-

Sort By

-

Newest

-

Newest

-

Oldest

The benchmark S&P/ASX 200 index rose 86.5 points, or 1.3 per cent, on Tuesday to 6,806.4 points, while the broader All Ordinaries gauge added 81.4 points, or 1.2 per cent, to 7,030. Nine of the ASX’s 11 sectors gained ground, with real estate and healthcare the only ones to retreat. The mining sector was the…

Utilities and tech shares dragged the S&P/ASX 200 lower on Monday, as the benchmark lost 19.2 points, or 0.3 per cent, to 6,719.9 points, its lowest closing level in two months. Real estate was the only sub-index to post a gain, led by heavyweight real estate investment trust (REIT) GPT, which gained 9 cents, or…

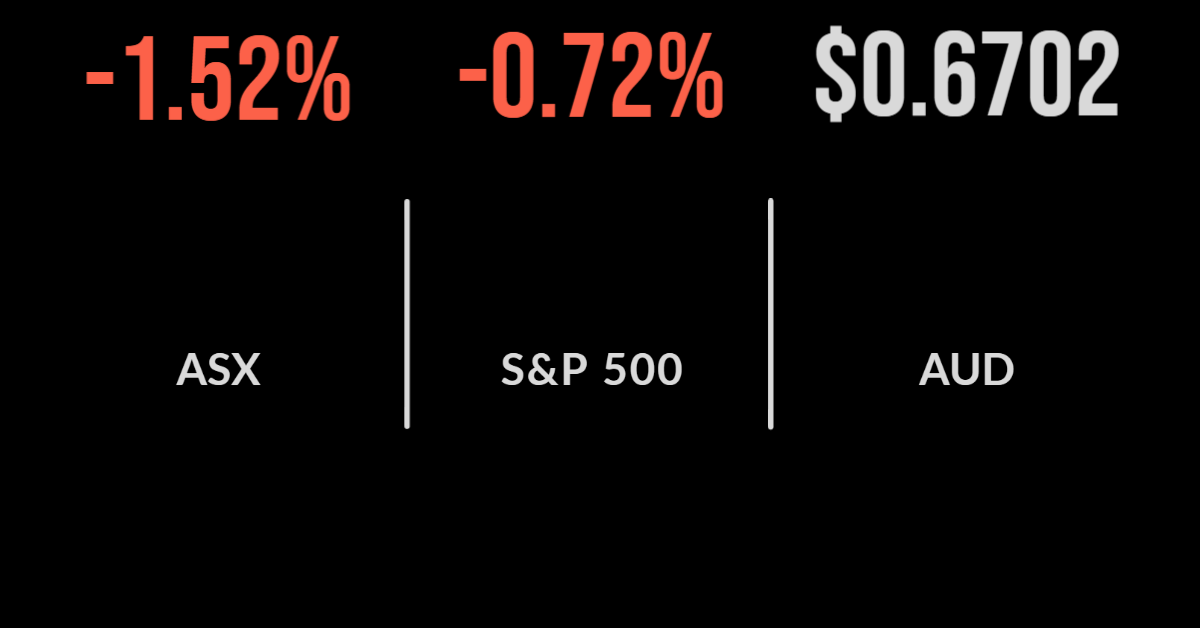

It was a sea of red on the S&P/ASX200, with the market closing down 1.5 per cent on Friday, resulting in a 2.1 per cent loss for the week. A reversal in the energy sector, triggered by a resolution of potential railroad strikes sent the energy sector down 3 per cent, with Whitehaven Coal (ASX:WHC)…

