Market soars on inflation data, China restrictions, technology in focus

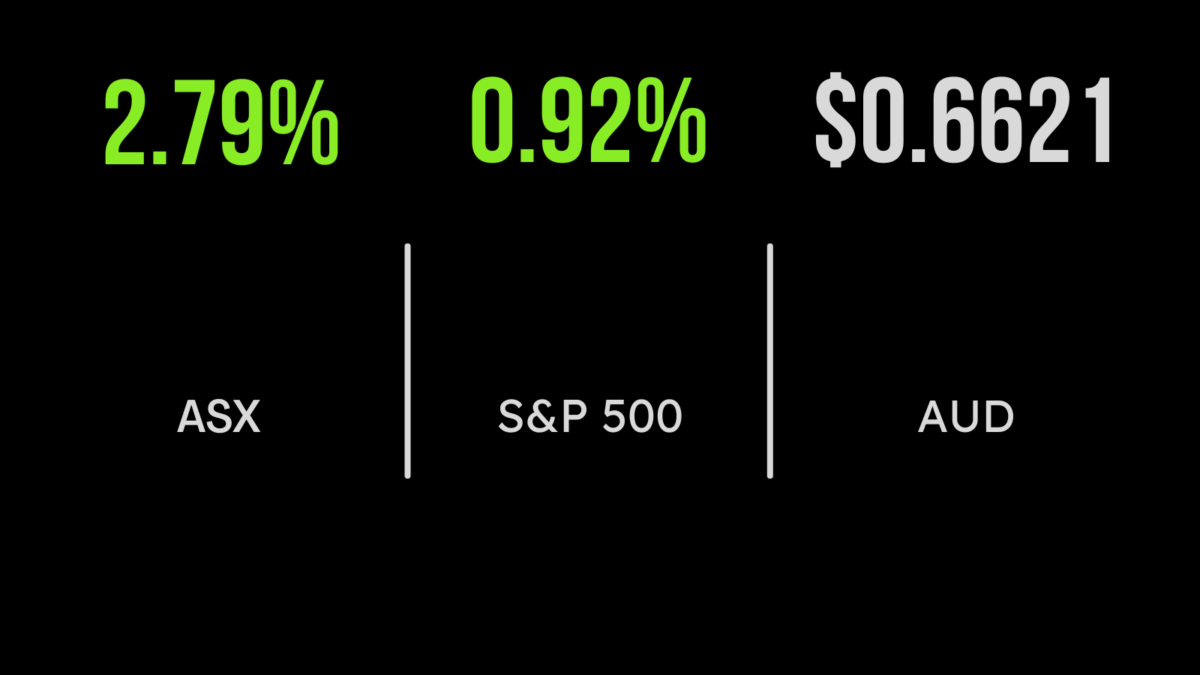

The local market rode the US inflation data wave, gaining 2.8 per cent on Friday, buoyed by the hope that interest rate hikes may be set to ease. Every sector finished higher outside of utilities, as Origin Energy (ASX:ORG) reversed 3.2 per cent as investors digest the recent takeover offer; the company was still up 32.1 per cent for the week. The deal will require multiple regulatory approvals, hence the continued discount to the $9 offer. Ramsay Healthcare (ASX:RHC) was the biggest name reporting on Friday with shares gaining 4.7 per cent on a stronger than expected update. Declining COVID-19 cases led to an improvement in activity in each of the group’s jurisdictions, contributing to a 6.7 per cent increase in revenue for the quarter, but another small reduction in earnings as costs bite. Profit fell 24 per cent to $81 million, with management now focused on ensuring they are able to pass through higher labour costs in the coming months. The telecoms sector overcame news of a $33 million fine for false and misleading representations with Telstra (ASX:TLS) gaining 1 per cent. The S&P/ASX200 managed to gain 3.9 per cent for the week with the gold mining sector benefitting from turbulence in the crypto market, Evolution Mining (ASX:EVN) gaining 29 per cent, while both New Hope (ASX:NHC) an Whitehaven Coal (ASX:WHC) fell by close to 20 per cent each.

Rally continues, China restrictions ease, FTX bankrupt

The impact of lower-than-expected inflation continues to filter through the market with all three benchmarks gaining on Friday, albeit at a slower pace than the torrid rally on Thursday. The Dow Jones gained 0.1 per cent, the S&P500 0.9 and the Nasdaq 1.9 per cent. The biggest beneficiaries were the technology sector with the likes of Amazon (NYSE:AMZN) and Microsoft (NYSE:MSFT) gaining 4 and 2 per cent respectively. The positive news on inflation comes as consumer sentiment continues to fall, down to 54.7 from 59.9. On the positive side, news that the Chinese government would reduce quarantine requirements across the country boosted all Asian markets with the likes of Pinduoduo (NYSE:PDD) an Alibaba (NYSE:BABA) gaining close to 2 per cent each. Over the week the Dow Jones gained 4.1 per cent, the S&P500 5.9 and the Nasdaq 8.1.

Crypto market tumbles, inflation ‘surprises’, old world attractive again

All eyes were on the cryptocurrency market this week with the impending bankruptcy of trading platform FTX sending the entire sector into a tailspin. The unregulated platform became embroiled in a liquidity crunch after a series of significant withdrawal requests could not be met and the intertwined finances of a number of entities came into focus. The result was that the balance of assets held on the platform was no longer matched by the same level of security. Regulators have been unable to act due to a lack of regulation, but there is little doubt change will now occur after the fact and following significant consumer losses. An inflation ‘surprise’ sent the market into a strong rally at a time when the vast majority of investors were unable to consider an alternative to the current pace of rate hikes. Only time will tell whether the slowdown is real and whether rates will also slow but it reiterated the need to plan for multiple outcomes. The takeover bid for Origin (ASX:ORG) shows a company that has gone full circle and that despite the issues with fossil fuel, traditional energy source will remain valuable for some time to come.