MAX Awards: now for the actual winners

Chris Mather, head of platforms distribution at BT Financial, and Adele Welsh, head of marketing at Praemium, took out the top two personal awards at last week’s MAX Awards.

The annual super and investment industry sales and marketing achievement awards night, held in Sydney on June10, attracted a record attracted a record 17,000 votes, according to Chris Page. He is the managing director and co-founder of Rainmaker Group, publisher of ‘Financial Standard’ which organizes the awards.

For ‘Investor Strategy News’ the night is also a test of our predictive abilities. As we have done for several years, we published our own selection of likely winners beforehand on May 15. And, as previously, our predictions proved to be prescient. We got four out of our nine correct. Well, it’s harder than you think. You try it.

With the MAX awards, after the candidates get through the initial and rather opaque selection stage to reach finalists status, it is people’s choice-style voting (one vote per voter), with some safeguards against organised voting, such as restricting multiples from the same organisation by monitoring IP addresses. The result has seen some excellent campaigns on social media deserving of a spot near the famous Academy Awards lobbying in Hollywood.

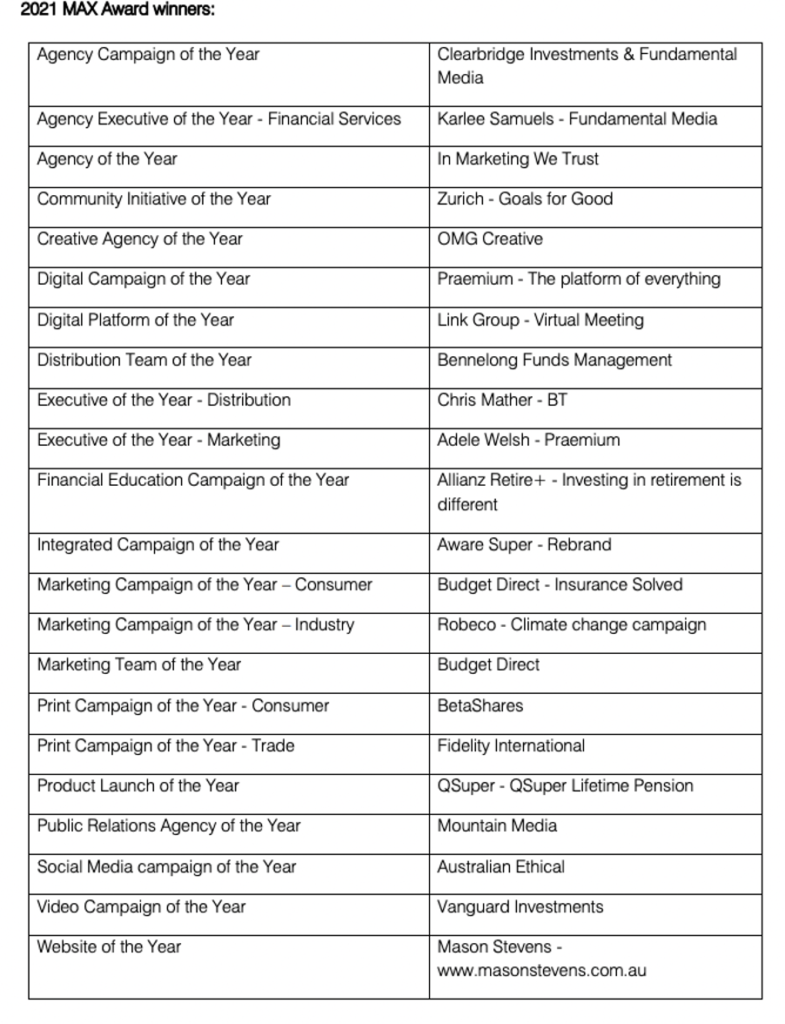

The full list of actual winners are listed below. Our predicted winners among them were:

- Chris Mather for ‘Executive of the Year – Distribution’. A 12-year veteran at BT Financial, he is in charge of the three big platforms for the Westpac-owned manager. We gave it to him for his “perseverence”, which we are now a little embarrassed about

- Aware Super for ‘Integrated Campaign of the Year’, following the fund’s merger with Vic Super and name change from First State Super

- Budget Direct for ‘Marketing Campaign of the Year – Consumer’, notwithstanding our doubts about the aesthetic quality of Budget’s advertising, and

- Link Group for ‘Digital Platform of the Year’. We said that if any of the finalists got a lucky break this year due to covid-19 it was Link, whose digital meetings service took off. A marketer’s dream.

The actual winners of the other five categories where we made predictions are:

- Adele Welsh of Praemium for ‘Executive of the Year – Marketing’. We predicted Wayne Sullivan at Frontier this year, after our successful winner selection last year of Franklin Templeton’s Felicity Nicholson

- In Marketing We Trust for ‘Agency of the Year’. We predicted Ptarmigan despite having won this award for the past two years

- Karlee Samuels of Fundamental Media, one of the largest firms in this space. We predicted Haissam Aoun, who only this year launched a new firm, We Are Better

- Fundamental Media and client ClearBridge for ‘Agency Campaign of the Year’. We predicted BlueChip, which was also a finalist in the PR agency category, as it usually is, and

- Mountain Media for ‘Public Relations Agency of the Year’. The 12-year-old firm, started by director Phil Davey, specialises in the not-for-profit sector.