The famous and closely watched US endowment model took a hit in FY23, with smaller, equity-heavy investors taking the lead. But the longer-term superiority of a chunkier exposure to alternatives remains unchallenged.

Value investing is a lonely road, especially for those practitioners who are looking for real deep value rather than small arbitrages. The stocks they buy are very unloved, and they can stay that way for some time, while everyone else in the market thinks they are nuts.

After a strong session for global markets on Friday, Australian shares will take a positive lead into the new week – and month. The Australian benchmark index, the S&P/ASX 200, added 16.5 points, or 0.2 per cent, on Friday, to 7,309.2, but eased 53 points, or 0.7 per cent over the week. ASX futures trading…

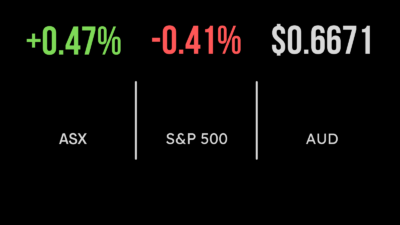

After a poor lead from Wall Street, the S&P/ASX 200 index recovered some of its early losses on Wednesday to close 5.7 points lower at 7316.3, after Australian core inflation for the first quarter came in weaker-than-expected. The broader All Ordinaries index was down 9.4 points, at 7,502.8. Annual inflation fell to 7 per cent…

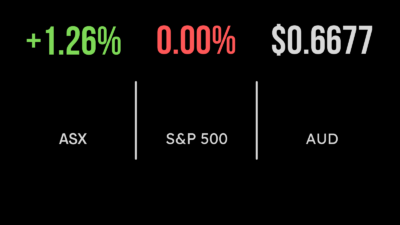

The local market managed to post a positive start to the week with the S&P/ASX200 gaining 0.3 per cent on the back of a rally in the more cyclical property and retailing sectors. Real estate gained 1.3 per cent and the discretionary sector 0.7 with Star Entertainment (ASX:SGR) a highlight, finishing 4.9 per cent higher….

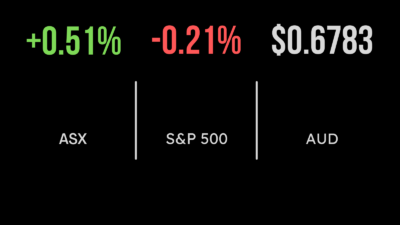

A positive mood on Friday lifted the benchmark Australian index, the S&P/ASX 200, by 0.5 per cent on Friday, to 7361.6, with gains in mining companies offsetting losses in health and property sectors. The index added 2 per cent over the week, notching its third consecutive week of gains, and ended at its highest closing…

On Thursday the Australian share market had to deal with the release of robust jobs data, which sparked predictions that the Reserve Bank of Australia could again lift interest rates. Employment rose by 53,000 in March, while the unemployment rate remained steady at a 50-year-low of 3.5 per cent, according to Australian Bureau of Statistics…

The Australian market did not appear overly concerned about tonight’s US inflation figure, with the benchmark S&P/ASX200 notching its tenth rise in 11 trading days. The ASX200 closed 34 points, or 0.5 per cent, higher, at a five-week high of 7,343.9, while the broader All Ordinaries index finished 34.7 points higher, also 0.5 per cent,…

Broad gains across the materials sector drove a 2.2 per cent rise in the sub-index on Tuesday, which in turn flowed into an advance in the main Australian indices. The S&P/ASX 200 advanced 90.9 points, or 1.3 per cent, to 7,309.9, while the 500-stock All Ordinaries index gained 92.2 points, or 1.2 per cent, to…

The Australian share market couldn’t continue its run of consecutive daily gains, closing it out at eight, making its longest winning streak since October 2017. The streak came to an end on Thursday, with the benchmark S&P/ASX200 index losing 22.3 points, or 0.3 per cent, to 7,219, while the broader All Ordinaries index lost 26.8…