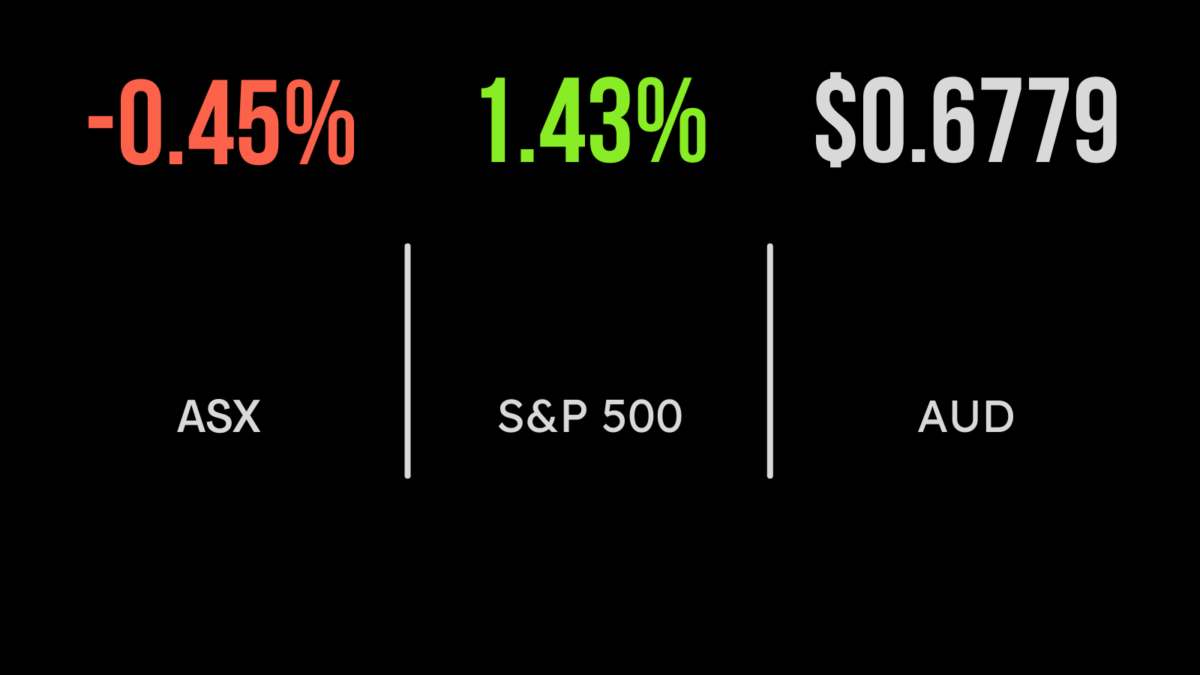

The S&P/ASX 200 fell 0.5 per cent, or 32.4 points, to 7180.8 on Monday, dragged lower by losses across the utilities sector, which contains Origin Energy – and the big electricity and gas supplier were hammered 61 cents, or 7.8 per cent, lower to $7.19, amid fears that the federal government’s intervention into the gas market could see Brookfield and EIG Group walk away…

