ANZ, ASB, AMP, Fisher and Mercer have all been dumped as the KiwiSaver default schemes following the latest government review. In a release last Friday (May 14), NZ Finance Minister, Grant Robertson, confirmed the default provider numbers would shrink to six with two new players – Smartshares and Simplicity – joining incumbents Westpac, BNZ, Booster…

Institutional investors are pushing companies for disclosures that clearly detail how climate-related risks impact the bottom line, according to a new global survey. The sixth annual Institutional Investor Survey carried out by specialist consultancy firm Morrow Sodali confirmed environmental, social and governance (ESG) factors are now firmly entrenched across industry practices. Almost 100 per cent…

Demand for specialist transition services is on the rise as institutional investors focus on containing the upfront and hidden costs of firing fund managers, according to a new Mercer study. Authored by Mercer NZ head of consulting, David Scobie, the report says institutions need to carefully consider the bottom-line expenses and risks of sacking underlying…

Russell Investments has made sweeping changes to its flagship global fixed income funds in a move that almost doubles the in-house managed component. In a note to clients last week (May 4), Russell revealed it had cut three incumbent bond managers – Colchester Global Investors, Insight and Voya – from the global fixed income menu…

The Israel Institute of NZ lobbied to halt the exclusion of certain banking stocks from the NZ Superannuation Fund’s portfolio this year, according to recently released documents. In an Official Information Act (OIA) request on April 12, the local Israel association asked for confirmation the NZ Government’s largest super fund had told underlying managers that…

FNZ has wrung out some relief from the UK Competition and Markets Authority (CMA) despite losing on most counts in the latest – and almost last – round of its bid to prevent a forced sale of GBST. In a provisional report handed down mid-April, the CMA upheld its November 2020 finding that a merger…

In a highly unusual move, the Financial Markets Authority (FMA) has cracked down on fund managers advertising post-COVID boom-time annual returns. The regulator has warned managers that advertising any “phenomenal” returns garnered over the 12 months to March 31 could “mislead investors”. Global share markets bounced back spectacularly from the brief COVID-induced shock early last…

About a third of securities trading firms on both sides of the deal experienced operational stresses during the peak covid-19 volatility last year, according to a new DTCC white paper. The paper, carried out by global back-office behemoth DTCC (Depository Trust & Clearing Corporation) and consultancy firm McKinsey & Company found some weak links in…

Last year proved once again that market timing can be very profitable but an extremely difficult task to pull off, according to a new analysis of tactical asset allocation. The paper, by influential Auckland-based actuarial advisory firm Melville Jessup Weaver and authored by newly minted actuary William Nelson, found NZ share investors could have engineered…

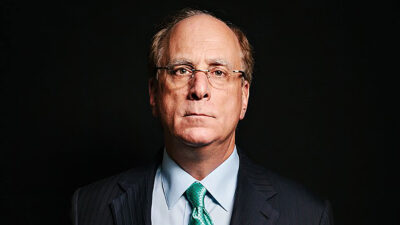

Larry Fink, BlackRock’s outspoken chief executive, has committed the firm to a cultural cleansing in the wake of alleged sexual and racial discrimination at the world’s largest fund manager. In an annual shareholder letter published last week, Fink says “certain employees have not upheld BlackRock’s standards”, putting the manager’s environmental, social and governance (ESG) credentials…