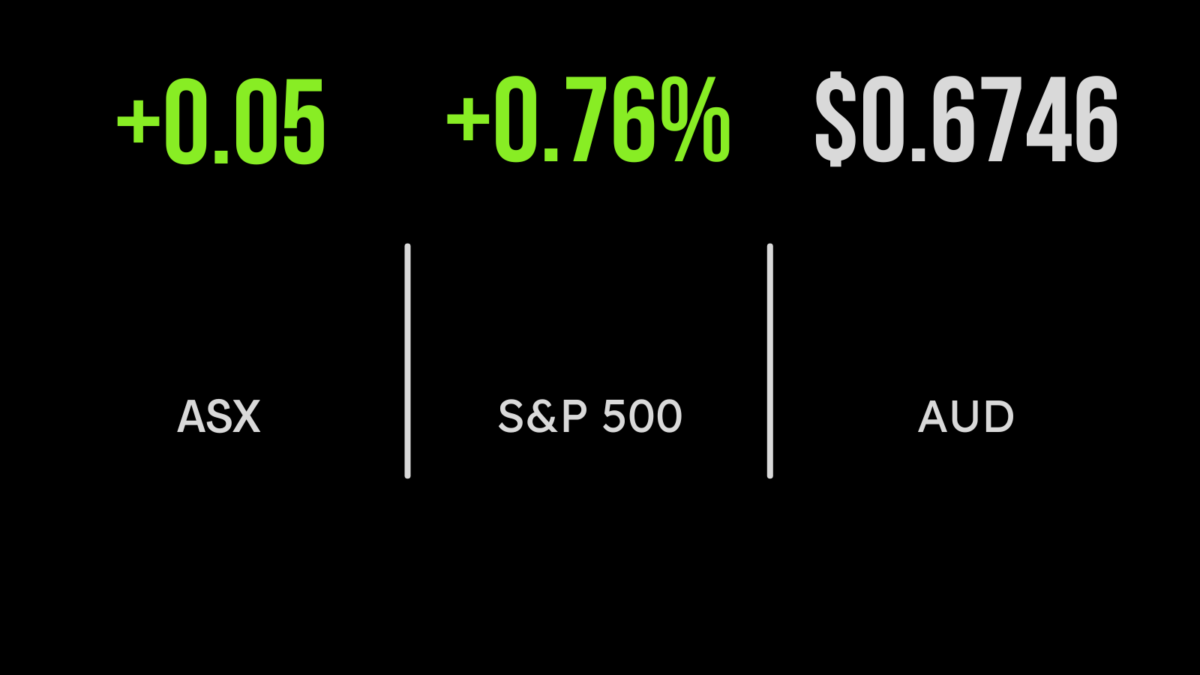

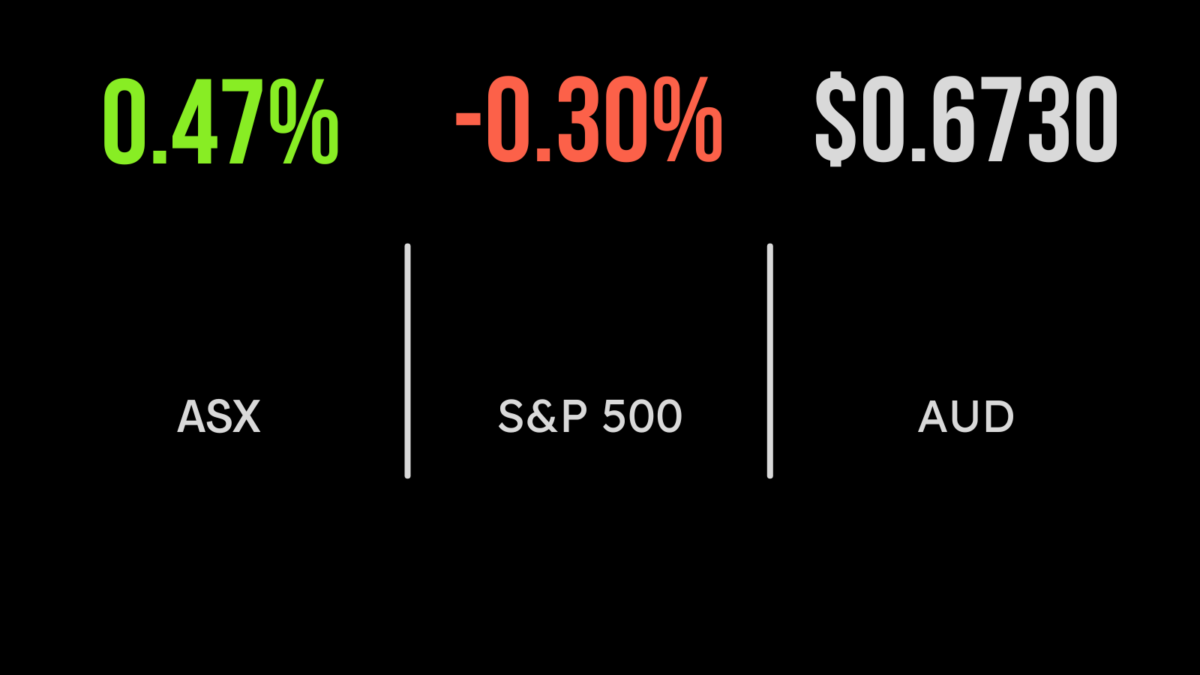

Ahead of what is expected to be another 25-basis-point interest rate rise announced today, it was a reasonably positive tone from the Australian share market on Monday. The benchmark S&P/ASX200 index gained 45 points, or 0.6 per cent, to 7,328.6, while the broader All Ordinaries was up 41.7 points, also 0.6 per cent, to 7,525.7….

Rising iron ore prices helped mining heavyweights BHP Group, Rio Tinto, Fortescue Metals and Mineral Resources on Thursday, and in turn that helped to push the major indices higher. The benchmark S&P/ASX200 index finished Thursday up 3.8 points at 7,255.4, while the broader All Ordinaries gained 3.9 points to 7,460. Iron ore has risen 15 per cent since the start of 2023, on optimism…

Australian retail sales rebounded in January as household spending defied inflation and higher borrowing costs, strengthening the case for the Reserve Bank to keep raising interest rates, and run a “higher for longer” rates scenario, taking its cue from its central bank peers in the US and Europe. Retail sales rose 1.9 per cent in January after…

Local investors had the weekend to digest Friday night’s alarming report of the Federal Reserve’s preferred inflation metric, and they decided they didn’t like it. On Friday night Australian time, the US personal consumption expenditure (PCE) figure showed that US consumer spending rose 4.7 per cent in the year to January, well above the market…

The benchmark S&P/ASX 200 index rose 86.5 points, or 1.3 per cent, on Tuesday to 6,806.4 points, while the broader All Ordinaries gauge added 81.4 points, or 1.2 per cent, to 7,030. Nine of the ASX’s 11 sectors gained ground, with real estate and healthcare the only ones to retreat. The mining sector was the…