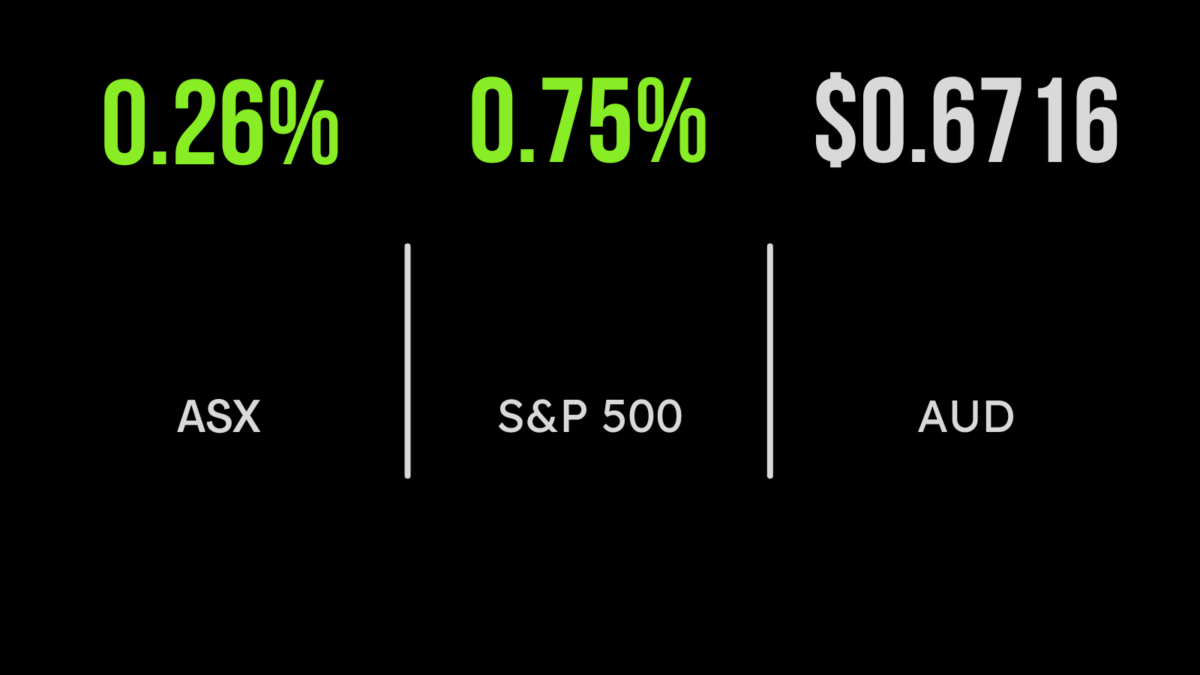

The local market managed to end the week on a positive note, adding 0.5 per cent, as continued strength in the iron ore price sent the materials sector close to 2 per cent higher. The rally was led by BHP (ASX: BHP) which gained 2.7 per cent, and Fortescue (ASX: FMG) which added 2.8 per cent, with the technology…

