News that Beijing was set to follow Shanghai into massive lockdowns to avert the threat of Omicron sent global share markets into a shockwave in this shortened week. The S&P/ASX200 fell another 2.1 per cent with every sector lower, led by the materials and energy sectors which fell 5.1 and 4 per cent respectively. The…

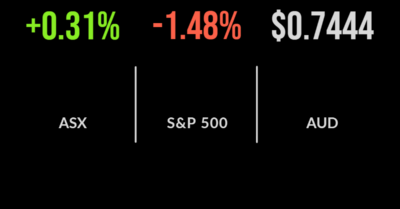

It was another positive day for the local sharemarket with retreating bond yields and more positive stock-specific news sending the S&P/ASX200 another 0.3 per cent higher. In a surprising turn, both the materials and technology sectors underperformed, down 2.6 and 1.6 per cent respectively, while the real estate and industrial sectors added over 2 per…

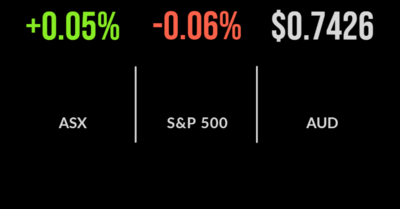

It was a flat day for the local bourse, with the S&P/ASX200 managing to deliver a gain of just four points or 0.05 per cent as the dualling pull of falling commodity prices and a surge in healthcare offset each other. The materials sector was down 1.5 per cent and energy 0.6, with every other…

The shortened week has begun positively with the S&P/ASX200 gaining 0.6 per cent despite lower-than-normal volumes. The release of the RBA’s policy meeting minutes dominated the conversation with commentary around the proximity of rate hikes now suggesting they will come sooner rather than later. The result was the perceived ‘inflation hedges’ within the market outperforming,…

It was another weak day for the local market with every major sector falling on Tuesday and dragging the S&P/ASX200 down another 0.4 per cent. The primary driver remains the oil price, which fell by 4 per cent, and the surging bond yields impacting valuations. This trend has benefitted the gold mining sector which contributed…

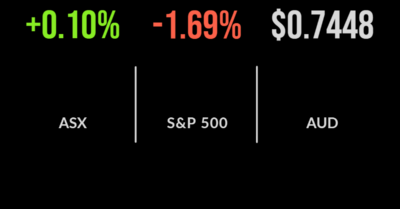

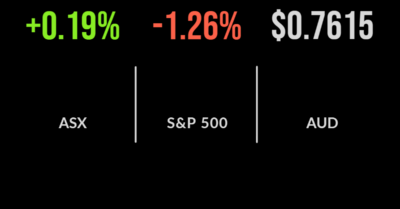

It was another volatile day for the S&P/ASX200, with the market trading significantly higher before reversing gains to finish up just 0.1 per cent. The market and individual sectors continue to diverge on a daily basis as the pressure of the 10-year Australian government bond yield impacts valuations very differently. The financial and banking sector…

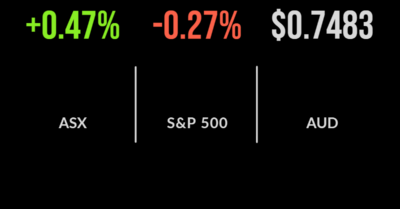

A strong rally to close out the week, with the S&P/ASX200 finishing 0.5 per cent higher, wasn’t enough to offset downward pressure during the week, with the market ultimately losing 0.2 per cent. Performance was varied on Friday, with materials and industrials both outperforming, gaining 1.3 and 0.9 per cent amid surging commodity prices and…

There has been a saying in markets for the last few years that fixed-income investments, favoured for their guaranteed returns and correlation benefits, have actually become “fixed-loss.” The driving factor was the threat (and now, realisation) that bond yields and cash rates were set to turn higher, reversing a four-decade tailwind. Naturally, these types of…

The threat of quantitative tightening extended to Australia on Thursday, with the S&P/ASX200 being dragged down another 0.6 per cent almost solely due to the technology sector. Just three sectors finished higher during the session, being perceived defensive companies in the utilities and staples sector, with the technology sector falling another 3.4 per cent. The…

Tuesday was a similarly strong day for the Australian market, with the S&P/ASX200 moving within 1 per cent of an all-time high; despite the incredibly difficult geopolitical backdrop. That was until the Reserve Bank of Australia delivered its latest board meeting result and associated explanation. Whilst rates remained on hold at 0.1 per cent, analysts…