-

Sort By

-

Newest

-

Newest

-

Oldest

With assets representing ten per cent of global GDP tipped to be tokenized by 2030, those deploying capital are keen to identify and harness the inherent opportunities. And Australia is leading the way.

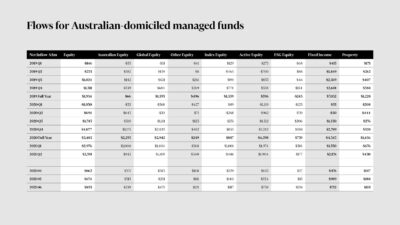

Managed equity funds have experienced their worst outflows since the Covid downturn of early 2020, according to Calastone. Specialist sector funds are feeling the pain too.

There’s no end in sight for the pain in equity markets, and investors are rushing for the exit. But Australian equities offer a bright spot.

Private markets assets are “ripe for the picking” for fund managers and administrators quick to use distributed ledger technology, as investment operations are on the cusp of “great change”. So said David Mackaway, the COO of Challenger Group, at the Calastone ‘Connect Forum’ last week (December 2. He was interviewed by Justin Christopher, Calastone director…

Member engagement is starting to rise from a very low base. But the industry is still “net nowhere” when it comes to winning their hearts and minds. It’s widely acknowledged that member engagement remains unacceptably low. Try as they might, super funds can’t seem to get members to care about their retirement savings, as evidenced…

The recovery of inflows into equity and other growth-orientated managed funds which started towards the end of last year has faltered, with the second-consecutive quarter of slower growth. According to the latest figures from Calastone, the global funds data network, net inflows for both Australian equities and Australian-domiciled global equities funds were, together, down about…

Australian investors put more money into traditional equity funds in February and March than they did in the whole of 2019, prior to the impact of covid-19. A new index shows Australians also had more conviction. According to figures from Calastone, which passes about 95 per cent of all fund flows, mostly from platforms, to…

The shift in investor preference for passive over active funds continued in the last two years, but Australian investors were more resistant to the global trend, according to research from Calastone. Calastone’s latest report, ‘Tidal Forces – Can Active Funds Fight the Passive Flows?’ compiled from analysis of fund transactions across its network during the last…

Australian fund managers see opening new distribution channels and embracing digitalisation as their major challenges in a post-COVID environment, according to a survey by financial data communications group Calastone and UK publisher Funds Global Asia. The Australian survey, for which there were 44 respondents, was part of a larger global survey with 291 respondents. It…