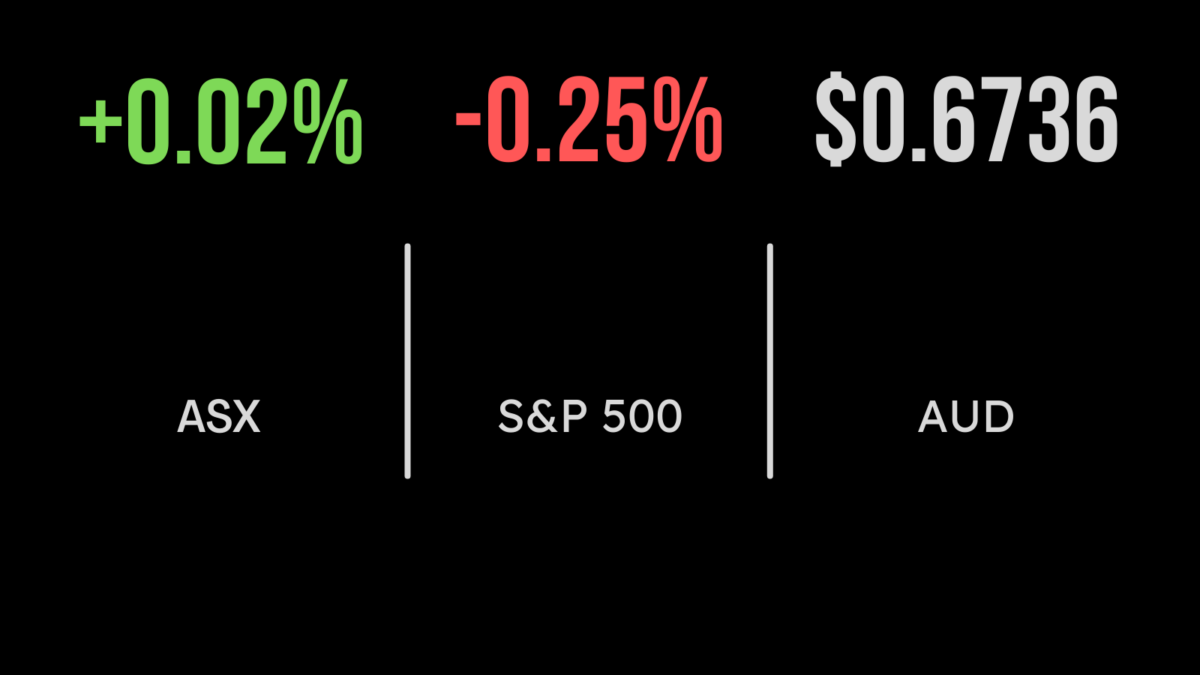

The Australian share market managed its eighth straight winning day on Wednesday, but only just; with the S&P/ASX 200 eking out a gain of 1.2 points, to 7123.2. Nor could the broader All Ordinaries index work up any momentum, ending the day 2.8 points higher at 7,434.3. The ASX’s 11 official sectors mostly rose, with…

