-

Sort By

-

Newest

-

Newest

-

Oldest

Margaret Cole, APRA’s new executive for superannuation, has brought the super war to its most unlikely, and probably reluctant, combatants: members. Faced with the disappointing reality that few have moved out of their underperforming fund in the aftermath of the performance test, Cole has resorted to browbeating them into it. “It has been just over…

The accusations of insider trading hurled at Australia’s big super funds are explosive in nature – and pose something of a headscratcher. Regardless of their weight, reputations are at stake. The revelations made by ASIC on Wednesday last week (October 27) are a tough wake-up call for an industry that prides itself on its duty…

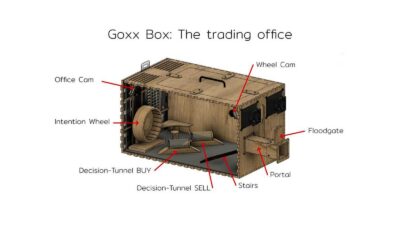

Two case studies this week provide an interesting opportunity to re-examine investor behaviour. As it turns out, a monkey can beat the market. Have you heard the one about the crypto-trading hamster? Mr Goxx is the only employee/inhabitant of Goxx Capital, a specially outfitted cage which allows him to trade cryptocurrencies based on his movements…

The new inquiry into common ownership wants to find evidence of collusion between super funds. But it appears to be the quintessential storm in a teacup. The standing committee on economics’ inquiry into the implications of common ownership and capital concentration in Australia has supposed a problem and now faces the difficult task of finding…

Ian Silk, soon to retire from AustralianSuper, was an infrequent speaker on the conference circuit, but his speeches were memorable. Two were very memorable and, as you might expect, prescient. AustralianSuper announced last week (July 13) that Silk, the first chief executive of AustralianSuper, would retire later this year. He is being replaced by Paul…

Before last week’s positive COVID-19 test, there was little doubt President Trump was on the comeback trail. Amid signs of an economic recovery, positivity around hopes for a vaccine, and progress on another fiscal stimulus package, all was looking up for a second term. Then came the ‘Presidential Debate,’ in which Trump brought Democratic candidate…

Many investors may be wondering whether there is any value left in domestic fixed-income markets. While outright yields may look tight on a historical basis, we contend that spread sectors still provide attractive risk-adjusted returns relative to cash and government bonds. Indeed, there still exist a number of compelling risk/return opportunities for active managers to…

The stellar run in the Nasdaq 100 index, which has seen it reach new all-time highs some 40 times already in 2020, shows no signs of slowing. With such strength and a willingness of investors to look beyond short-term losses, a single-file, socially distanced line of “unicorns” is awaiting their piece of the action. The…

The possibility for government to increase superannuation taxes in response to the ballooningbudget deficit caused by COVID-19 could severely hurt member balances at retirement, according to a research note by the global implementation specialist manager Parametric. Raewyn Williams, head of research (Australia) and analyst Josh McKenzie, in a short paper titled“Will retirees pay the price…

As Coronavirus cases drop, and talk of CSL’s contracts to manufacture vaccines (that is, AstraZeneca’s and/or the University of Queensland’s candidate, if they are successful) starts doing the rounds, hopefully it shouldn’t be too much longer before second-wave lockdown restrictions ease and the economy is back on track. That is the plan, notwithstanding any unforeseen…

While one can fret about the relative performance of equity and fixed income funds, the frustration with those that have underperformed is directed at their evident style bias.

Semiconductors would have to be one of the most pervasive and critical pieces of technology in our daily lives – but they are usually not thought about very much. They certainly don’t seem to get the investment love like they should, or get talked about as much as, say, the FAANG stocks or electric vehicle…