China COVID easing fails to negate market fears

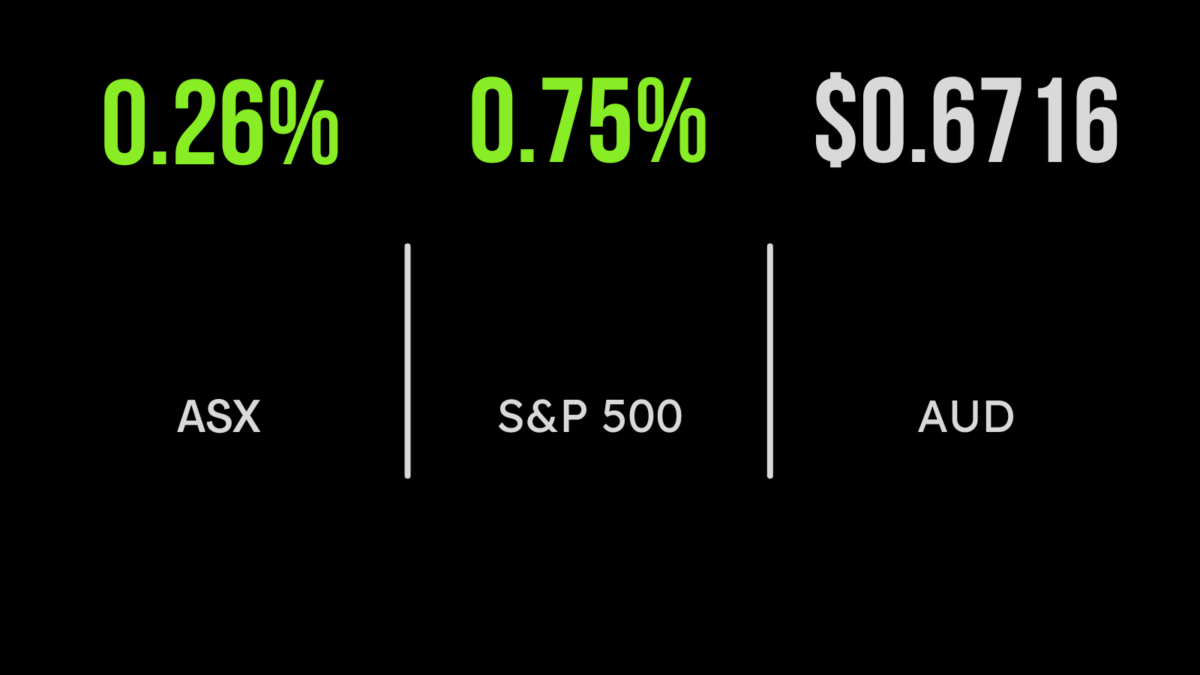

Geo-political and economic worries mounted for the local share market on Thursday, with the upshot being a slide of 53.9 points, or 0.8 per cent, in the benchmark S&P/ASX200 index, to 7,175.5 points while the broader All Ordinaries index lost 53.8 points, or 0.7 per cent, to 7,369.4.

Seven of the ASX’s 11 official sectors retreated, with energy the worst hit as the global benchmark Brent crude oil grade slid under $US80 a barrel for the first time since early January, on fears that a global recession would slam demand. Miners were also down across the board, despite an announcement from Beijing that the government was easing its Zero-COVID-19 strategy, reducing mass testing and letting people isolate at home, which has positive implications for demand in the nation’s biggest resources customer.

BHP gave up 37 cents, or 0.8 per cent, to $46.23; Fortescue Metals also lost 37 cents, in its case 1.8 per cent, to $20.80; and Rio Tinto slipped $1.00, or 0.9 per cent, to $114.50.

In coal, Whitehaven Coal walked back 13 cents, or 1.3 per cent, to $9.57; New Hope Corporation lost 15 cents, or 2.6 per cent, to $5.64; and Yancoal Australia fell 8 cents, or 1.4 per cent, to $5.79.

The lithium sector had a shocker, with producer Allkem declining 51 cents, or 3.7 per cent, to $13.29; fellow producer Pilbara Minerals losing 23 cents, or 4.9 per cent, to $4.48; project developer Lake Resources weakening by 3.5 cents, or 3.6 per cent, to 94 cents; Core Lithium hammered by 13 cents, or 9.9 per cent, to $1.18; and Liontown Resources losing 14 cents, or 7.5 per cent, to $1.79. Amid the rout, it was impressive that Piedmont Lithium managed to advance by 1 cent to 84 cents.

Mineral Resources, which mines iron ore and lithium, was down $2.28, or 2.5 per cent, to $87.78; and IGO, which produces nickel and lithium, lost 64 cents, or 4.1 per cent, to $14.89. Rare earths producer Lynas Rare Earths fell 16 cents, r 1.9 per cent, to $8.51.

Goldminers stood out, with Newcrest adding 42 cents, or 2 per cent, to $21.22; Northern Star gaining 20 cents, or 1.9 per cent, to $10.92; Evolution rising 10 cents, or 3.6 per cent, to $2.90; and Bellevue Gold surging 8.5 cents, or 8 per cent, to $1.15.

In energy, Woodside Energy slid $1.55, or 4.3 per cent, to $34.45; Santos lost 8 cents, or 1.1 per cent, to $7.09; Brazilian-based producer Karoon Energy fell 10 cents, or 4.6 per cent, to $2.06; but Beach Energy, which has had a horror week, stemmed the bleeding, eking out a half-cent gain, to $1.64.

Downer lives up to its name

Infrastructure giant Downer EDI sank 98 cents, or 20.4 per cent, to $3.82, after announcing that it had detected $30 million to $40 million in financial accounting irregularities in relation to a maintenance contract, across three years. Downer also said it was unlikely to meet its full-year guidance given difficult weather conditions in Australia’s eastern states and New Zealand.

In the big-bank world, ANZ slid 44 cents, or 1.8 per cent, to $23.59; Westpac retreated 28 cents, or 1.2 per cent, to $23.29; National Australia Bank fell 53 cents, or 1.7 per cent, to $30.12; Commonwealth Bank lost 20 cents, or 0.2 per cent, to $105.35; and investment bank Macquarie Group surrendered $2.48, or 1.4 per cent, to $171.16.

In the US overnight, the broad S&P 500 index gained 29.6 points, or 0.8 per cent, to 3,963.5, while the 30-stock Dow Jones Industrial Average added 183.6 points, or 0.6 per cent, to 33,781.5, and the tech-heavy Nasdaq Composite index rose 123.5 points, or 1.1 per cent, to 11,082.

US yield curve inversion worsens

The US yield curve has inverted to depths not seen since the 1980s, raising recession fears. The 10-year US Treasury yield is at 3.491 per cent, and the 2-year Treasury yield is at 4.314 per cent, and the difference – the 10-year minus the 2-year – is not only negative, it is the most negative seen since the 1980s. Yield curve inversion, where yields at the shorter end exceed longer-term yields, is considered a traditional harbinger of recession: research by the New York Federal Reserve puts the chance of a recession in 12 months, based on the yield curve, at 38 per cent, currently.

Oil prices continued to slide, with Brent crude down 89 cents, or 1.2 per cent, to US$76.28 a barrel, and West Texas Intermediate off 33 cents, or 0.5 per cent, to US$71.68 a barrel. Gold gained US$1.99, or 0.1 per cent, to US$1,789.35. The Australian dollar is buying 67.7 US cents, up from 67.11 cents at the local close yesterday.