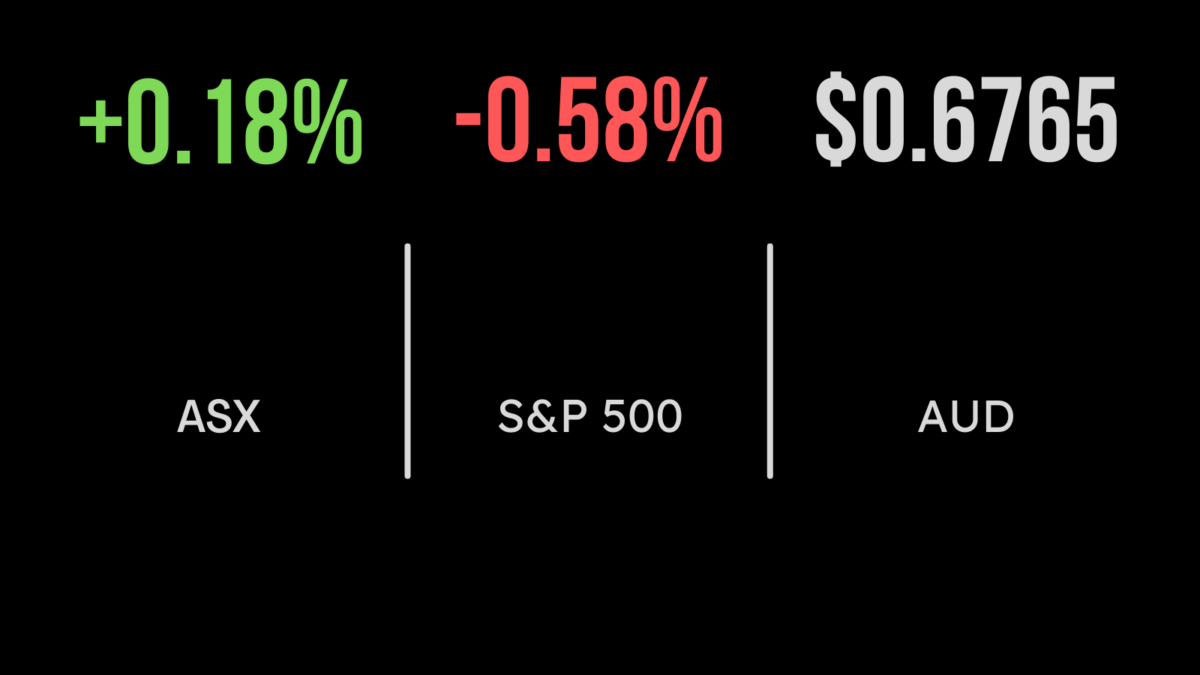

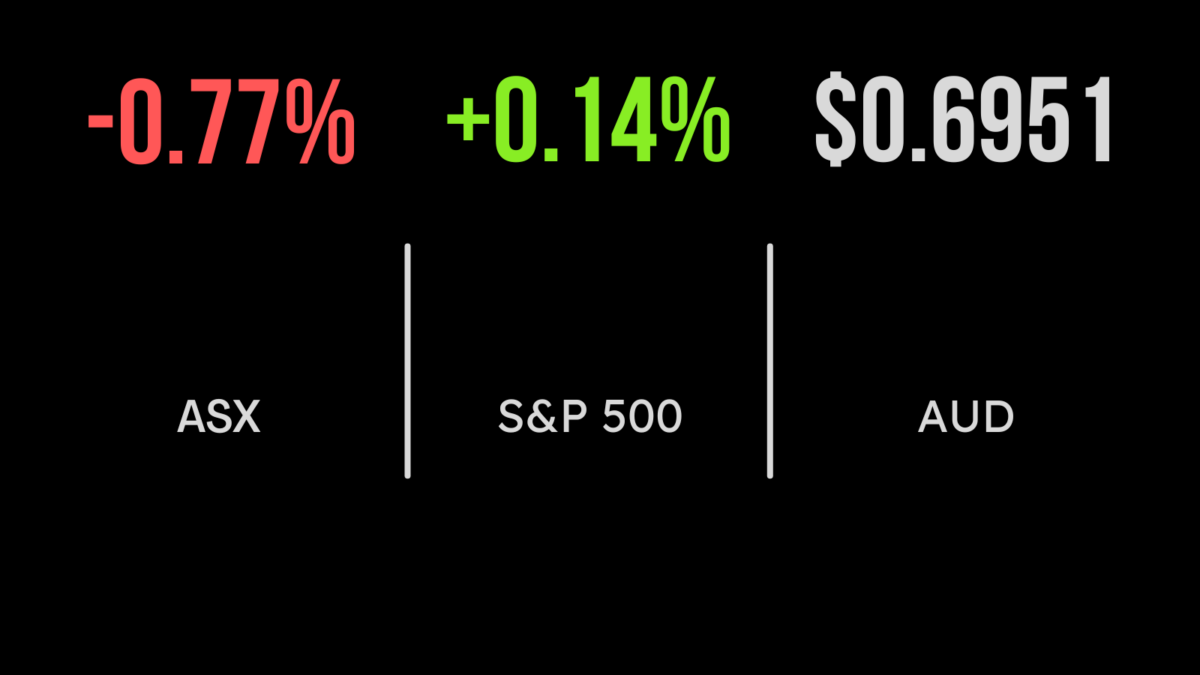

Australian shares advanced for a seventh consecutive trading day on Tuesday after the Reserve Bank held interest rates steady, as the central bank assesses whether its ten-month hiking program is getting on top of inflation. The RBA left the cash rate at 3.6 per cent, but Governor Philip Lowe warned some further rate rises may…

The Australian stock market moved higher on Monday, ahead of today’s Reserve Bank board meeting, which is widely expected to see a pause in interest rate rises. Market pricing expectations clearly expect the RBA to leave the cash rate on hold at 3.6 per cent, but economists think the decision will be a closer call,…

Australian shares closed stronger on Thursday, boosted by strong gains in the financial and information technology sectors. The optimistic mood was widespread, with ten out of 11 sectoral indices gaining over the day. The benchmark S&P/ASX 200 ended the day up 71.9 points, or 1 per cent, at 7122.3. The All Ords gained 76.40 points,…

