As China’s domestic market liberalises and regulatory upheaval eases, quant strategies stand to gain that will gain from the massive inefficiencies in its “opaque landscape.” While many bottom-up investors tout the domestic consumption story as the main reason for getting involved in China A-Shares, its huge, retail-dominated market also makes it perfect for a “nimble,…

As the amount of capital available to them soars and equity markets grow more volatile, companies increasingly don’t want to go public – and don’t need to. The number of publicly-listed companies on US exchanges has roughly halved from 8000 to 4000 in the last 20 years, according to Liberty Street Advisors. And while part…

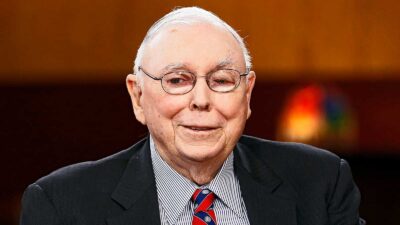

The near-centenarian investor believes that institutions like BlackRock and Vanguard will wield outsize power in the market, and that our latest period of “wretched excess” will end with a bang. As passive investing becomes the go-to for a new wave of dumb money, Wall Street’s masters of the universe have been replaced with the emperors…

Active managers are more sensitive than ever to valuation risk. But in recent times it’s been a case of “go big or go home.” In recent years, Frontier has noted a narrowing in the breadth of US equity market return drivers, and short-term extremes of the same, with just a handful of tech mega-cap stocks…

In the aftermath of Your Future Your Super (YFYS), members of dud funds still aren’t moving their super. And it’s not clear what the government and regulators can do about it. It sometimes seems that so much time was spent on implementing the contentious YFYS reforms that the question of what would happen to members…

The last two years have seen an “anomaly” in equity markets where stocks with no dividends were king. But those who “kept the faith” might finally be rewarded. The concept of duration, while intrinsic to fixed income, doesn’t get much of an innings in equities. But John Tobin, managing director and portfolio manager at Epoch…

Investors are focusing too heavily on the transition to renewables and aren’t seeing the catastrophic implications of a short fall in oil supply, according to Pzena Investment Management. In recent times, a number of institutional investors have made waves by announcing sweeping divestments from fossil fuels like oil and thermal coal. But investors are pricing…

Australia’s superannuation system is leading the world in pensions, but the broader market is still missing opportunities on stewardship and technology. The Thinking Ahead Institute’s 2022 Global Pension Assets Study has named Australia the world’s number one pension market, with 20-year pension asset growth of 11.3 per cent per annum in US dollar terms. The…

The two funds have now committed to exploring a proper merger after announcing a pooled superannuation trust (PST) arrangement in 2021 that drew the ire of members of the Morrison Government. Hostplus and Maritime Super have signed a memorandum of understanding and will commence joint due diligence with an intention to merge in 2023, with…

Magellan has gone to its investors with a profit beat, a potential share buyback, and a promise that it will no longer be distracted by dalliances outside its core funds management business. Magellan came out swinging at its first results briefing since the surprise departure of Hamish Douglass, announcing an increased dividend, a potential share…