-

Sort By

-

Newest

-

Newest

-

Oldest

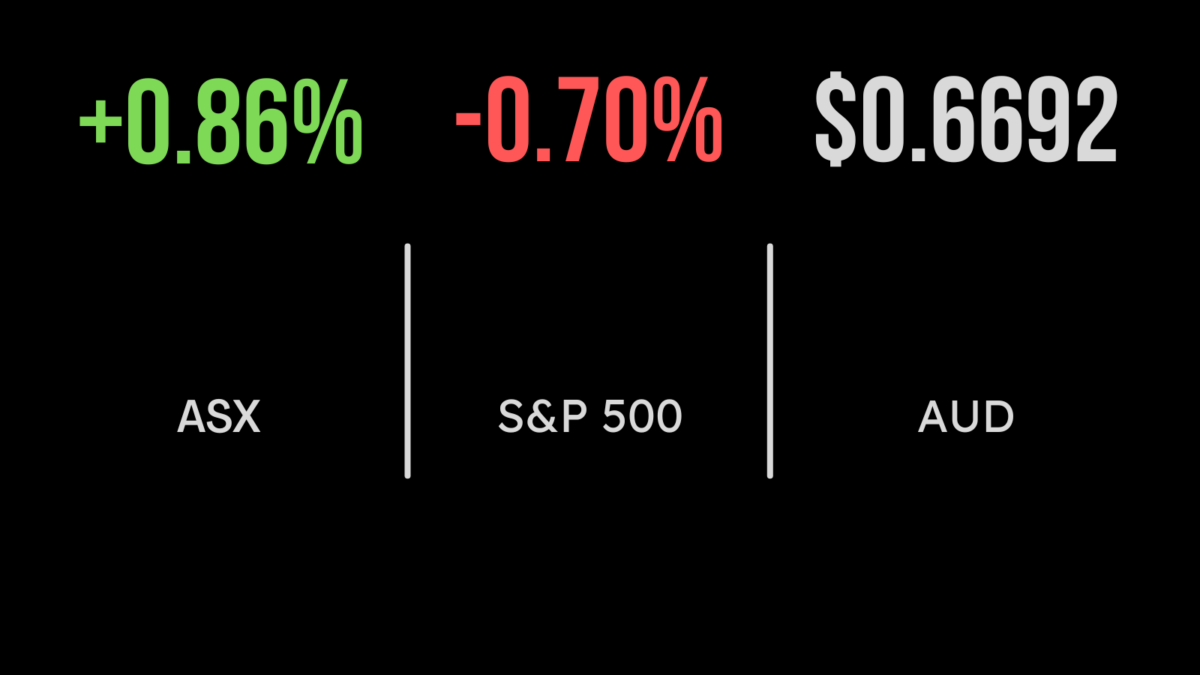

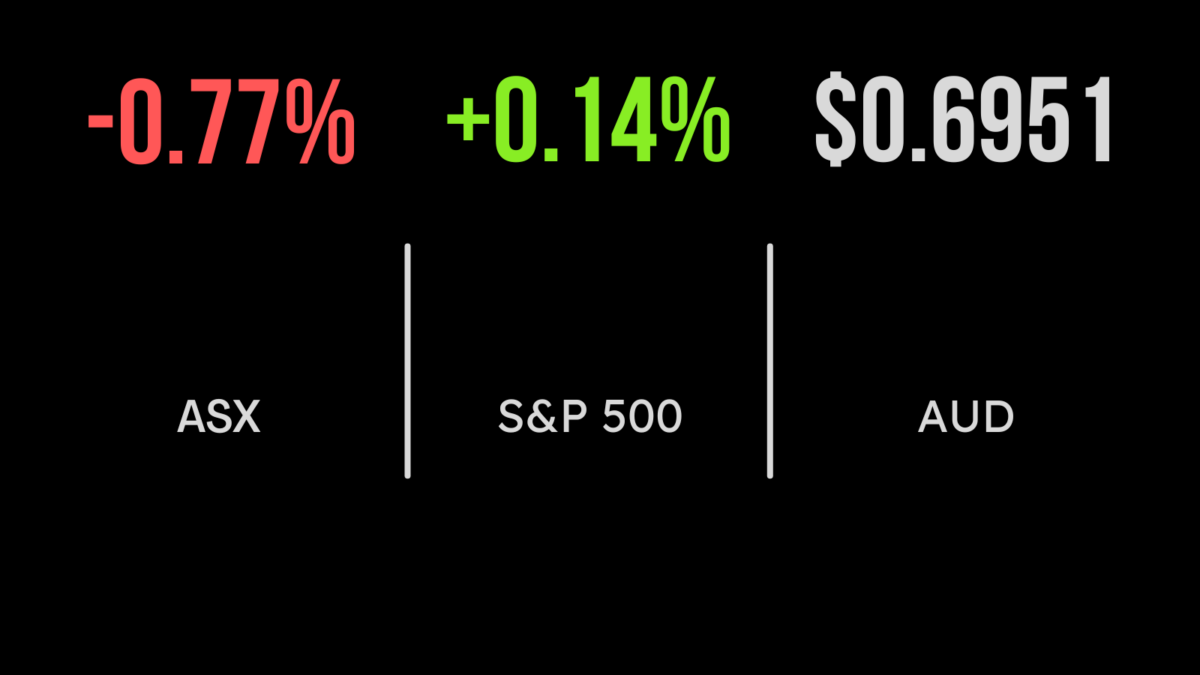

The cauterising of the Credit Suisse wound over the weekend, as emergency talks in Europe ended with UBS buying its embattled rival in a $4.5 billion acquisition – half the value Credit Suisse had at the end of last week – calmed markets to some degree on Monday, but the benchmark S&P/ASX200 index still finished…

The local market powered into the close, overcoming early losses to finish 0.4 per cent higher. The energy and financial sectors were central to the positive move, adding 2.3 and 0.9 per cent respectively. All four major banks gained, led by the National Australia Bank (ASX:NAB) which was 1.7 per cent higher on the day….

