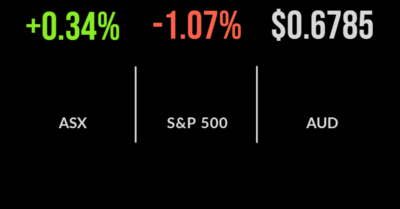

The local market dropped 0.8 per cent on Friday, taking the weekly loss to 1.7 per cent and the lowest level for three weeks. The biggest driver was a heavy retreat in coal stocks after thermal coal prices fell by more than 5 per cent, taking the price per tonne down 50 per cent from…

The local sharemarket copped its biggest fall in five weeks on Tuesday after the Reserve Bank of Australia (RBA) delivered a ninth consecutive rate rise, and for good measure, poured cold water on hopes of an imminent pause in its tightening cycle. RBA governor Philip Lowe warned that further increases will be needed in the…

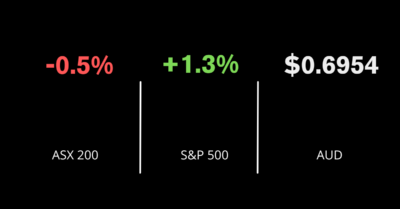

The Australian share market eased on Monday ahead of today’s Reserve Bank of Australia meeting, with many in the market convinced that the central bank will hit borrowers with an interest rate hike of 0.4 per cent, although the most likely outcome of the meeting is still seen as a standard 0.25 per cent rise….

Custodial news raced up the ISN editorial leaderboard this year, even while mergers and acquisitions and the flawed Your Future Your Super (YFYS) performance test dominated the front page.

John Green from Ninety One goes in-depth with Peter White from The Inside Network on sustainable investing in emerging markets.

Energy powered the Australian market higher on Monday, with a 4 per cent rise in the S&P/ASX 200 Energy index at the heart of market sentiment, as oil, gas and coal prices rose. The energy action helped the benchmark S&P/ASX 200 advance 23.5 points, or 0.3 per cent, or to 6852.2, while the broader All…

The Inside Network’s industry-first ESG Retreat brings together leaders from every major pool of capital in Australia to focus on the transformative change occurring in capital markets as pressing societal, environmental and sustainability issues come to the fore.

Grant Webster from Ninety One goes in-depth with Peter White from The Inside Network on investing in emerging market debt.

Despite the -16.3 per cent year-to-date (YTD) performance, we are impressed with the resilience of emerging market (EM) equities. In any year with the S&P down 19.9 per cent, the US Dollar (USD) up 7.2 per cent, Russian assets marked to zero, and China locking down its two largest cities, one would rightly cover their…

An allocation to municipal bonds by non-US investors may provide a high quality and differentiated fixed income exposure to a portfolio. With an increase in issuance and market size, investors outside the United States are expanding their search for yield to a hitherto unexpected place: US municipal bonds. US municipal bonds offer generally higher nominal…