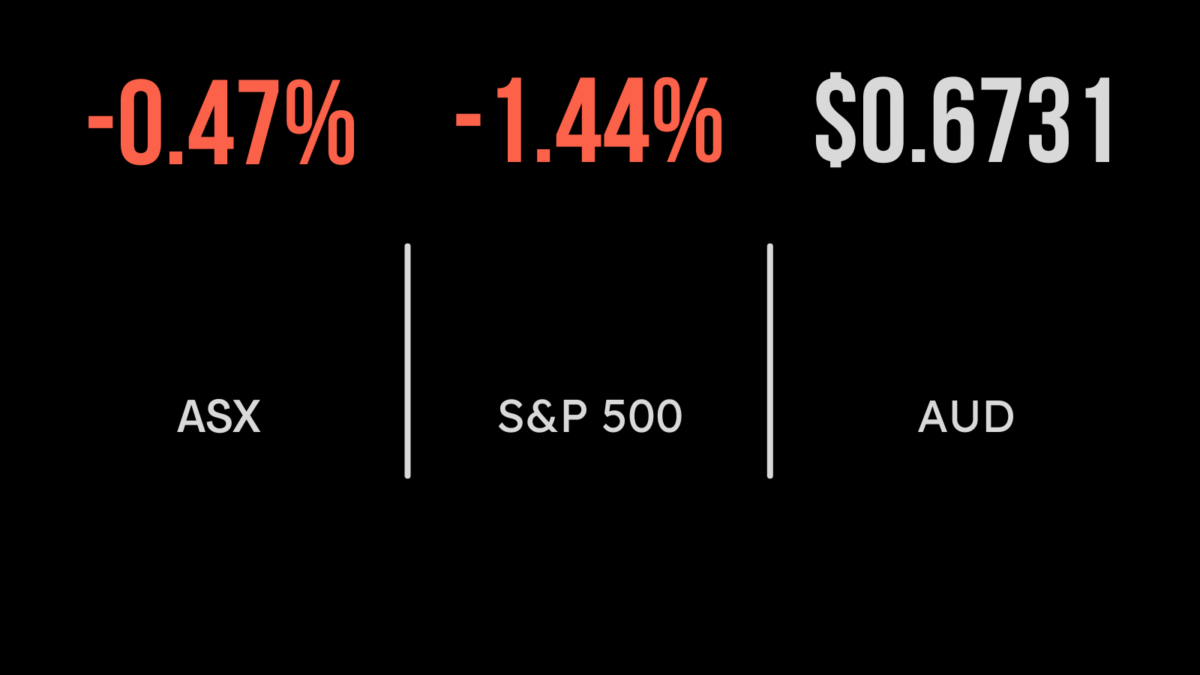

Geo-political and economic worries mounted for the local share market on Thursday, with the upshot being a slide of 53.9 points, or 0.8 per cent, in the benchmark S&P/ASX200 index, to 7,175.5 points while the broader All Ordinaries index lost 53.8 points, or 0.7 per cent, to 7,369.4. Seven of the ASX’s 11 official sectors retreated, with energy the worst hit as…

Local shares followed Wall Street lower on Wednesday, despite the release of data showing that the Australian economy grew by 0.6 per cent in