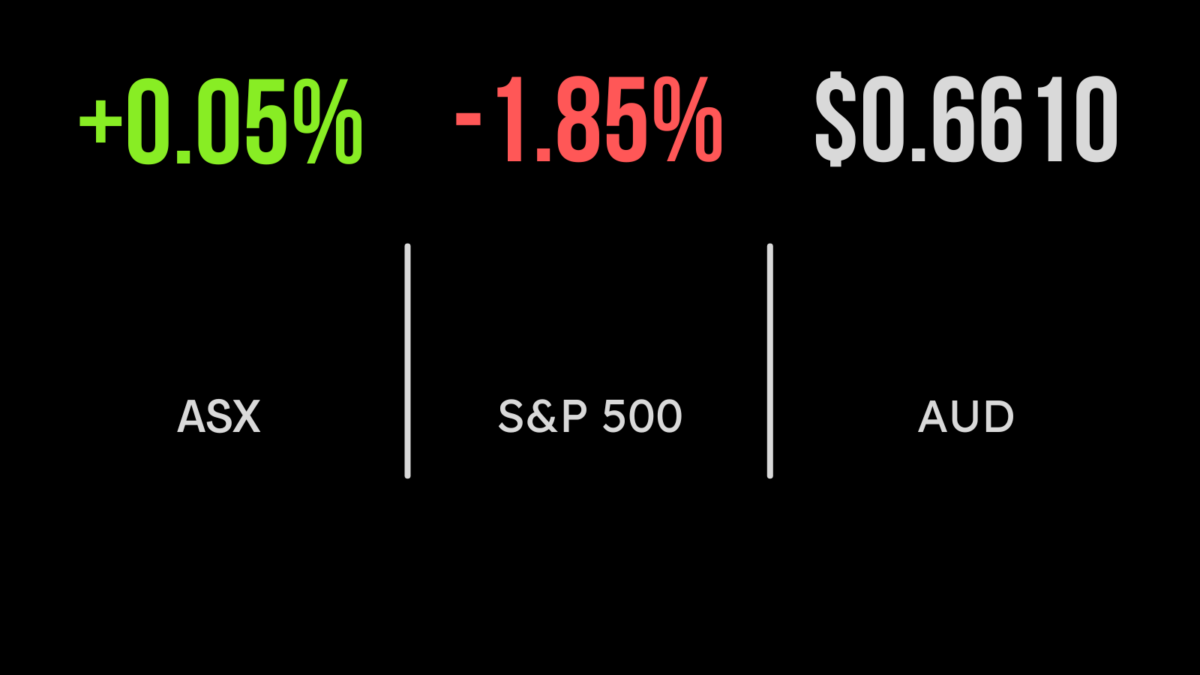

Energy shares sank on Monday, with Woodside among the worst hit, after the lower house passed an emission reduction plan in a deal with the Greens. Energy’s woes dampened the market, but the benchmark S&P/ASX 200 index managed to add 6.8 points, or 0.1 per cent, to 6962, while the broader All Ordinaries advanced 6.2 points,…

The cauterising of the Credit Suisse wound over the weekend, as emergency talks in Europe ended with UBS buying its embattled rival in a $4.5 billion acquisition – half the value Credit Suisse had at the end of last week – calmed markets to some degree on Monday, but the benchmark S&P/ASX200 index still finished…