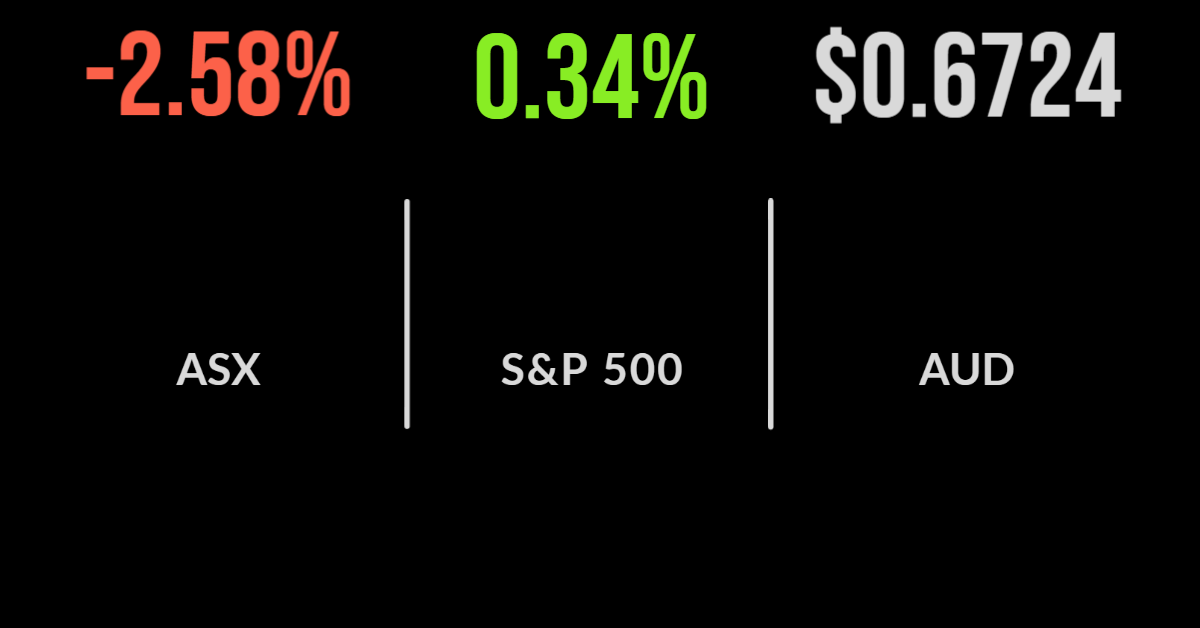

The local market fared better than global shares on Wednesday, falling 2.6 per cent in comparison to the 5 per cent drop in the Nasdaq. There was red across the board, led by the property and retail sectors, with the likes of Charter Hall (ASX:CHC) and Wesfarmers (ASX:WES) dropping more than 4 per cent on…

The local market was buoyed to a significant 1 per cent gain for the week, following a strong day on Friday. The 0.7 per cent gain was driven by the energy and materials sector which gained 1.1 and 3.3 per cent respectively on news of a potential split of Mineral Resources (ASX:MIN). Rumours that the…

The local market capped off the worst week in several months, falling another 0.3 per cent and taking the weekly loss to 3.9 per cent. On Friday it was the financial sector leading the way on hopes that the economy may remain strong, bounced 0.7 per cent, with the more defensive healthcare and real estate…