the September quarter, for an annual growth rate of 5.9 per cent, a strong result coming off the back of the final wave of COVID-19 lockdowns in 2021. The quarterly figure was slightly…

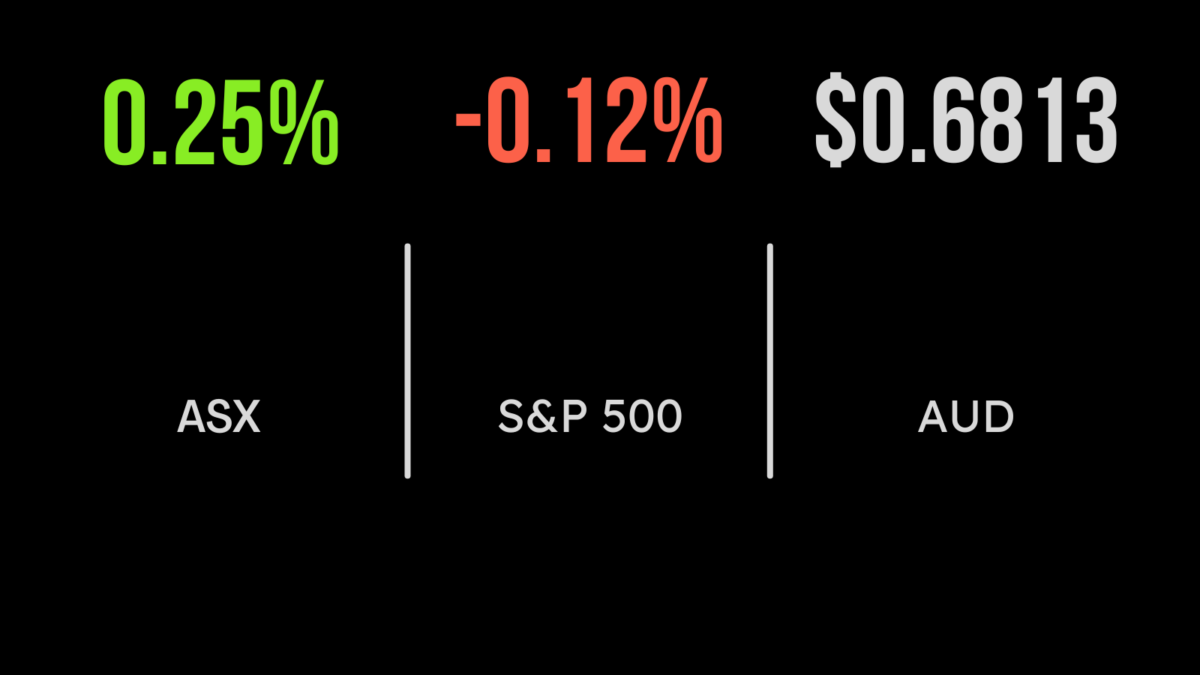

The Australian share market eased on Tuesday as the eighth consecutive rate hike from the Reserve Bank saw the cash rate lifted by 0.25 percentage points, to 3.1 per cent – up from 0.1 per cent in just seven months. The rate hike was mostly expected, and the central bank indicated that further tightening was in store in…