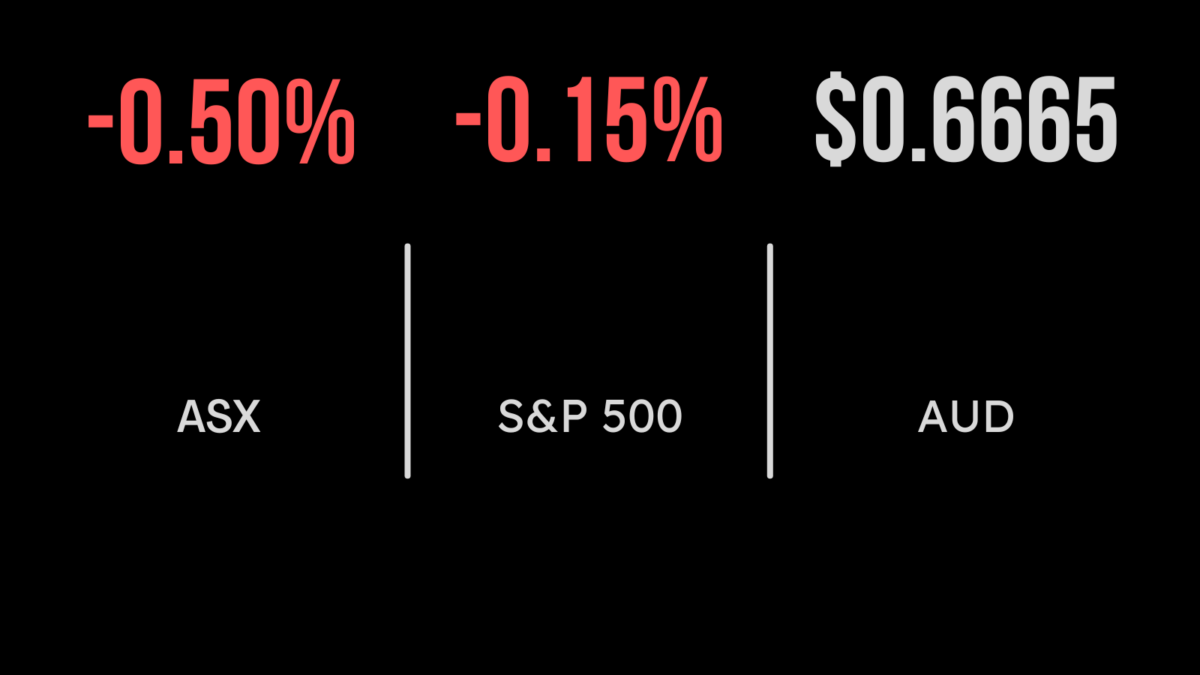

The failure of two major banks in the United States on Friday continued to roil markets, with the US indices – and bond yields – falling over the weekend, and the inevitable follow-on effect saw the Australian market under pressure, too. The benchmark S&P/ASX200 index on Monday finished down 35.9 points, or 0.5 per cent,…

There was not much action on the Australian share market on Thursday, if you are judging that by index movements: the benchmark S&P/ASX 200 index added 3.3 points, to close at 7311.1, while the broader All Ordinaries edged 10.5 points higher, to 7,514.40. On the industrial screens, accounting software giant Xero surged $89.38, or 10.7…

Australia’s benchmark S&P/ASX200 index closed down 56.9 points, or 0.8 per cent, on Wednesday, to 7,307.8, while the broader All Ordinaries was 58.8 points lower, also 0.8 per cent, at 7,503.9. It was a particularly bad day for gold miners, caught in a gold price slide in the fall-out of US Federal Reserve chair Jerome…

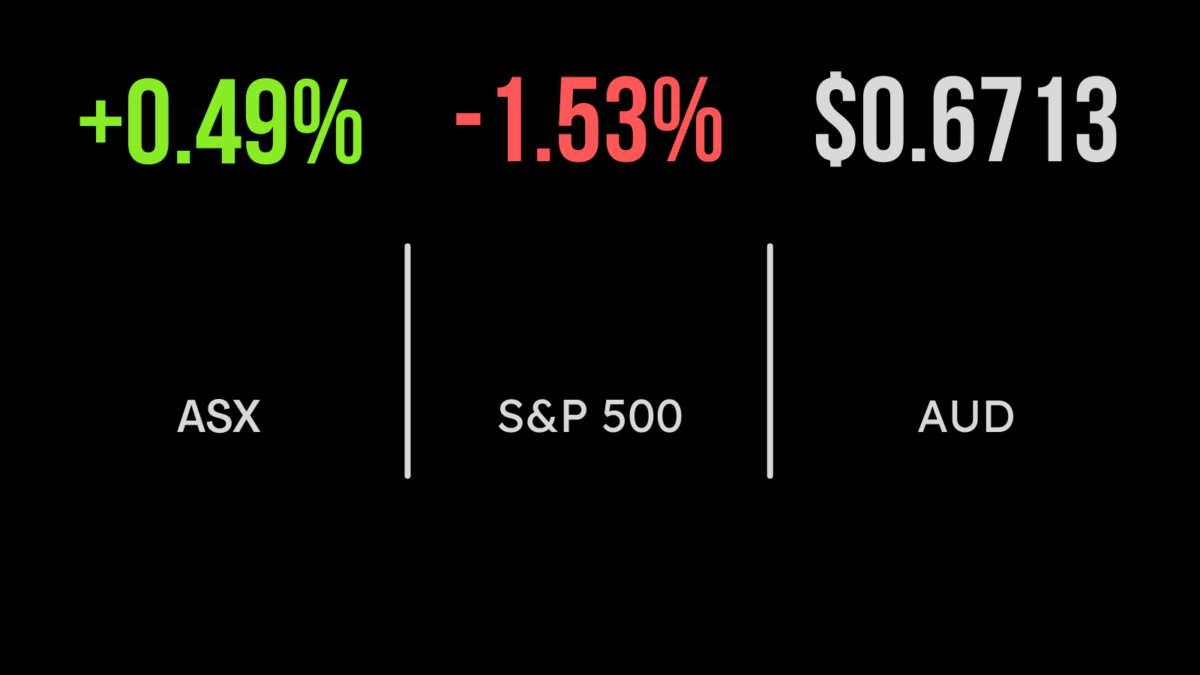

While the Reserve Bank of Australia, as expected, lifted the country’s official cash rate by 25 basis points to 3.6 per cent, in the tenth consecutive hike, the semantics of Governor Philip Lowe’s policy statement galvanised the market. A slight change of wording in the crucial final paragraph, which discarded a specific reference to “further…