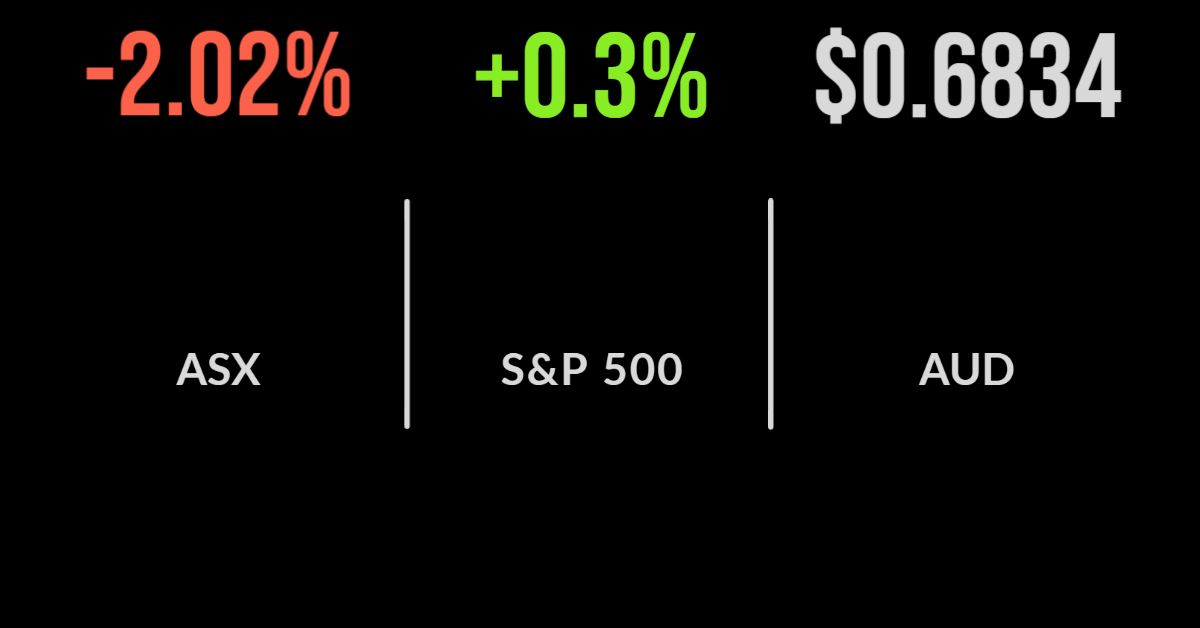

The local sharemarket continued its recent weakness, falling another 2 per cent for the first day of spring. Australia’s largest company, BHP (ASX:BHP) was the biggest detractor falling 7.6 per cent, or $3.09 cents as the stock went ex-dividend. This is a regularly forgotten impact of the payment of dividends, which totalled $2.56 plus franking credits, as…

The S&P/ASX200 almost turned around a sharply weaker start to trading on the final day of August, falling just 0.2 per cent on Wednesday. In a reverse of recent days, the energy sector was the biggest detractor after the European Union warned of a potential intervention in energy markets and China faces another COVID-19 outbreak….

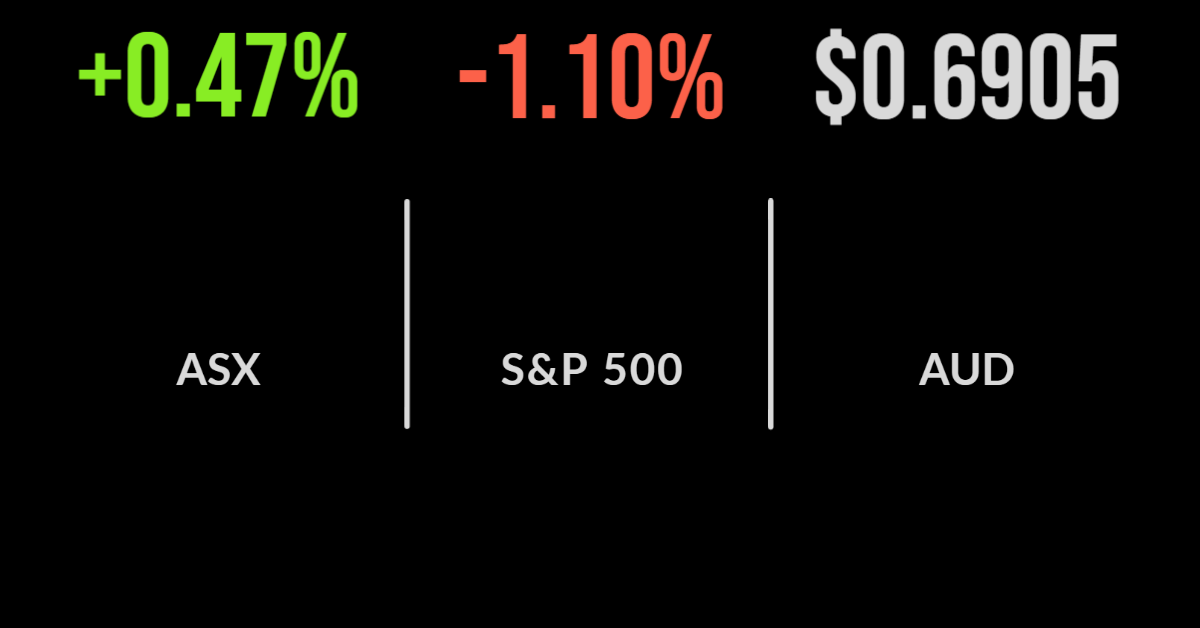

The local market managed to overcome another weak global lead, gaining 0.5 per cent on Tuesday, with the energy sector a key support. Gaining 1.4 per cent on the back of a strong inaugural report by Woodside Energy (ASX:WDS) the sector was second only to technology, which gained 1.8 per cent. Renewed conflict in Libya…

The local market followed an increasingly negative global lead, ultimately finishing 2 per cent lower. The sole driver was commentary from Federal Reserve Chair Jerome Powell from the Jackson Hole summit, which suggested aggressive central bank action was unlikely to slow any time soon. The result was just four companies posting increases on the day,…