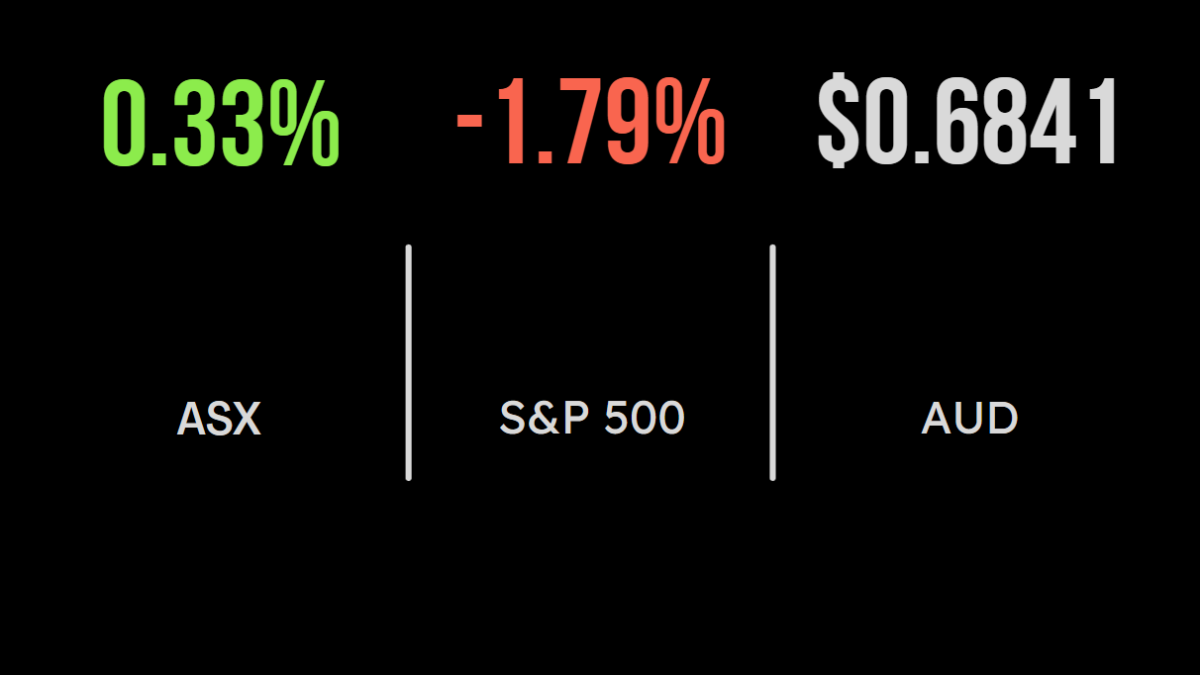

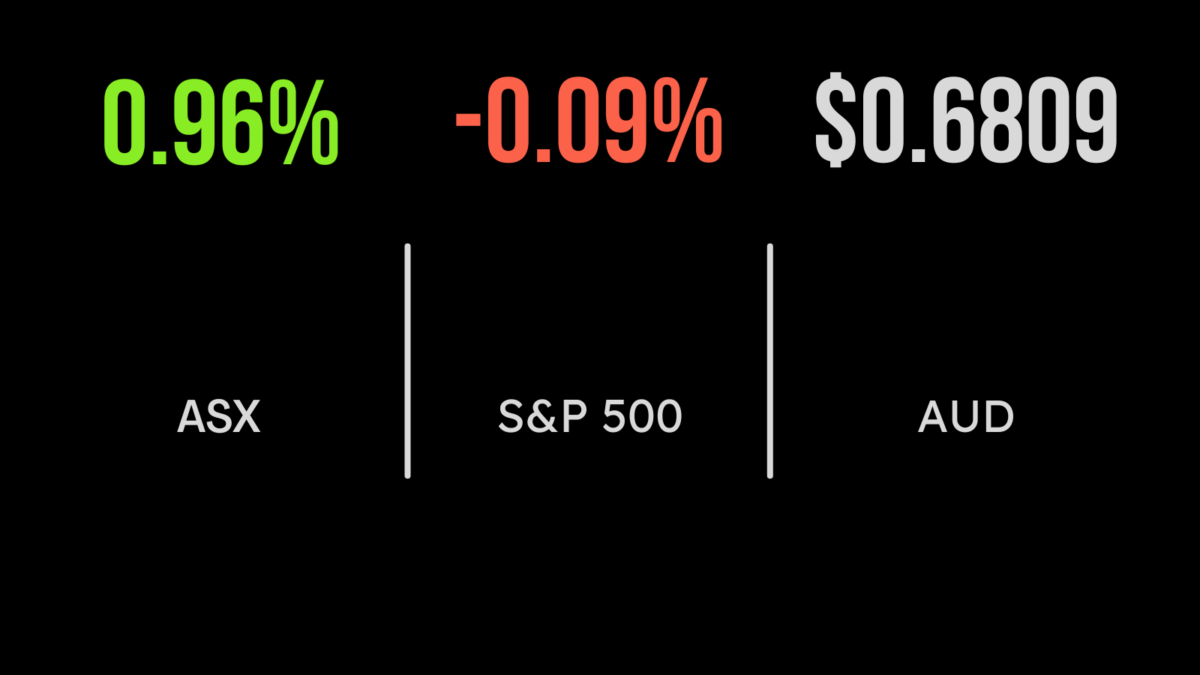

Despite plenty of uncertainty around what the Reserve Bank will announce with the cash rate this morning – although consensus expects that the central bank will lift the cash rate by another 25 basis points, to 3.15 per cent – there was a reasonably positive mood afoot on the local stock market on Monday, with the benchmark S&P/ASX…

The week ended poorly for the domestic sharemarket, with the energy sector (down 2.5 per cent) dragging the S&P/ASX200 0.7 per cent lower. Real estate also fell 2.6 per cent with healthcare and communications the highlights, gaining 1.1 and 0.8 per cent. The property sector sold off heavily amid news that global giant Blackstone had seen…

