The International Monetary Fund (IMF) has called for internationally coordinated mandatory measures including ‘swing pricing’ – equivalent to buy-sell spreads – to limit systemic risks posed by liquidity misalignment in open-ended funds.

A host of things investors have benefitted from in recent decades are likely to turn on a multi-year view. Even the much vaunted alternatives will find it harder to generate alpha.

Portfolios built along factor lines may be better-placed to withstand the grinding effects of high inflation, a recent study probing almost 150 years of market returns has found.

Renowned fund manager Jeremy Grantham has warned investors to prepare for an “epic” blowout with the recent market resurgence following the script of previous “superbubble” implosions.

Blame the unicorn-hunters. Or luck. Just don’t point the finger at central bankers for the recent value-v-growth stock performance trends, according to quantitative investment legend, Cliff Asness.

Shame-based investment strategies yoked to simplistic environmental, social and governance (ESG) scoring systems have come under fire in a new report from UK data analytics firm, Util.

Dotted with various government funds, the Pacific Islands has emerged as a competitive space for NZ and Australian-based investment advisers.

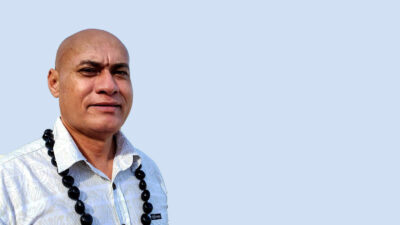

New research shows broad-faced hedge fund managers tend to take more risks but deliver less alpha for the effort compared to those with more elongated features.

Not-for-profit industry body Focusing Capital on the Long Term (FCLTGlobal), has refreshed its mandate guidelines for institutional investors.

The investment arm of State Street has forecast a bonanza ahead for environmental, social and governance (ESG) investment service providers as the sector explodes into the mainstream.