The great crypto debate

Bitcoin’s volatility means that institutional investors have historically steered well clear. But the times are a-changing, and even skeptics believe the cryptocurrency will have its day.

Cryptocurrency is clearly here to stay. While most investors watch its massive price swings with bemused detachment, a few have begun to think seriously about the role they can play in portfolios. UK-based Ruffer recently made a £550 million ($A970 million, around 2.5 per cent of its assets under management) investment in Bitcoin and turned it into an estimated £$1.1 billion profit. And surveys of institutional investors have found that more are considering investments in Bitcoin, but that the lack of trusted custodial services was preventing wider uptake.

But beyond the gains to be made from its significant price swings, there’s a deeper question to be answered about whether Bitcoin can ever function as what their proponents believe it to be: a store of value, akin to gold. Robeco believes the answer to that question is yes – with some considerations. Criticisms about its lack of intrinsic value are mostly irrelevant, given that many other stores of value don’t have that either. They’re also prone to the same significant fluctuations in price that many criticise cryptocurrencies for – though perhaps not on the same time scale.

“Gold’s real value has increased substantially since 1971, the end of the gold standard. But, just as with bitcoin, there is no compelling argument why gold should rise in real terms going forward, as there are no cash flows and its industrial use is limited,” Robeco wrote in its annual Expected Returns report. “The gold price fluctuates about as much as a stock market index. Therefore, it’s a risky short-term store of value, even though in the long run it has proven to keep its purchasing power.”

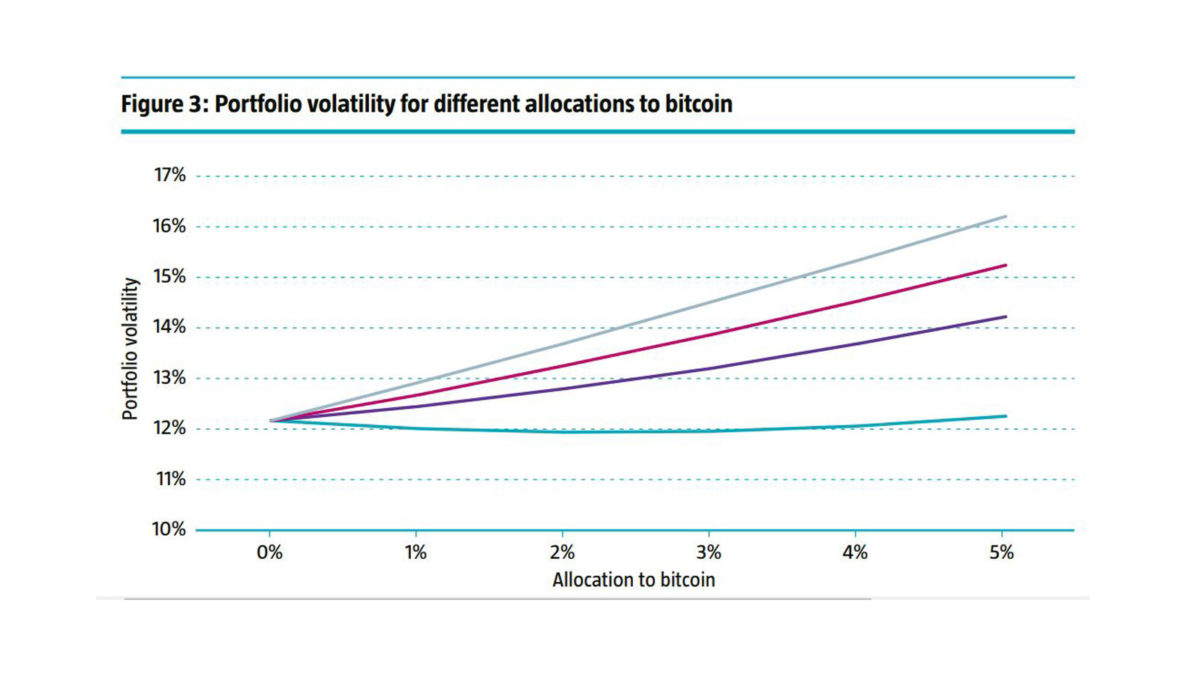

Its return characteristics are a little bit trickier. Bitcoin’s empirical correlation to gold is 0-40 per cent; for its modelling, Robeco assumed a volatility rate of 20 per cent for equities, 5 per cent for bonds, and 100 per cent for Bitcoin. At zero correlation, a four per cent allocation to bitcoin creates portfolio volatility below that of the traditional 60-40 allocation. With a 25 per cent correlation, a one per cent allocation has a higher volatility than the base portfolio, and a five per cent allocation increases portfolio risk regardless of the correlation assumptions made.

“Without a strong conviction on the future return of bitcoin ownership, and disregarding ESG aspects of the asset class for now, a strategic allocation ranging between 0-2% seems optimal from a portfolio risk perspective,” Robeco wrote.

But it’s near-impossible to ignore those ESG considerations. Bitcoin mining is famously dirty – the process uses about as much energy as a medium-sized country every year, with annual carbon emissions roughly on par with those of the gold mining industry. Higher Bitcoin prices also require more computational power. In a world where more and more institutional investors are thinking seriously about the transition to net-zero, the pollution will likely be a turnoff – even if the volatility isn’t.

“That said, the mining sector is in the process of curbing its carbon emissions, and we count on the crypto mining community to follow this example soon, driven by crypto innovation as well political and regulatory action,” Robeco wrote. “Alternative technologies to the proof of worth process that bitcoin relies on are on the way. For example, Ethereum is expected to switch to proof of stake (PoS), which will substantially reduce the required energy to keep the blockchain safe.”

The other problem is one that its proponents don’t believe is a problem at all: its decentralized nature, which makes it possible to use cryptocurrencies for all manner of activities that would normally draw the ire of a regulator like AUSTRAC. China’s latest crackdown on cryptocurrency was launched from the perspective of thwarting illegal activity; and while one might be tempted to view that within the lens of its wider regulatory efforts, it’s one of the issues in which it is in lockstep with global central banks. Few have welcomed the intrusion of digital currencies outside of those which they have oversight over – even Facebook’s recent experiment in digital currencies, which would have been backed by a basket of fiat currencies, elicited raised eyebrows from the RBA.

“Decentralization means that there is no benevolent or malicious dictator that can force their rules,” Robeco wrote. “There needs to be consensus among network participants, otherwise so-called forks appear. This shared-responsibility feature is a strength, though can also lead to nobody taking responsibility.

“At this moment, transparency and accountability of cryptocurrencies are differently organized than most corporate governance charters that investors use today. Therefore, a separate governance policy may be needed for cryptocurrency investments.”