which mines iron ore and lithium, rose $1.03, or 1.2 per cent, to $86.01; and IGO, which produces nickel and lithium, gained 7 cents, or 0.5 per cent, to $14.97. Rare earths producer Lynas Rare Earths added 4 cents, or 0.5 per cent, to $8.27.

Gold stocks had a good day, as the price of the precious metal moved above $US1,810 an ounce for the first time since early July, on the US inflation report and the expectation of slower rate hikes.

Newcrest Mining gained 45 cents, or 2.2 per cent to $21.07; Evolution Mining put on 8 cents, or 2.8 per cent, to $2.90; Northern Star rose 14 cents, or 1.3 per cent, to $10.97; Gold Road Resources was up 3.5 cents, or 2.1 per cent, to $1.74; Regis Resources lifted 7.5 cents, or 3.8 per cent, to $2.05; and Ramelius Resources advanced 2 cents, or 2.2 per cent, to 94 cents.

Also, St Barbara spiked 9 cents, or 13.9 per cent, to 74 cents; and Genesis Minerals gained 15 cents, or 12.6 per, cent to $1.34, as shares of both resumed trading following their merger agreement on Monday.

US rates lifted, as expected

In the US, as widely expected, the Federal Reserve fired another shot against inflation, lifting its benchmark interest rate to the highest level in 15 years. The Federal Open Market Committee (FOMC) voted to boost the overnight borrowing rate half a percentage point – a smaller increase from the prior four consecutive rate hikes of 75 basis points (0.75 per cent) – taking the rate to a targeted range between 4.25 per cent-4.5 per cent. Along with the increase came an indication that the central bank expects to keep rates higher through next year, with no reductions until 2024.

In response, the 2-year Treasury yield rose to 4.249 per cent, while the benchmark 10-year yield eased 3 basis points to 3.474 per cent.

In shares, the benchmark S&P 500 declined 24.3 points, or 0.6 per cent, to 3,995.3, while the blue-chip Dow Jones Industrial Average lost 142.3 points, or 0.4 per cent, to 33,966.3, and the tech-heavy Nasdaq Composite eased 85.9 points, or 0.8 per cent, to 11,170.9.

Gold is trading US$2.13 lower, down 0.1 per cent at US$1,807.60, while in oil, the global benchmark Brent crude is up US$2.17, or 2.7 per cent, at US$82.85 a barrel. West Texas Intermediate Crude is up US$1.96, or 2.6 per cent, at US$77.35 a barrel.

The Australian dollar is changing hands at 68.6 US cents, up from 68.42 US cents at the local close yesterday, which itself was a three-month high against the greenback.