BlackRock has a message for investors trying to navigate the confusion that has sundered markets in recent weeks: get used to it. Rising inflation was enough to give markets the jitters; tack on a war – and the prospect of an even bigger one, should the situation in Ukraine devolve further – and all the…

Hyperion believes that the sell-off in growth stocks in recent months has become indiscriminate, with the market failing to differentiate between trend setters and trend followers. The last few years has seen the ascendancy of high growth tech stocks in US and global markets, to the extent that many bears now believe it’s a bubble…

HSBC has recruited a State Street custody veteran as part of a long-planned expansion of its own business. Sinclair Scholfield has been appointed head of sales and client management for HSBC’s Securities Services business in Australia and New Zealand. Scholfield spent the last 18 years at State Street, where he was most recently head of…

A mere 13 funds were dispatched by the first round of the Your Future Your Super (YFYS) performance test. Chant West believes the damage could be worse in the choice sector. Later this year, APRA’s performance test will be brought to bear against the choice sector after a dry run on the smaller universe of…

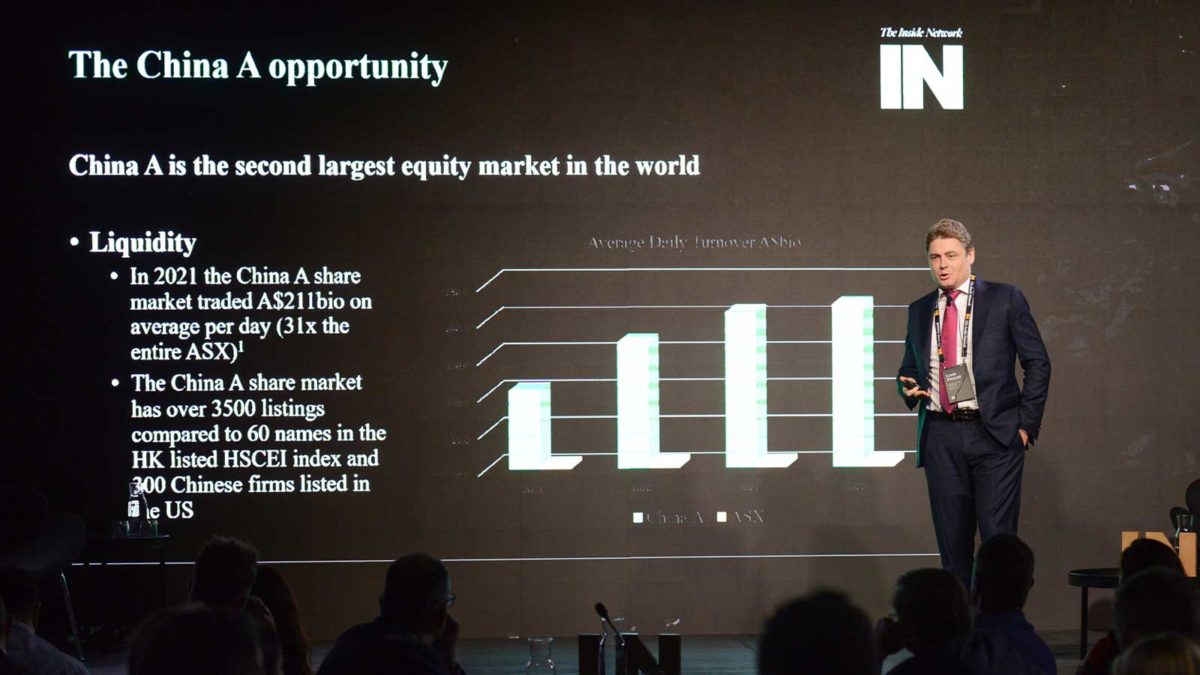

As China’s domestic market liberalises and regulatory upheaval eases, quant strategies stand to gain that will gain from the massive inefficiencies in its “opaque landscape.” While many bottom-up investors tout the domestic consumption story as the main reason for getting involved in China A-Shares, its huge, retail-dominated market also makes it perfect for a “nimble,…

As the amount of capital available to them soars and equity markets grow more volatile, companies increasingly don’t want to go public – and don’t need to. The number of publicly-listed companies on US exchanges has roughly halved from 8000 to 4000 in the last 20 years, according to Liberty Street Advisors. And while part…

The near-centenarian investor believes that institutions like BlackRock and Vanguard will wield outsize power in the market, and that our latest period of “wretched excess” will end with a bang. As passive investing becomes the go-to for a new wave of dumb money, Wall Street’s masters of the universe have been replaced with the emperors…

Active managers are more sensitive than ever to valuation risk. But in recent times it’s been a case of “go big or go home.” In recent years, Frontier has noted a narrowing in the breadth of US equity market return drivers, and short-term extremes of the same, with just a handful of tech mega-cap stocks…

In the aftermath of Your Future Your Super (YFYS), members of dud funds still aren’t moving their super. And it’s not clear what the government and regulators can do about it. It sometimes seems that so much time was spent on implementing the contentious YFYS reforms that the question of what would happen to members…

The last two years have seen an “anomaly” in equity markets where stocks with no dividends were king. But those who “kept the faith” might finally be rewarded. The concept of duration, while intrinsic to fixed income, doesn’t get much of an innings in equities. But John Tobin, managing director and portfolio manager at Epoch…