Another day, another recapitalisation of bailout of a major bank. It was all about global giant Credit Suisse (SWX:CSGN), the company that had been in the news in recent weeks due to a run of poor quarters and growing outflows from the bank. The Swiss National Bank was forced to offer as much as $81…

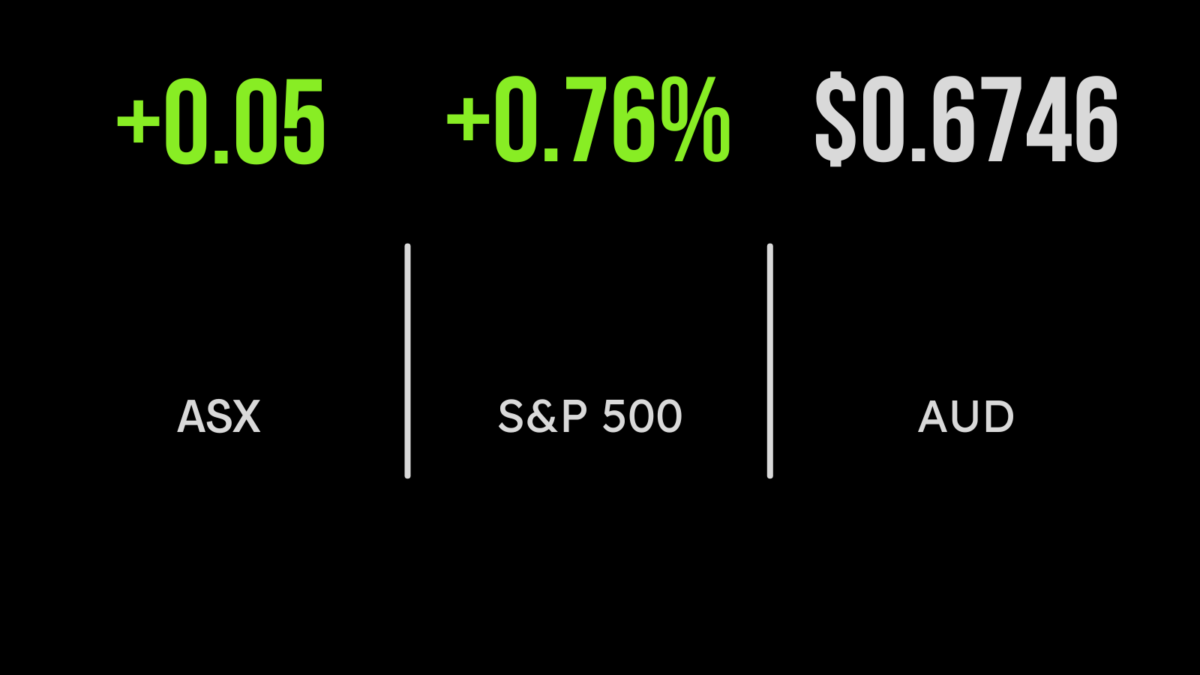

Positive sentiment continues to return to the local market, with the S&P/ASX200 gaining 0.9 per cent on Wednesday. While the technology sector was the biggest gainer, finishing up 2.4 per cent, a broad-based improvement in the financial and banking sector was central to the rally. Australia’s regional banks, despite having significantly more capital requirements than…

