Renowned US hedge fund Bridgewater Associates is tipping a messy market transition as inflation and interest rate changes wash through the global financial system this year. Bridgewater, founded by Ray Dalio (photo at top), warns that while extraordinary COVID-era global monetary stimulus measures have finally kick-started the real economy, investors remain overly optimistic about the…

Investor time horizons pulled back slightly while corporate capital allocators took a much longer view during 2020, according to a new study. The analysis from institutional think-tank, Focusing Capital on the Long Term (FCLTGlobal), found investor time horizons shrank by 2.3 per cent last year as companies pushed out their expected capital return timeframes by…

The Australian financial regulator has urged institutional investors trading on the ASX to better prepare for future market blackouts in the wake of a meltdown on the exchange last November. In a new report charting a series of ASX operational incidents during the week starting November 16 last year, ASIC (chaired by Joe Longo, pictured)…

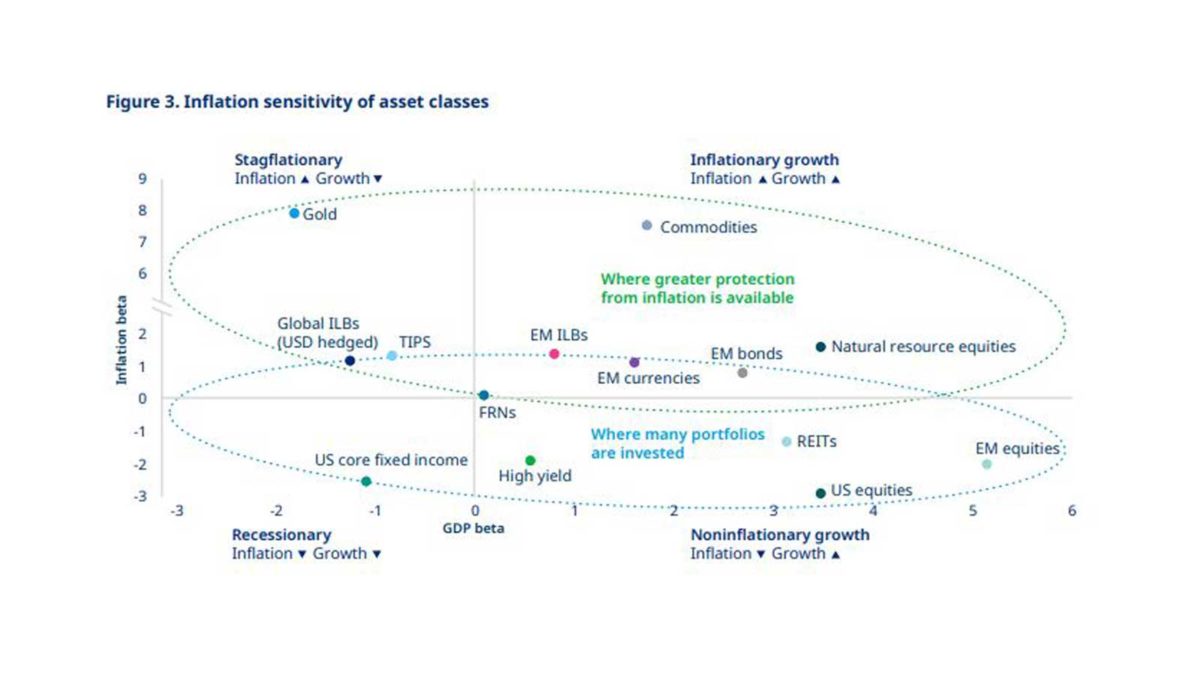

Mercer has urged investors to consider a wider range of inflation scenarios in portfolio design plans as price uncertainty ramps up across the world. In a new paper, the global multi-manager and consultancy firm says investors now face more complicated decisions amid confusing inflation signals. “Adding a less predictable inflation environment now increases complexity for…

AMP Capital will continue in a A$29 billion investment management gig with Resolution Life after selling down its stake in the insurer last week. According to an AMP spokesperson, there has been “no change to the [Resolution] mandate for AMP Capital” post the agreement to offload its over 19 per cent holding in the life…

Local equities fund shops have increasingly allocated to Australian shares over the last four years, a new Mercer NZ analysis has found, partly to ease pressure from ballooning assets under management. The Mercer study of a dozen NZ fund managers found Australian shares now represent 34 per cent of their collective portfolios compared to 26…

NZ’s largest community trust, Foundation North, will move to rein-in exposure to private assets after a stellar year saw exposure to the sector blow-out almost 5 per cent above the top-end of its target allocation. According to the Foundation North annual report released last week, the community trust’s private assets accounted for almost 20 per…

Dutch asset management giant, Robeco, tips a mainly positive, if subdued, outlook for equities over the next five years but with a high degree of uncertainty ahead in a decade it dubs the ‘Roasting Twenties’. In its new five-year forecast returns paper, Robeco says “we expect risk-taking to be rewarded in the next five years,…

Investors looking to arbitrage index ins-and-outs would have seen shrinking rewards for their efforts over the last 25 years based on the findings of a new S&P Dow Jones Indices (S&PDJI) paper. The S&P study found a “structural decline” in the so-called ‘index effect’ where share prices bounce up on entering key market benchmarks and…

Family office portfolios could see massive underperformance ahead with most well-overweight cash, according to the latest Citi Private Bank global survey of the sector. David Bailin, Citi Global Wealth chief investment officer, said about a third of family offices in the survey reported cash holdings of 20 per cent or more while a further third…