Markets are looking rosy as the end of the year approaches, but the two extremes aren’t being priced in. Meanwhile, the enthusiasm for generative artificial intelligence risks obfuscating who could really win and lose from the boom.

By some measures market breadth has fallen to its lowest levels in more than 20 years as the “Magnificent Seven” reign supreme. Investors should position for a broadening out of equity market leadership.

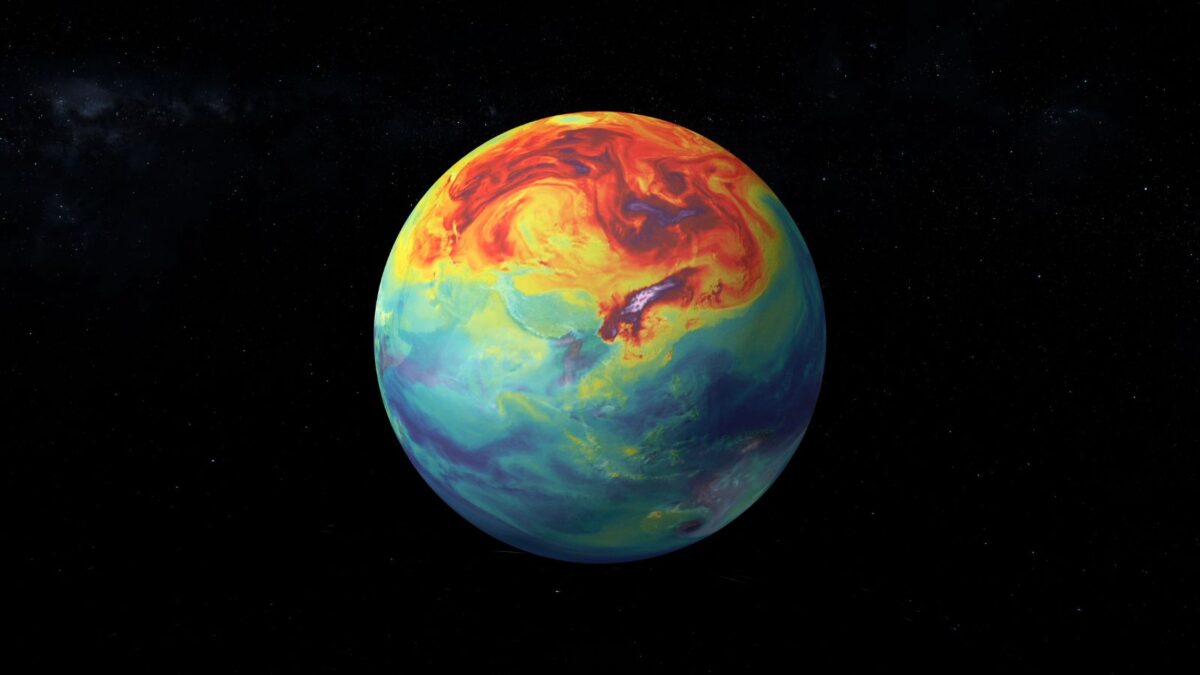

The use of climate-related investment practices is seeing a sharp fall among the global institutional investor set, while more than half of them are worried about achieving the best returns while delivering emissions reductions targets.

Teams from Pzena and Invesco scored highly against the Northern Trust-backed Essentia Analytics’ Behavioural Alpha Benchmark, a system designed to differentiate between luck and true investment nous.

Big institutions live and die by their data, but State Street finds that very few have a strategy for acquiring and managing it while many are lagging in their technology investment.

Biodiversity loss could threaten more than 50 per cent of global gross domestic product, but the amounts spent on reversing it pale in comparison to investment in clean energy.

Specialist private debt manager Revolution Asset Management has boosted its ranks with a new portfolio manager hailing from Bank of America.

The $85 billion industry fund has poached its new head of infrastructure from Hostplus as it looks to double down on an ambitious new five-year investment strategy.

As the fund contemplates managing $700 billion by 2030 it’s looking for new ways to invest with a global portfolio mindset and chase hot assets in local markets to drive value creation for its members.

Unrest in the Middle East, political dysfunction in Washington and the looming shadow of a global recession means markets face a new wall of worry in time for the holiday season.