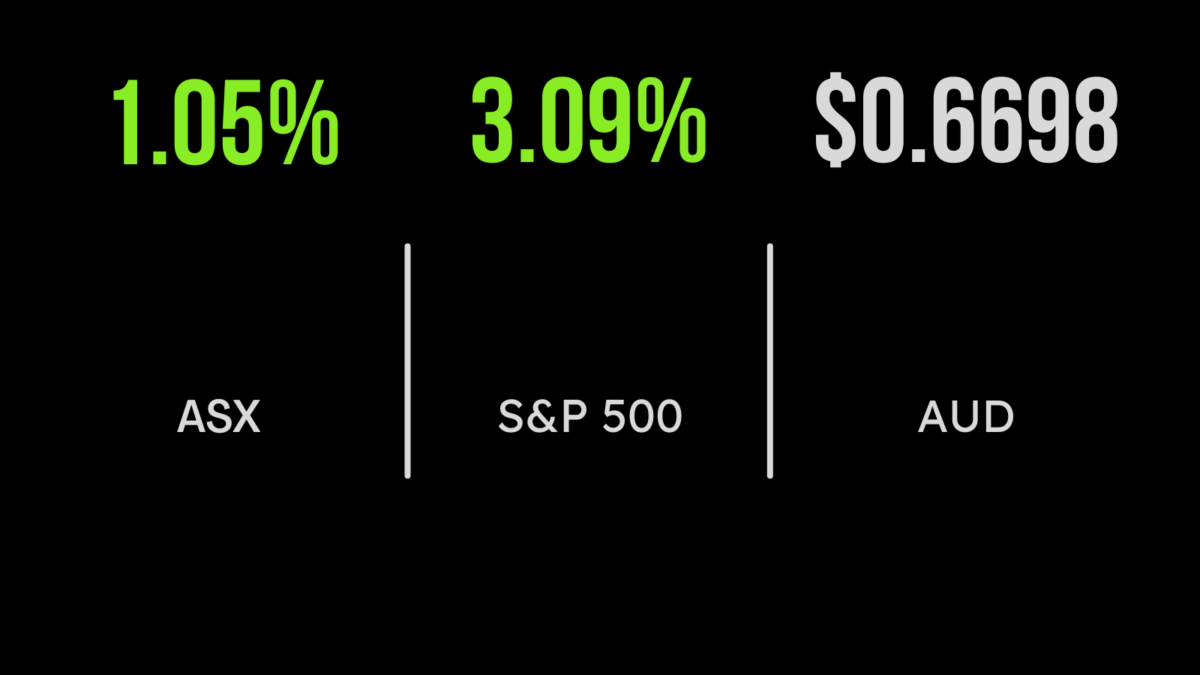

The local market joined the global rally in risk assets with the S&P/ASX200 finishing 1 per cent higher on Thursday on the back of Jerome Powell’s dovish comments in the US. A peak in the cash rate may well be in sight, which has moved the Dow Jones out of bear market territory.

What began as another rough day for the S&P/ASX200 finished on a much more positive note, as the market closed at its high, 0.4 per cent higher.

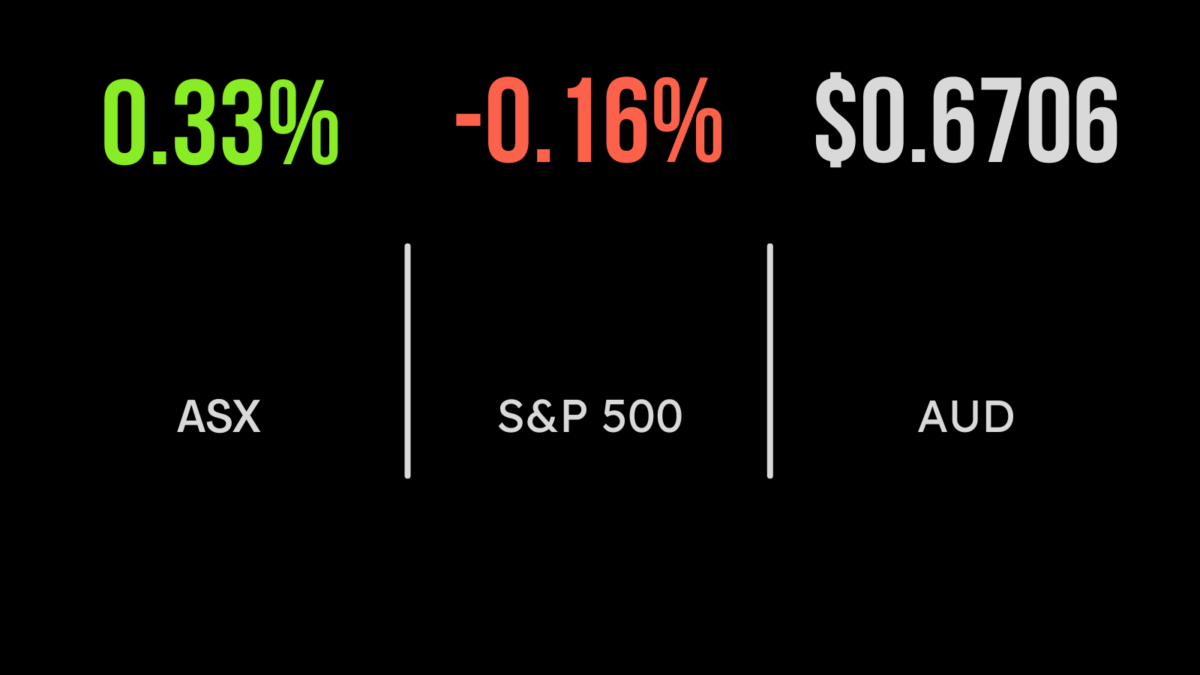

The local market managed to deliver another gain, the S&P/ASX200 adding 0.3 per cent as signs of improvement in China supported a rally in key commodity prices. Rio Tinto (ASX: RIO) gained 3.5 per cent and Fortescue (ASX: FMG) 2.2 per cent after the latter named a new CEO, Fiona Hick, who was previously part of the Woodside’s Australian leadership team. An important…