Australian shares advanced for a third straight day on Monday, driven by the materials sub-index, which rode rising commodity prices to a 2.2 per cent gain. The S&P/ASX 200 benchmark advanced by 70.3 points, or 1 per cent, to 6964.5, while the broader All Ordinaries index closed up by a similar percentage, lifting 69.2 points…

The local market was buoyed to a significant 1 per cent gain for the week, following a strong day on Friday. The 0.7 per cent gain was driven by the energy and materials sector which gained 1.1 and 3.3 per cent respectively on news of a potential split of Mineral Resources (ASX:MIN). Rumours that the…

The Australian sharemarket surged in the afternoon, gaining more than 1.6 per cent after the Reserve Bank Governor flagged a more cautious approach to future rate rises. Every sector finished the day higher and significantly so with the technology sector gaining 2.8 per cent as bond yields fell. The top performers were Life360 (ASX:360), Megaport…

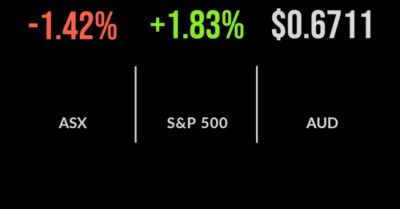

The Reserve Bank of Australia’s aggressive pursuit of a neutral interest rate policy setting has offered a challenging backdrop to the sharemarket this week, with the S&P/ASX200 falling 1.4 per cent on Wednesday. It wasn’t rates alone, however, with the oil price falling to levels not seen since January 2022 as concern grows about the…

After a positive start, the local market turned tail after the Reserve Bank board lifted the cash rate target by 50 basis points to 2.35 per cent, its highest level since December 2014, at its meeting yesterday. The central bank has now raised interest rates for five months in a row, in its most aggressive…

The local market capped off the worst week in several months, falling another 0.3 per cent and taking the weekly loss to 3.9 per cent. On Friday it was the financial sector leading the way on hopes that the economy may remain strong, bounced 0.7 per cent, with the more defensive healthcare and real estate…

The local sharemarket continued its recent weakness, falling another 2 per cent for the first day of spring. Australia’s largest company, BHP (ASX:BHP) was the biggest detractor falling 7.6 per cent, or $3.09 cents as the stock went ex-dividend. This is a regularly forgotten impact of the payment of dividends, which totalled $2.56 plus franking credits, as…

The S&P/ASX200 almost turned around a sharply weaker start to trading on the final day of August, falling just 0.2 per cent on Wednesday. In a reverse of recent days, the energy sector was the biggest detractor after the European Union warned of a potential intervention in energy markets and China faces another COVID-19 outbreak….

The local market managed to overcome another weak global lead, gaining 0.5 per cent on Tuesday, with the energy sector a key support. Gaining 1.4 per cent on the back of a strong inaugural report by Woodside Energy (ASX:WDS) the sector was second only to technology, which gained 1.8 per cent. Renewed conflict in Libya…

The local market followed an increasingly negative global lead, ultimately finishing 2 per cent lower. The sole driver was commentary from Federal Reserve Chair Jerome Powell from the Jackson Hole summit, which suggested aggressive central bank action was unlikely to slow any time soon. The result was just four companies posting increases on the day,…