S&P/ASX200 falls on quarterly updates, Graincorp dividend hike, Nufarm lifts

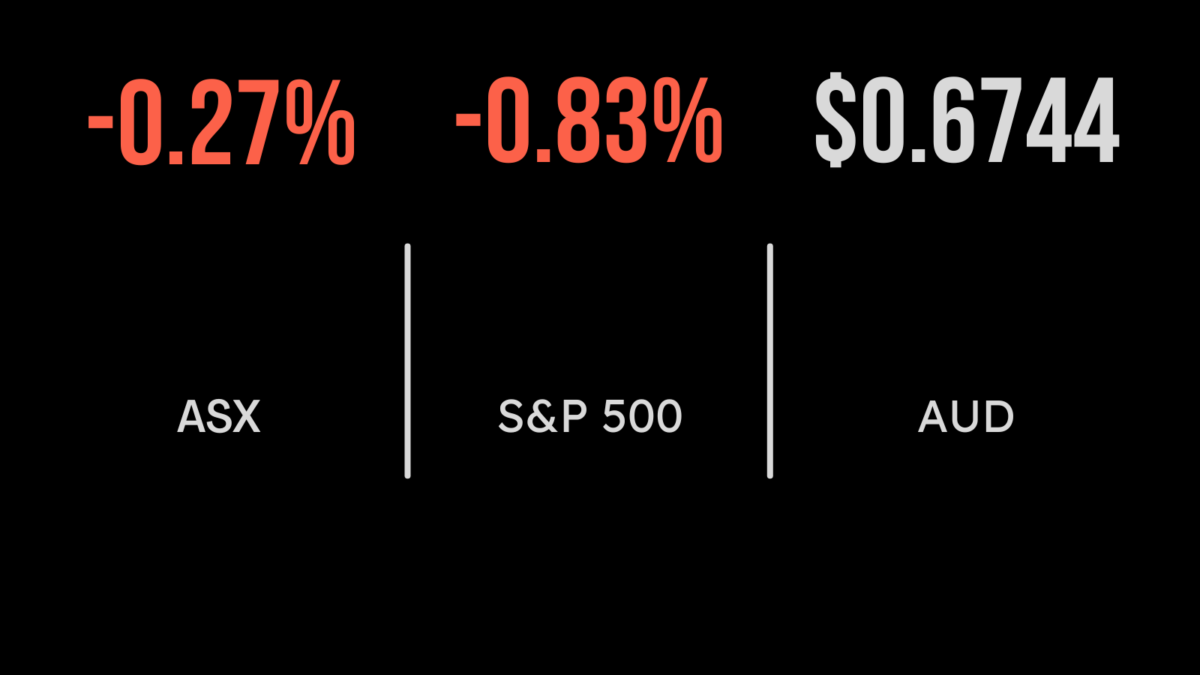

The S&P/ASX200 fell 0.3 per cent on Wednesday, with 8 of the eleven sectors finishing the red led by utilities, down 1.5 and retailers, down 1.3 per per cent. The highlight once again was the energy and materials sectors, which gained 1.2 and 0.7 per cent. Shares in Oz Minerals (ASX: OZL) entered a trading halt on rumours that bidder BHP (ASX: BHP) was back for another attempt to take over the company. Fertiliser group Nufarm (ASX: NUF) gained close to 9 per cent after the company reported a 65 per cent increase in profit on the back of higher commodity prices and ‘favourable seasonal conditions’. The result was an upgrade to FY26 results and a hike in the dividend. At the other end of the spectrum Graincorp (ASX: GNC) lost around 2 per cent despite reporting a 173 per cent increase in profit to $380 million, driven by higher volumes and prices of Australian grain. The dividend was also increased significantly as demand for local grain remains strong due to the challenges in Ukraine.

Kathmandu sales surge, Aristocrat sinks

Shares in clothing retailer KMD Brands (ASX: KMD), owner of the Kathmandu brand, gained more than 4 per cent after the company reported a 61 per cent increase in first quarter sales as lockdowns in Australia and New Zealand came to an end. Total sales were 17 per cent higher than even the first year of the pandemic resulting in a $30 million jump in profit. Poker machine operator Aristocrat Leisure (ASX: ALL) fell by another 5 per cent after releasing its earnings update. Revenue jumped 18 per cent and profit close to 16 per cent to $948 million but this wasn’t strong enough to offset growing expectations for the company. Wage growth appears to be recovering finally, with the annual rate growing to 3.2 per cent, slightly ahead of expectations but not enough to force the Reserve Bank’s hands on a significant change to the current interest rate policy. The merger between Perpetual (ASX: PPT) and Pendal (ASX: PDL) is set to be considered by the Supreme Court on Thursday which will determine whether other deals can be considered including that from Regal Funds.

S&P500 falls, Target down on earnings, retail sales increase

Shares in Target (NYSE: TGT) fell by more than 13 per cent after the company delivered a weaker than expected earnings report. While revenue beat expectations, with same store sales 2.7 per cent higher, profit margin contracted significantly as the cost of sales increased, with management warning of a ‘consumer spending recession’ ahead of the all important holiday shopping season. The result was a 0.1 per cent fall in the Dow Jones, 0.8 per cent in the S&P500 and 1.5 per cent in the Nasdaq. Bucking the evidence of the prior day’s Walmart report were signs that retail sales remained strong, up 1.3 per cent in October, the risk remains that spending stays strong despite increasing interest rates specifically targeting this issue. In a similar vein, industrial production shrank 0.1 per cent while another Federal Reserve member suggested the cash rate may need to be above 5 per cent before the inflation will be brought under control. Finally, the risk of an escalation in Ukraine was increased after a missile unexpectedly crossed into Poland.