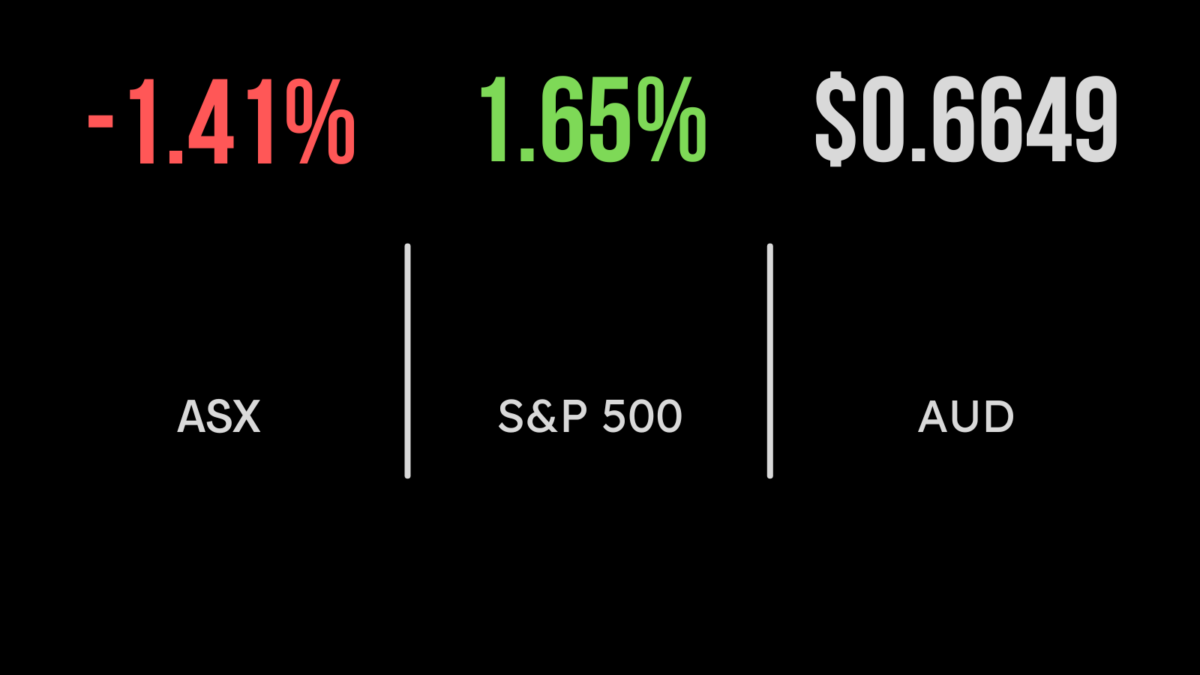

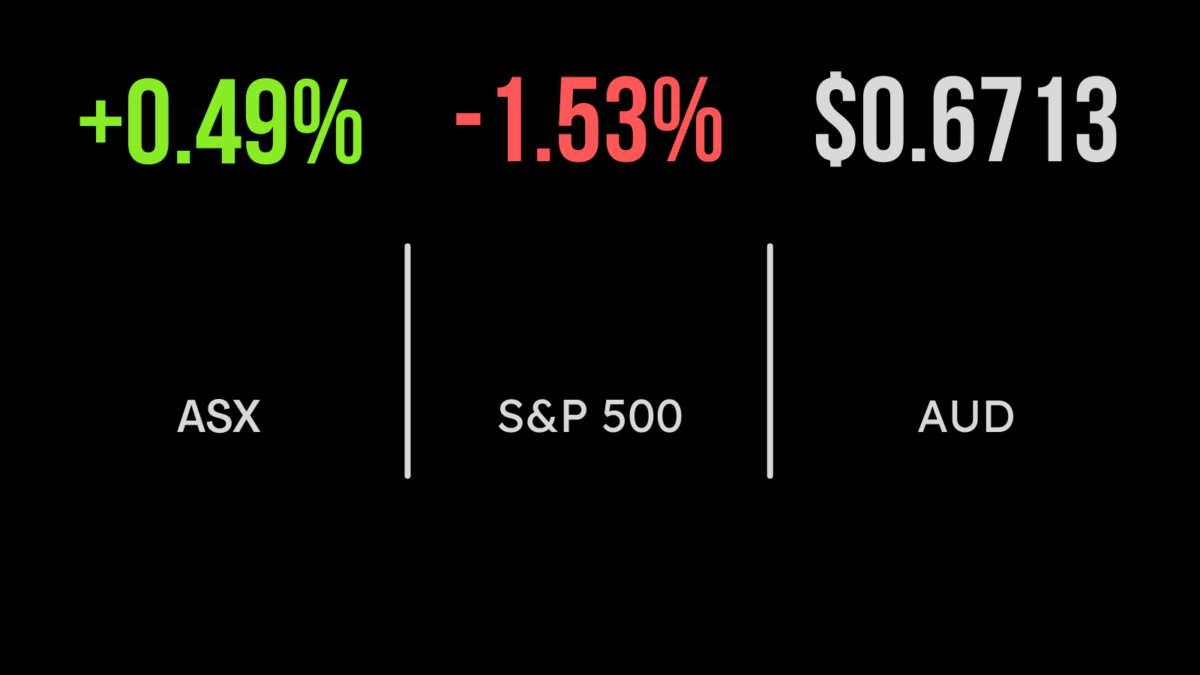

The local market has now given back most of the gains achieved in 2023, falling 1.4 per cent on Tuesday as concerns of further bank runs spread around the world. The threat was triggered by the bankruptcy and subsequent bailout of Silicon Valley Bank after it’s many accountholders sought to withdraw a significant amount of…

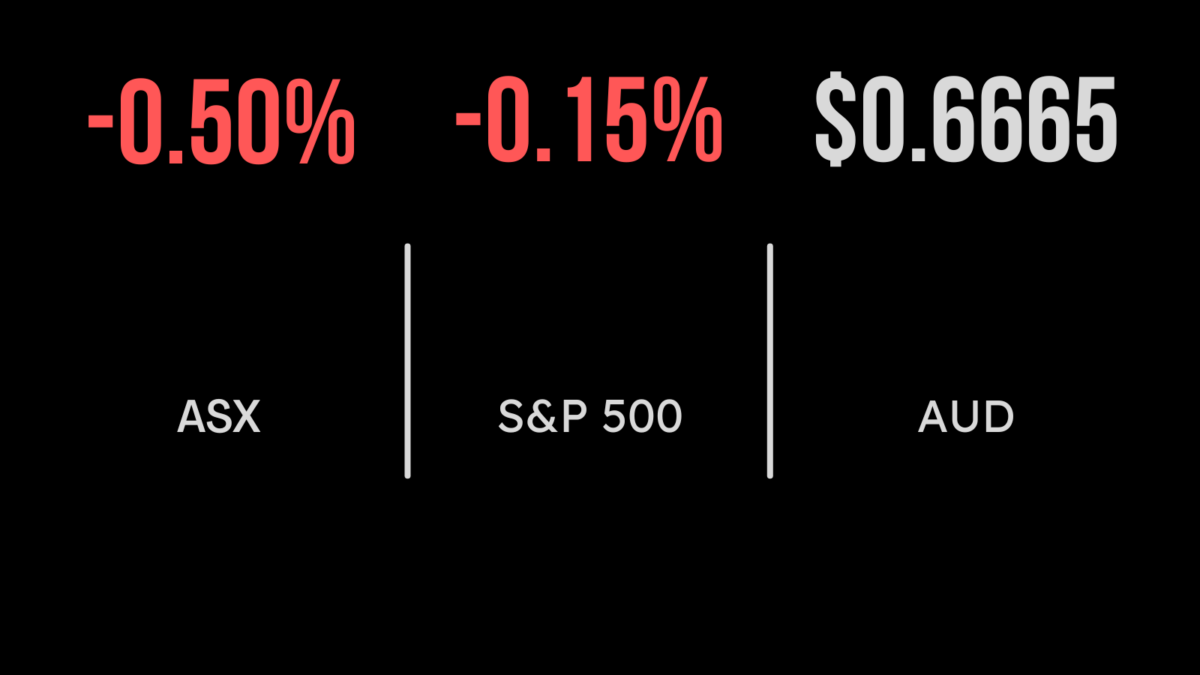

The failure of two major banks in the United States on Friday continued to roil markets, with the US indices – and bond yields – falling over the weekend, and the inevitable follow-on effect saw the Australian market under pressure, too. The benchmark S&P/ASX200 index on Monday finished down 35.9 points, or 0.5 per cent,…

There was not much action on the Australian share market on Thursday, if you are judging that by index movements: the benchmark S&P/ASX 200 index added 3.3 points, to close at 7311.1, while the broader All Ordinaries edged 10.5 points higher, to 7,514.40. On the industrial screens, accounting software giant Xero surged $89.38, or 10.7…

