Global sentiment continues to drive daily market movements in Australia, with the S&P/ASX200 falling 0.7 per cent on Thursday. Just two of the markets nine sectors finished higher, that being communications and consumer staples, up 0.1 per cent each, with the materials and technology sector the hardest hit by recessionary concerns, falling 1.1 and 0.8…

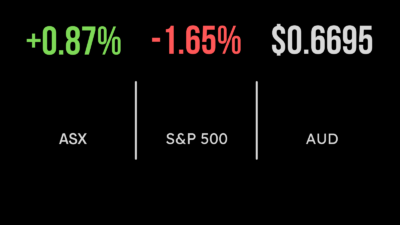

It was another positive day for the local market with the S&P/ASX200 adding 0.9 per cent on growing optimism that the spiralling global banking crisis will cause a slowdown in the pace of rate hikes. The Federal Reserve is set to meet overnight, with bond yields remaining well below levels of just two weeks ago…

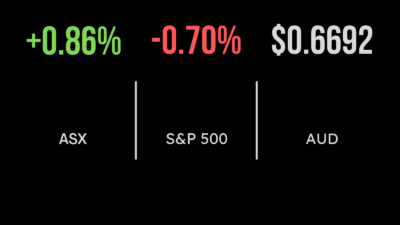

Sharemarkets continue to navigate the escalating global banking crisis, with the S&P/ASX200 managing to deliver a 0.8 per cent gain on the back of a 1.2 per cent surge in the financial sector. The rally was led by the likes of Macquarie (ASX:MQG), up 3.3 per cent, as recent transactions highlighted the continued support for…

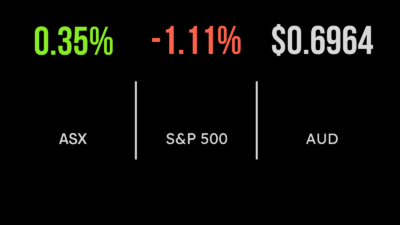

The local market powered into the close, overcoming early losses to finish 0.4 per cent higher. The energy and financial sectors were central to the positive move, adding 2.3 and 0.9 per cent respectively. All four major banks gained, led by the National Australia Bank (ASX:NAB) which was 1.7 per cent higher on the day….

Another day, another recapitalisation of bailout of a major bank. It was all about global giant Credit Suisse (SWX:CSGN), the company that had been in the news in recent weeks due to a run of poor quarters and growing outflows from the bank. The Swiss National Bank was forced to offer as much as $81…

Positive sentiment continues to return to the local market, with the S&P/ASX200 gaining 0.9 per cent on Wednesday. While the technology sector was the biggest gainer, finishing up 2.4 per cent, a broad-based improvement in the financial and banking sector was central to the rally. Australia’s regional banks, despite having significantly more capital requirements than…

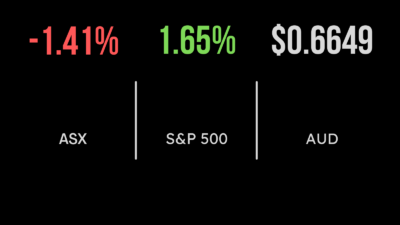

The local market has now given back most of the gains achieved in 2023, falling 1.4 per cent on Tuesday as concerns of further bank runs spread around the world. The threat was triggered by the bankruptcy and subsequent bailout of Silicon Valley Bank after it’s many accountholders sought to withdraw a significant amount of…

The local market managed to finish the week on a positive note, gaining 0.4 per cent, but ultimately capping a fourth straight week of losses to finish 0.3 per cent lower. On Friday, it was all about the mining and energy sectors with Rio Tinto (ASX:RIO) gaining 1.6 per cent and BHP (ASX:BHP) 0.6 per…

The benchmark S&P/ASX 200 Index fell 39.8 points, or 0.5 per cent on Thursday to 7490.3; while the broader All Ordinaries index dropped 44.7 points, or 0.6 per cent, to 7695.8. Energy was in the spotlight, with the Mike Cannon-Brookes-backed AGL Energy plunging 82 cents, or 10 per cent, to $7.12 after the company downgraded full-year earnings guidance, cut its dividend and reported…

The benchmark S&P/ASX200 index on Wednesday advanced 26 points, or 0.4 per cent, to 7,530.1, while the broader All Ordinaries closed 27.4 points to the good, also 0.4 per cent, at 7,740.5. Goldminer Newcrest added another 65 cents, or 2.6 per cent, to $25.60, taking its gain to almost 14.5 per cent since it received a $24.5 billion takeover offer from US…