All fund managers like to talk about protecting capital. At Ruffer Investment Management, it is a more embedded philosophy than most.

Like everyone, Eben Bowditch, head of sales at Invesco Australia, was trying to navigate the abnormal and difficult times of the COVID-19 pandemic and wondering about the wellbeing of others. Was everyone feeling as disconnected as he was? Bowditch started to think about a way of creating stronger links among the financial services community. Other…

One of the great investment success stories of the last 25 years has been the exchange-traded fund (ETF), which got under way in the early 1990s as a vehicle offering access in one listed stock, to the entire stock market through tracking an index. Gone were the worries of paying “active” management fees and failing…

Another fintech is heading for the ASX screens, with online mortgage provider Lendi poised to push “go” on an initial public offering (IPO) that could see it list at a market capitalisation of between $500 million-$550 million. Lendi specialises in the home loan market: its software platform matches borrowers with more than 35 lenders. The…

4DMedical (4DX, $1.58)Market capitalisation: $418 millionThree-year total return: n/aAnalysts’ consensus target price: $1.70 (Thomson Reuters) Imaging company 4DMedical (4DX) surged on to the ASX screens in its August float, at a 100% “pop.” Issued in the prospectus at 73 cents, the shares opened for trade on August 7 at $1.47, and reached $1.70 in August…