A recovery in the UK’s equity market has almost always been predicated on valuation grounds, according to Ruffer. But this time the recovering domestic economy and a high exposure to commodities and financials might act as additional catalysts.

For investors contending with changing risk and return dynamics, regulated utilities stand out as a stable choice amid sectoral uncertainty according to Nick Langley, senior portfolio manager at ClearBridge Investments.

The aggressive sell off in US bonds has prompted many to speculate that interest rates have adjusted upwards on a structural basis. But Ninety One investment strategist Russell Silbertson takes a different view.

For this mid-year outlook, the theme continues to be the attractiveness of investments beyond cash including fixed income, equities and alternatives. We give you our Institute perspective for the second half of 2023, with our ongoing conversations with our investment teams driving the narrative. The major highlights are: Fixed income deserves a good deal of…

As we settle into 2023, we believe long-term responsible investors focused on risk management and opportunity capture, must consider material changes impacting four areas:

Transparency should be the bedrock of sustainable finance.

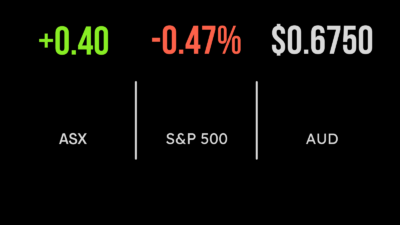

Optimism for mining stocks battled a downturn in the big banks in deciding the direction for the Australian share market on Wednesday, with the banks prevailing just enough to see the benchmark S&P/ASX 200 close 6.8 points, or 0.1 per cent, lower at 7251.6, while the broader All Ordinaries Index retreated 1.9 points to 7456.1. The bullishness for the miners…

There are a range of factors that will determine the fees a member will pay. The difference could have a dramatic effect on the final balance of a retiree’s nest egg.

Income arrives in many shapes and sizes The first half of 2022 has been challenging for investors across all asset classes, and the uncertainties plaguing markets remain-particularly with regard to inflation, interest rates and the possibility of recession. Stephen Dover, Chief Market Strategist, Franklin Templeton Investment Institute says: “As we look toward the second…

Net-zero pledges on carbon emissions are everywhere – but you can’t manage what you can’t measure. We know that the vast majority of the ~37 billion tonnes of industrial carbon dioxide emitted annually comes from companies. But there’s still an enormous data gap at the company level for investors to truly understand the losers and…