Nuveen will embrace “natural capital” as institutional demand for sustainable alternatives rises. But fighting climate change can be hard when climate change fights back. “The challenge we have to increase the production of food, fibre and timber over the next 30 years or so is just monumental,” says Martin Davies, CEO of Nuveen affiliate Westchester,…

The Financial Services Council (FSC) fought to keep its submission on the proposed proxy advice reforms confidential for fear it would “play out in the media”. The FSC’s submission to Treasury on its proposed proxy advice reforms has been kept confidential despite a freedom of information request for its release, with the FSC concerned that…

The small cap sector has traditionally been the domain of the underinformed and underprepared. But by taking a fundamentals-based systematic approach, Blue Orbit is hoping to change the game. “There’s a real clear gap and an opportunity for us to approach this from the ground up,” said Megan Talmage, Blue Orbit director and portfolio manager….

The 2020s are set to be the years of thematic investing – but so were the early 2000s. And the more things change, the more they stay the same. One of the problems in thematic investing is figuring out what’s a theme and what’s just plain old trendy. But that problem is also a problem…

The first thing funds usually consider in a merger is cost to member – but that won’t necessarily be what leaves them better off. The trick is getting the alignment right. According to David Carruthers, senior consultant and head of the members solutions group at Frontier, the top priority for any fund considering a merger…

As AustralianSuper continues to grow, Mark Delaney is focusing his attention on the burgeoning private markets space and the problem of culture in megafund land. “Size can creep up on you. You stand still, and all of a sudden you’re bigger than what you think you are. I first started managing pension money 20 years…

Sean Henaghan’s new role at Aurora Capital sees the former AMP CIO turn his gaze to climate change – and the question of what retail investors really want from their money. For Sean Henaghan, a “return to the coalface” of investing has come with its share of challenges. “You’re doing everything. It’s quite amazing what…

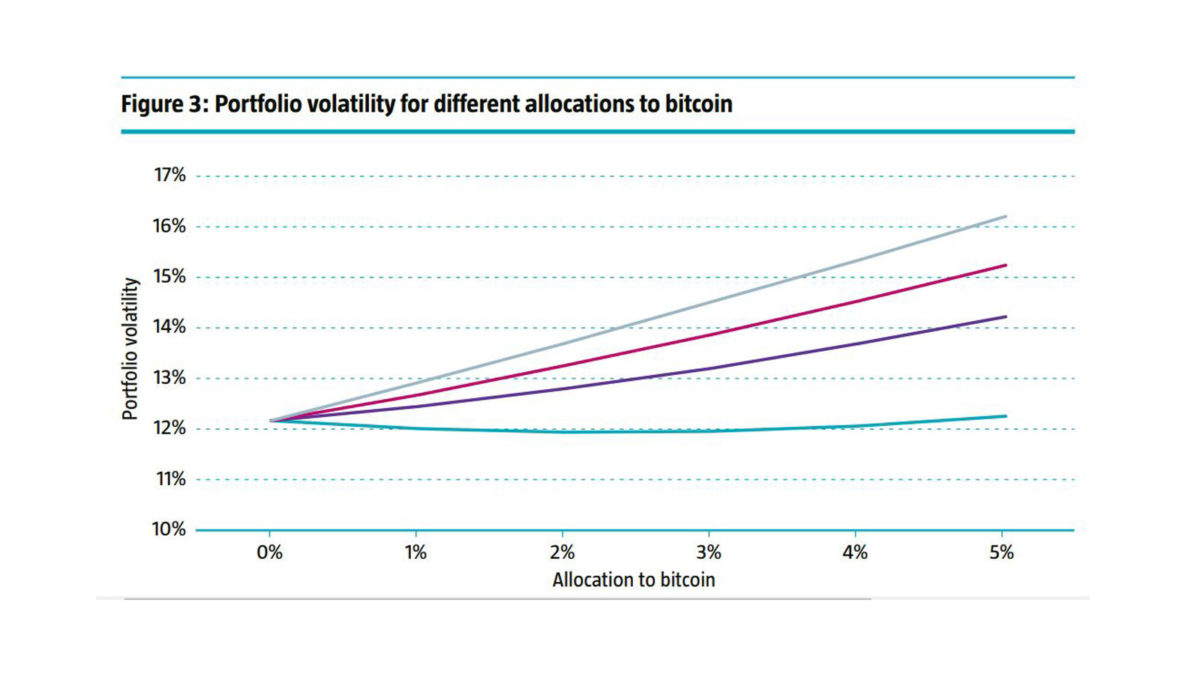

Bitcoin’s volatility means that institutional investors have historically steered well clear. But the times are a-changing, and even skeptics believe the cryptocurrency will have its day. Cryptocurrency is clearly here to stay. While most investors watch its massive price swings with bemused detachment, a few have begun to think seriously about the role they can…

China’s regulatory crackdown is just one piece of the puzzle when it comes to investing in Asia. The real game is geopolitics – and in that area, things are heating up. “I think Asia will probably look better as we move into 2022. I think the remainder of 2021 is really about timing of entry;…

The problem with high expectations is that you have to keep meeting them. And after a year where some funds returned 20 per cent, investors and super members are expecting more, more, more. Investors are relentlessly cheerful creatures. According to Schroders’ latest Global Investor Study, Australian investors (defined here as those expecting to invest the…