Australia’s benchmark S&P/ASX200 index closed down 56.9 points, or 0.8 per cent, on Wednesday, to 7,307.8, while the broader All Ordinaries was 58.8 points lower, also 0.8 per cent, at 7,503.9. It was a particularly bad day for gold miners, caught in a gold price slide in the fall-out of US Federal Reserve chair Jerome…

While the Reserve Bank of Australia, as expected, lifted the country’s official cash rate by 25 basis points to 3.6 per cent, in the tenth consecutive hike, the semantics of Governor Philip Lowe’s policy statement galvanised the market. A slight change of wording in the crucial final paragraph, which discarded a specific reference to “further…

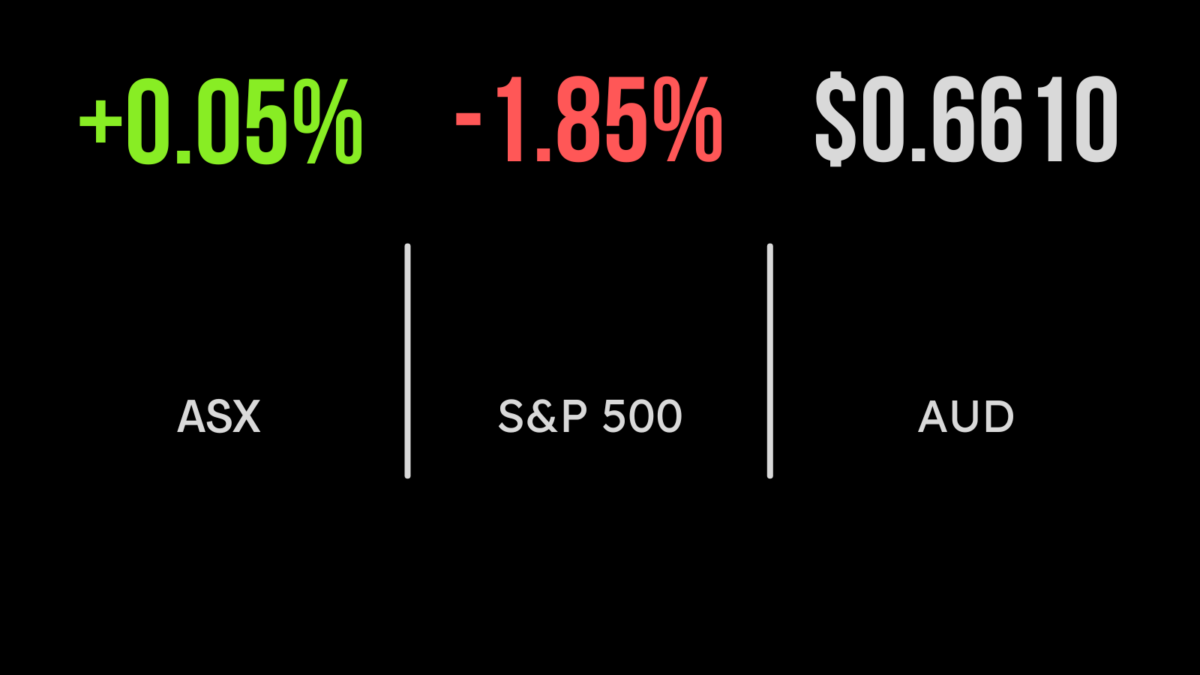

Ahead of what is expected to be another 25-basis-point interest rate rise announced today, it was a reasonably positive tone from the Australian share market on Monday. The benchmark S&P/ASX200 index gained 45 points, or 0.6 per cent, to 7,328.6, while the broader All Ordinaries was up 41.7 points, also 0.6 per cent, to 7,525.7….

The local market managed to finish the week on a positive note, gaining 0.4 per cent, but ultimately capping a fourth straight week of losses to finish 0.3 per cent lower. On Friday, it was all about the mining and energy sectors with Rio Tinto (ASX:RIO) gaining 1.6 per cent and BHP (ASX:BHP) 0.6 per…

Rising iron ore prices helped mining heavyweights BHP Group, Rio Tinto, Fortescue Metals and Mineral Resources on Thursday, and in turn that helped to push the major indices higher. The benchmark S&P/ASX200 index finished Thursday up 3.8 points at 7,255.4, while the broader All Ordinaries gained 3.9 points to 7,460. Iron ore has risen 15 per cent since the start of 2023, on optimism…