The ups and downs of 2023 have shifted the fortunes of active managers in the eyes of the big institutional investors that hold the keys to trillions of dollars in retirement savings. But they’re still fretting volatility and valuations.

Even the biggest fund managers have to change with the times, and the US$750 billion Fidelity is staring down a world that’s moving beyond the traditional investment landscape in which its business was built.

Big super funds still aren’t really involved in the large nation-building projects that could make Australia a renewables powerhouse. Getting them to “cross the Rubicon” will take initiative from infrastructure managers and leadership from Australia’s sovereign wealth fund.

Everybody and their dog has an idea for putting the Future Fund to work beyond its core mandate.

But the best idea for getting it to invest more in Australia’s economy is probably already being done.

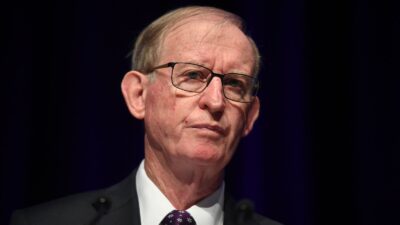

The first chair of the Future Fund has rubbished “populist pleas” to use the money in Australia’s sovereign wealth fund for pet causes, saying that they are “infused with an unrealistic optimism of the likelihood of success”.

The prudential regulator will undertake another review of how superannuation funds treat their unlisted assets, with a special focus on “valuation and liquidity management practices” as they come to account for larger and larger chunks of the portfolio.

The former chairman of IFM Investors and Industry Super Australia has been appointed to the Future Fund Board of Guardians as the government looks to “maximise” the role Australia’s sovereign wealth fund plays while preserving its independence.

The $160 billion industry fund has found a new head for its $90 billion public equities portfolio in an alumnus of passive investing giants like Vanguard and BlackRock. It’s also pulled the trigger on promotions in the public equities team.

It’s a narrow path to a Goldilocks financial environment with steep drops on either side. Should markets tumble off the edge, big investors could cast their eyes back over macro hedge funds, long-short strategies and gold.

The $13 billion Mine Super might have had Chant West’s top performing growth option for the calendar year, but CIO Seamus Collins questions whether many default growth products are doing enough for young members who are “temporally diversified”.