Market overcomes energy weakness, James Hardie sinks on weak property market

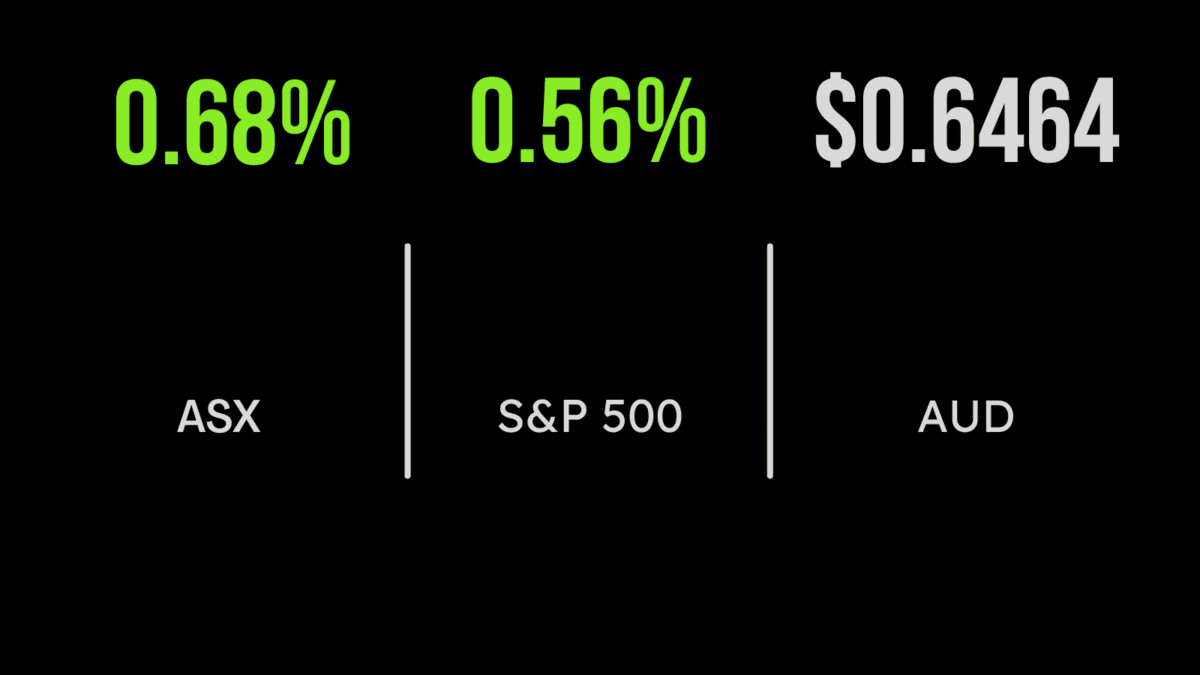

The S&P/ASX200 gained another 0.4 per cent on Tuesday with a broad-based rally managing to overcome a selloff in the energy sector. The staples and utilities sectors were strongest gaining 1.3 and 1.4 per cent, with healthcare and financials not far behind. Energy, however, fell by more than 2.3 per cent on a weaker oil price and talk of further intervention. Santos (ASX:STO) shares fell 5.3 per cent after the company became the latest downgrade production guidance 103 to 106 million barrels to 91 to 98 million. Shares in James Hardie (ASX:JHX) were the biggest detractor falling more than 13 per cent after the company flagged a tougher US housing market and downgraded profit guidance by around 10 per cent. Profit for the year finished 22 per cent higher and management confirmed the decision to buy back US$200 million in shares via a buyback. Global sales surged by more than 10 per cent in the second quarter but activity in Europe remains muted due to the war, falling 2 per cent.

Feed inflation to continue, Platinum loses mandate, Sims down on margins

Poultry producer Inghams (ASX:ING) fell by more than 2 per cent after management suggested that high feed costs may continue into 2023, due to a shortage of what and soymeal. It was a similar story for recycling group Sims (ASX:SGM) which fell by close to 10 per cent after the company suggested both sales and costs were heading in the wrong direction. Volumes remain lower than expected whilst costs are elevated due to energy and associated costs leading to a cut to earnings guidance of around $65 to $75 million. Shares in Platinum Asset Management (ASX:PTM) overcame another $351 million in outflows, taking assets to $17.2 billon, to post a slight increase on the day. The company confirmed a large institutional investor had drawn $200 million from the Platinum Asia Fund with another similar amount to follow. Shares in annuity issuer and fund manager Challenger Financial (ASX:CGF) gained 1.3 per cent after the company confirmed it had received authority to redeem two tier two bonds by the regulator, removing uncertainty around the debt instruments.

Mid-terms support strong market, Lyft, TakeTwo sink

The impending mid-term elections in the US are supported further strength in the local market with the Dow Jones gaining 1 per cent, the S&P500 0.6 and the Nasdaq 0.5 per cent. Historically a split of power between the two parties has been a positive for equity markets as it reduces the ability for each to deliver significant policy change for the remaining term of government. Shares in Lyft (NYSE:LYFT) fell by more than 20 per cent during the session after the company reported a significantly weaker than expected result. Lyft saw 20 million riders during the quarter, 14 per cent year on year growth, which contributed to a 25 per cent jump in revenue. Earnings were hit by a jump in stock-based compensation, while managed announced 13 per cent of the work force would be laid off. It was a similar story for Take Two Interactive (NYSE:TTWO) which flagged a drop in in game spending as inflation and higher interest rates hit, with mobile downloads and usage central to the weakness. Despite this, revenue jumped 50 per cent for the quarter, of which 47 per cent continues to come form mobile applications; shares finished 13 per cent lower.