Bank of Queensland boosts market, energy declines, GM buys into Queensland Pacific

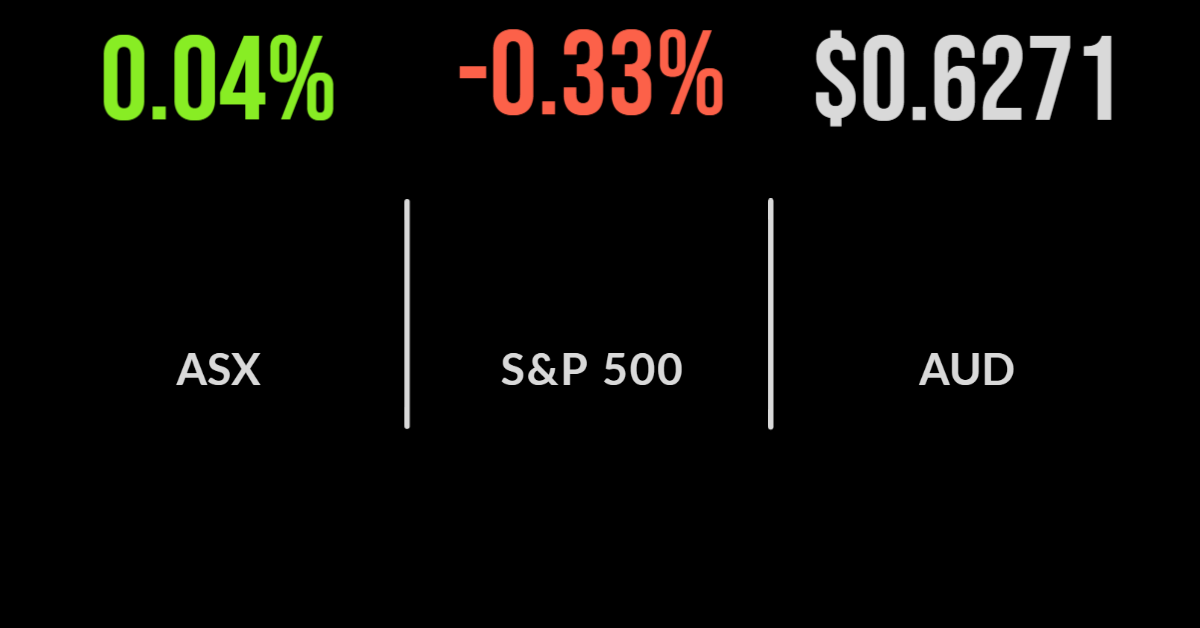

The local sharemarket managed to overcome global weakness, posting a 2.5 point gain behind a significantly rally in the financial sector, up 1.9 per cent.

The property sector also added 1 per cent, with energy and utilities falling 1.5 and 2.2 per cent following significant commentary around the future of energy policy in Australia.

Shares in Origin (ASX:ORG) fell 2 per cent, and AGL Energy (ASX:AGL) 1.9 per cent as board pressure continues to grow.

Shares in Bank of Queensland (ASX:BOQ) almost singlehandedly lifted the market, gaining more than 11 per cent after reporting a better than expected quarterly result.

The company announced a 5 per cent decline in cash profit, but a 15 per cent increase on a statutory basis after revenue jumped 34 per cent to $1.7 billion.

The dividend was increased by another 10 per cent, on the back of housing and business loan growth of 7 per cent. Small cap Queensland Pacific (ASX:QPM) added 16.7 per cent after car manufacturer General Motors announced it would take a $110 million in the business.

CSL, NIB deliver updates, mining sector weakens

The local mining sector remains under pressure, as Chinese growth looks to remain slow for the remainder of the year.

The result was a weakening of the iron ore price which send Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) down 2.1 and 2.8 per cent respectively.

On the positive side, the Australian dollar has reached a new two year low of 0.62 cents as the RBA appears set to slow the pace of rate hikes.

Insurer NIB Holdings (ASX:NIB) has launched a $150 million capital raising, at an 8 per cent discount to the current price, in an effort to fund the acquisition of Maple Plan.

The group also reported a small increase in underwriting premium, which supported 6 per cent growth in revenue, but offset by weakness in the underlying investment performance.

Shares in CSL were 1.1 per cent lower despite the company reaffirming guidance of revenue growth between 7 and 11 per cent, along with profit of $2.4 to $2.5 billion, a 10 to 14 per cent improvement on FY22.

Global markets turn negative on producer inflation, Intel to cut staff, Pepsi delivers

All three benchmarks were dragged into the red late as stronger than expected producer price inflation threatens to force the Fed to remain on its aggressive hiking path.

The Nasdaq and Dow Jones both fell 0.1 per cent with the S&P500 down 0.3 per cent, despite the growth in producer input prices falling from an 8.7 to 8.5 per cent annual rate.

Core inflation data was unchanged at 5.6 per cent, with the consumer facing data set to be released tomorrow.

All eyes remain on the UK were the support of the Bank of England in the bond market is set to finish this week, however, reports suggest they have indicated they will step in, if and when required to ensure stability of the market.

The news comes as the IMF downgrades the global growth outlook, increasing the risk of global recession to 50 per cent.

Intel (NYSE:INTC) shares gained 1.2 per cent after the company indicated they may fire thousands of employees in an effort to cut costs and focus on margins.

PepsiCo (NYSE:PEP) gained more than 4 per cent after management delivered an 8 per cent increase in revenue and 20 per cent jump in profit for the quarter.

The result was driven by the north and latin American business lines.