Market limps to eight-month high

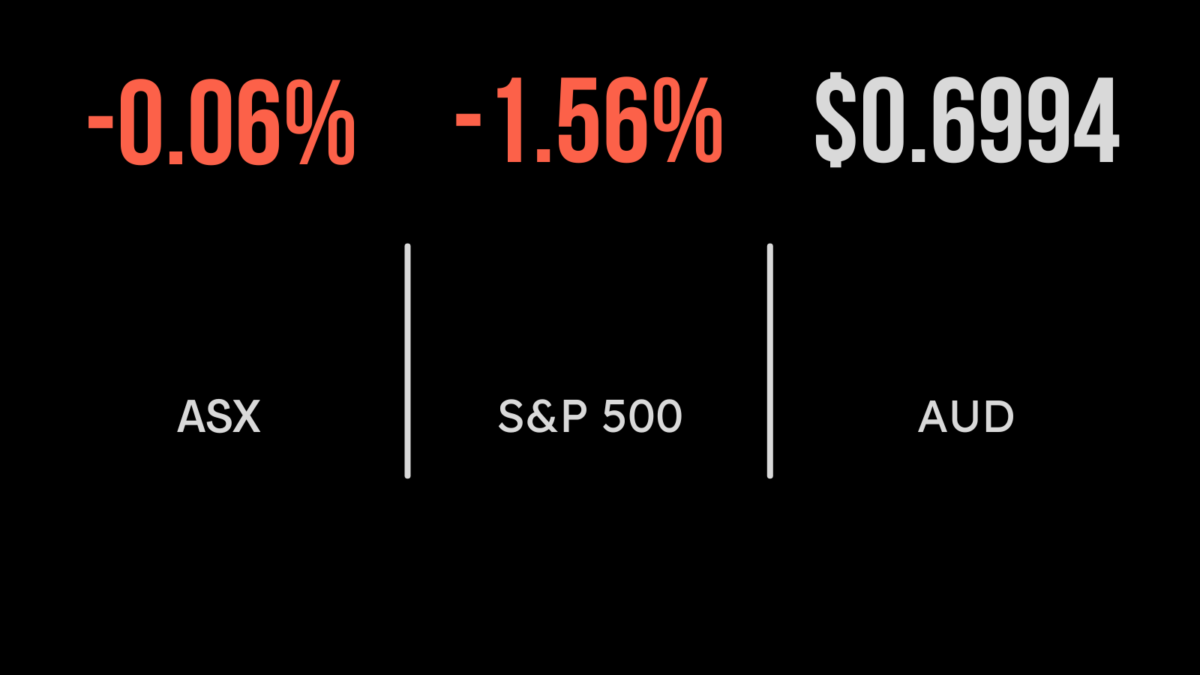

It was a mixed day on the local market on Wednesday, with six of the 11 sectors higher, and the upshot being a 0.1 per cent rise in the benchmark S&P/ASX 200 index, to 7393.4. The broader All Ordinaries Index added 11.9 points, or 0.2 per cent, to 7,609.5. The market was not exactly off to the races, but the S&P/ASX 200 close was in fact its highest in eight months.

The major news with which the market had to grapple was the Bank of Japan leaving interest rates unchanged, acting contrary to widely held expectations that it might loosen efforts to control the yield of 10-year Japanese government bonds, a massive monetary stimulus program.

In the heavyweight mining sector, BHP lost 6 cents, or 0.1 per cent, to $49.08; Rio Tinto gained $1.32, or 1.1 per cent, to $121.99; and Fortescue Metals was up 17 cents, or 0.8 per cent, to $22.20. Among lithium producers, Allkem was down 4 cents to $12.25, and Pilbara Minerals eased 6 cents, or 1.5 per cent, to $4.01. In energy, Woodside Energy lost 37 cents, or 1 per cent, to $37.00 and Santos was 2 cents weaker at $7.36.

Redbubble well in the red

Online marketplace Redbubble plunged to its lowest level since April 2020 after reporting plans to reduce its employee numbers by 14 per cent, warning of flat revenue growth in 2023 and lower profitability. Redbubble shares plunged 6 cents, or 11.4 per cent, to 50 cents following the announcement, taking the stock’s losses in the past year to 77 per cent.

Embattled plus-sized women’s fashion company City Chic surged 9 cents, or 16.4 per cent, to 64 cents as retail billionaire Brett Blundy reported a 7.3 per cent stake in the company. But to put that in context, City Chic is still down by 90 per cent in the past 12 months.

Of the major banks, ANZ eased 12 cents, or 0.5 per cent, to $24.79; Commonwealth Bank was up 21 cents, or 0.2 per cent, to $107.65; and Westpac retreated 11 cents, or 0.5 per cent, to $23.82; while National Australia Bank was unchanged at $31.67. Investment bank Macquarie gained 32 cents, or 0.2 per cent, to $179.60

Biotech heavyweight CSL advanced $2.27, or 0.8 per cent, to $292.83, while Telstra was steady at $4.09.

US retail sales disappoint

On Wall Street, investors took profits on some of the strong January gains and as a disappointing December retail sales figure raised concerns about a recession. U.S. retail sales fell by 1.1 per cent in December, the measure’s biggest fall in 12 months.

Bank shares led the market lower, with the 30-stock Dow Jones Industrial Average dropping 613.9 points, or 1.8 per cent, to 33,296.96, while the broader S&P 500 lost 62.1 points, or 1.6 per cent, to close at 3,928.86, its lowest level since December 15. The tech-laden Nasdaq Composite Index gave up 138.1 points, or 1.2 per cent, to 10,957, ending a seven-day win streak.

On the commodity front, gold was down US$4.54, or 0.2 per cent, to US$1,904.13, while the global benchmark Brent crude oil retreated US$1.40, or 1.6 per cent, to US$84.52 a barrel and West Texas Intermediate crude lost US$1.04, or 1.3 per cent, to US$79.14 a barrel. The Australian dollar is buying 69.42 US cents, down from 69.9 cents at the local close on Wednesday.